Building Better Business Cases

“Companies can’t shrink their way to success.”

Capex planning & management software for building better business cases from Finario:

Where strategy, risk assessment, and governance converge.

It’s been said, cutting expenses alone won’t drive success. Growth requires well-conceived investments. It’s why strategic alignment, rigorous vetting, and continuous oversight are so important. Finario Capex planning & management software shines for all of these.

SEE HOW FINARIO CAN HELP YOU WHEN DEVELOPING A CAPEX BUSINESS CASE

“Capital allocation is highly relevant, even critical, for the success of, and sustainable value creation by, companies. It is where corporate finance meets corporate governance.”

– International Corporate Governance Institute

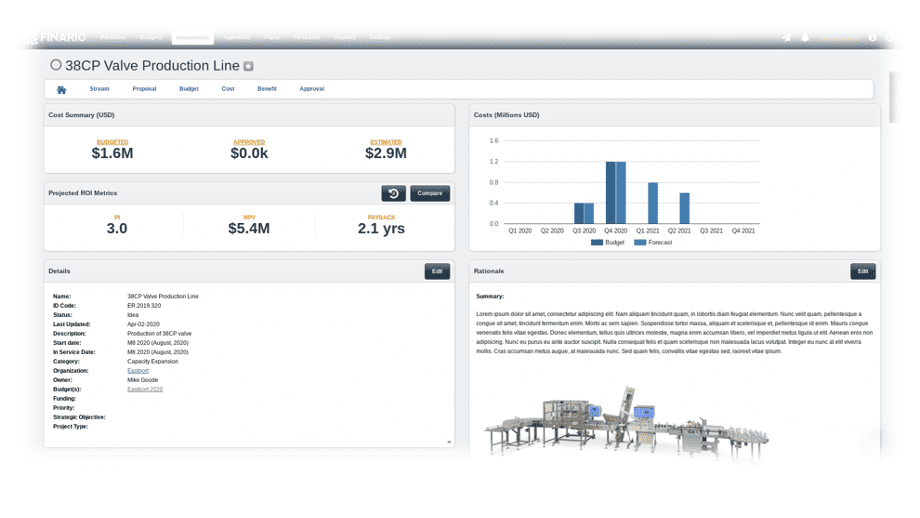

A Key Criteria for Modeling Capex ROI

![]()

An “apples to apples” evaluation of every capital project proposal is crucial to making better investment choices. Automating the application of your organization’s ROI criteria is a great way to ensure that happens.

Whichever metric, or combination of metrics, your organization uses, a key question to ask if you’re choosing a capital planning automation solution is: Will the resulting metrics be populated into all phases of Capex decision making and reporting, from start to finish?

Want to learn more about how Finario treats ROI modeling? Contact us for a complimentary consultation.

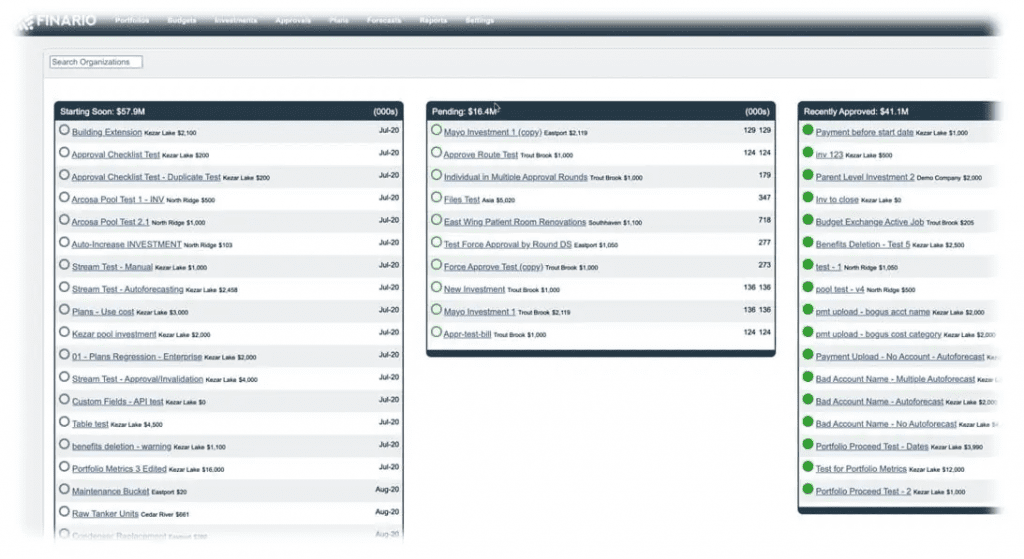

Rules-Based Approval Workflow:

Governance in Action

![]()

Good investment governance requires policies, processes and systems be in place that align corporate strategy with its investments.

This includes having “templates” that compel required criteria for evaluating and prioritizing investments, the ability to monitor and control forecast deviation across defined stages, and financial impact transparency.

