Why Agile Finance Teams Are Turning to ZBB Amidst Tariff Shocks

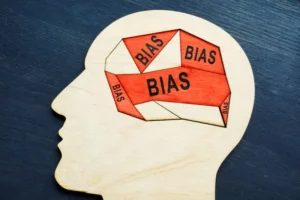

Adjusting to the Impact of Tariffs: Why Zero-Based Budgeting is More Critical Than Ever CAPITAL PLANNING | CAPEX BUDGETING | CAPEX MANAGEMENT In the wake of global tariff shifts and trade