Optimizing Capex. Optimize everything.

With so much on the line, it’s hard to fathom having a multi-million (or billion) dollar Capex budget being left on an island of manual processes and generic document-sharing software. It’s more than just a “gap” … it’s a handicap.

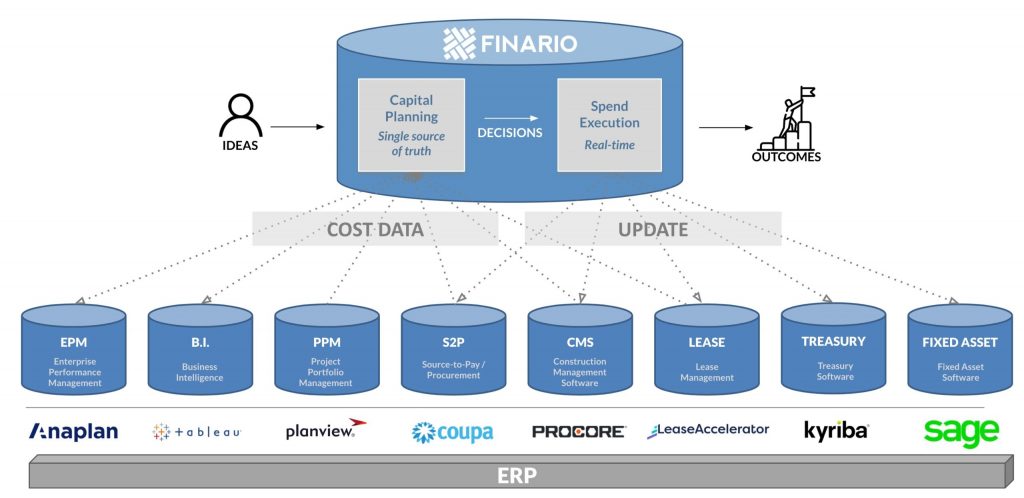

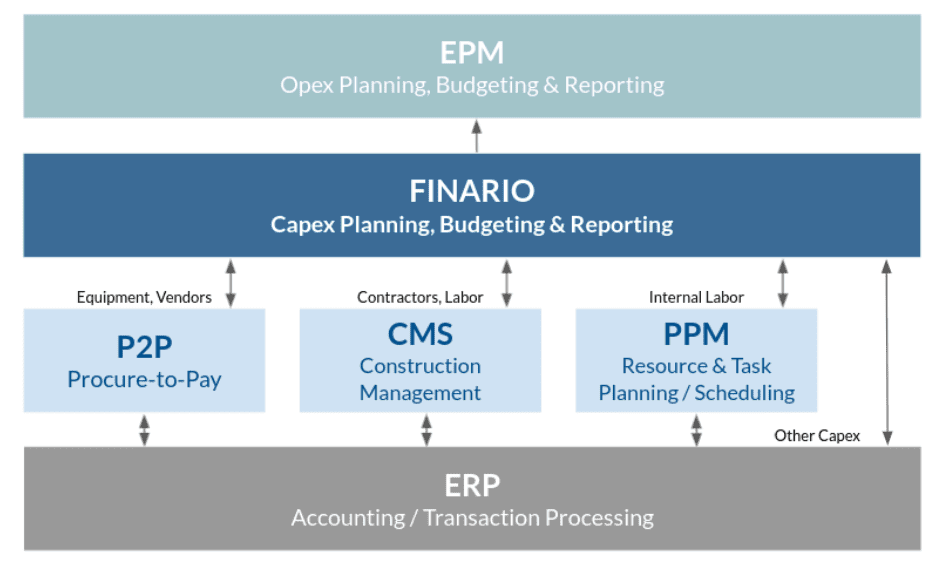

Finario brings your vision of automation, connectivity, and “sophistication with simplicity” to your organization’s capital planning function. With its open API, pre-built connectors and robust support, Finario gives you the ability to create a truly synchronized and powerful single source of truth, while fulfilling the mandate and impact of an effective and secure IT strategy.

The best performing organizations embrace your enterprise IT blueprint.

Leaders in IT have a unique opportunity to help drive better collaboration between operations, procurement, and other functional areas. This translates to better liquidity management, reporting accuracy for improved governance, and added flexibility to act opportunistically. It’s why Finario’s purpose-built, cloud-based software belongs in your finance stack.

Data dexterity drives decision agility.

Analysts talk of IT’s role in creating an organization with digital dexterity … that is, one which embraces and uses technology for better business outcomes. Synchronizing your Capex project data in Finario with your opex, procurement, construction spend and other financials provides that dexterity to empower decision-makers to act more quickly, with greater accuracy and actionable insights. It’s digital transformation, delivered.

Speed to value. Best-in-class security.

Whether your organization is ready for an integrated enterprise solution, or looking to take the first step with capital expenditure requests and approvals workflow automation, there’s a Finario solution ready to go right now. Be up and running in as little as two months, with full-fiscal-year support and continuous updates/feature enhancements. Finario checks all your boxes.

In an Era of Uncertainty, Enterprise Capex Strategies Are Under Scrutiny

In an Era of Uncertainty, Enterprise Capex Strategies Are Under Scrutiny CAPEX PLANS | CAPITAL BUDGETING MODEL | STATIC ALLOCATIONS Take John Deere. The global agricultural equipment manufacturer recently announced

Why Agile Finance Teams Are Turning to ZBB Amidst Tariff Shocks

Adjusting to the Impact of Tariffs: Why Zero-Based Budgeting is More Critical Than Ever CAPITAL PLANNING | CAPEX BUDGETING | CAPEX MANAGEMENT In the wake of global tariff shifts and trade

The capital budgeting process: What’s next after the ink is dry?

The capital budgeting process: What’s next after the ink is dry? You’re halfway through Q1. The capital budgeting process is complete, the plan is locked in and loaded into your system, and

What to do when finance and operations aren’t on the same page

What to do when finance and operations aren’t on the same page. Everyone’s trying to do the right thing. Finance wants to deploy capital wisely, and operations wants to keep

Capex Confidential: Mining

The metals and mining industry is at a pivotal moment. Long known for navigating complex regulatory environments and technological disruptions, the sector now faces an unprecedented convergence of challenges and

Why Every Industrial Company Needs a Capex Council

Why every industrial company needs a Capex Council You can tell a lot about a company by how it allocates capital. For example: Is it outperforming its peers? Can it