Finario’s full lifecycle solution does just that. In particular, the approval workflow capabilities ensure that projects are considered consistently, and that there’s a holistic view of where projects rank in meeting overall objectives.

Moreover, with its dynamically updated data and reporting capabilities, project execution management and post-completion reviews can be governed effectively.

Stock Buybacks v. Capital Investment

There’s no shortage of opinion on whether stock buybacks are good for business and the economy. Proponents say it’s an efficient way to return money to shareholders and improve EPS. Opponents say it is a form of “short-termism” that cannabilizes future growth by cutting into capital investment and only enriches executive compensation packages.

Some things to consider:

- Stock buybacks were illegal until 1982 with the passage of SEC rule 10b-18.

- Companies that buyback shares “deprive themselves of the liquidity to help them cope when sales and profits decline in an economic downturn”*

- Buybacks disproportionately benefit short-term investors vs. long-term shareholders

- Strong balance sheets are essential to surviving economic headwinds

- Capital allocation is critical for the success of, and sustainable value creation of companies

Wherever you land on this, ensuring that capital projects are backed by a sound business case is crucial.

* SOURCE: Harvard Business Review. Link to article below.

“When corporate resource allocation is done well, companies are able to evolve and renew themselves over time, while at the same time producing a continuous flow of products and services that meet the needs of their customers and a continuous flow of profits that can be re-invested in the business or paid out to shareholders.”

– Harvard Business Review

A DEEPER DIVE INTO FINARIO: BUSINESS CASES & GOVERNANCE

MAKE A CASE

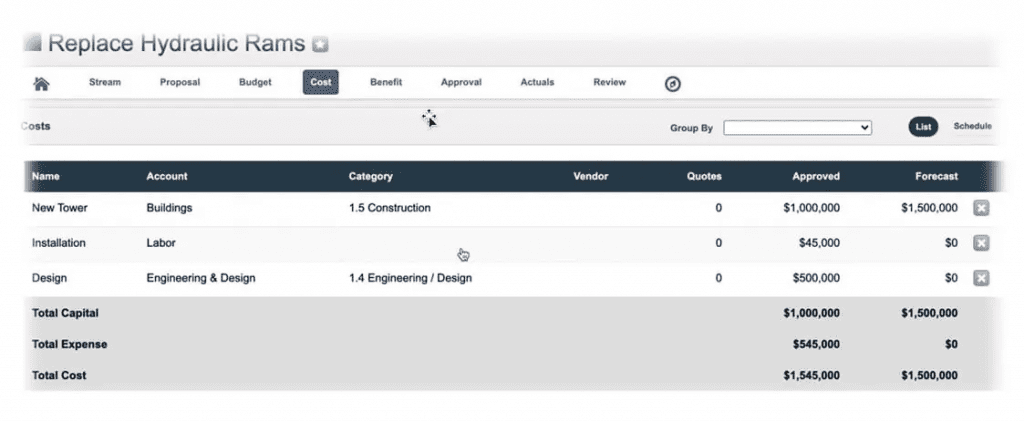

Lay out your business case whether your request is simply for a single piece of equipment, or a major multi-year material construction project. Finario makes it easy to explain the rationale clearly, including written justification, cost details and ROI projections. Moreover, it brings all necessary elements together automatically, such as tax depreciation, to ensure metrics are calculated correctly and consistently.

APPROVE SMART

Finario automates the entire approval workflow based on the business rules you set, at the division or organizational level, project type or other criteria. Set variance tolerance thresholds to require additional approvals. See every project in the queue, including projects starting soon, pending, and recently approved.

LEARN HISTORY

Finario makes it easy to view an audit history of who made changes, when they were made, and why. This ensures transparency, an audit trail, and the ability to support continuous learning.

FAQs

What are business case templates?

This refers to the information that is required for input – be it in a spreadsheet or on a screen that will provide context and justification for the project. This can include objectives, business benefits, alternative options, risk analysis, costs, projected ROI and more.

Finario lets you customize the templates to match your company’s chosen taxonomy, data fields (for an ROI mode, for instance), risk-scoring criteria, etc. Once you’ve set this, it ensures that everyone who is using your system is guided by the same criteria/metrics – which can have an enormous impact on driving uniform decision-making and adherence to investment governance.

What is reference class forecasting?

Reference class forecasting is “a method of predicting the future by looking at similar past situations and their outcomes,” according to Daniel Kahneman and Amos Tversky, whose work on the topic won them the Nobel Prize in Economics.

At its core, it’s a way to apply “lessons learned” vs. relying on human judgment, which has the tendency to be biased toward optimism. In capital planning, it means associating the performance of past projects of similar types, strategies, assumptions, governance structure, complexity etc. (referred to as “comparables”) to estimate potential outcomes.

Additional Resources You May Be Interested In

From Finario Executive Briefings

Why Making the Most of Your Capex Budget Should be a Priority