Translating executive vision into real results

The Strategic Capital Allocation Commitment:

Aligning capital availability

with strategic opportunity to drive long-term value

Nothing is more important to the health and performance of a company than the way it manages capital. Core to this: strategic discipline – regardless of the size of a project or its timeline. It's why companies should have a "strategic capital allocation commitment" like this.

We commit to ...

Taking a long-run view to increase corporate growth and profitability v. short-term hyper-focus on Wall Street analysts

Ensuring that capital can flow from "mature" portions of the business to "emerging" opportunities with higher potential

Having an "activist" philosophy for both multi-year planning and re-deployment of capital to optimize assets across business units and enable agile in-fiscal-year adjustments

Adapting a forward-looking investment mindset that puts ROI front and center as the primary metric for material projects v. backward-looking "accounting expense mentality"

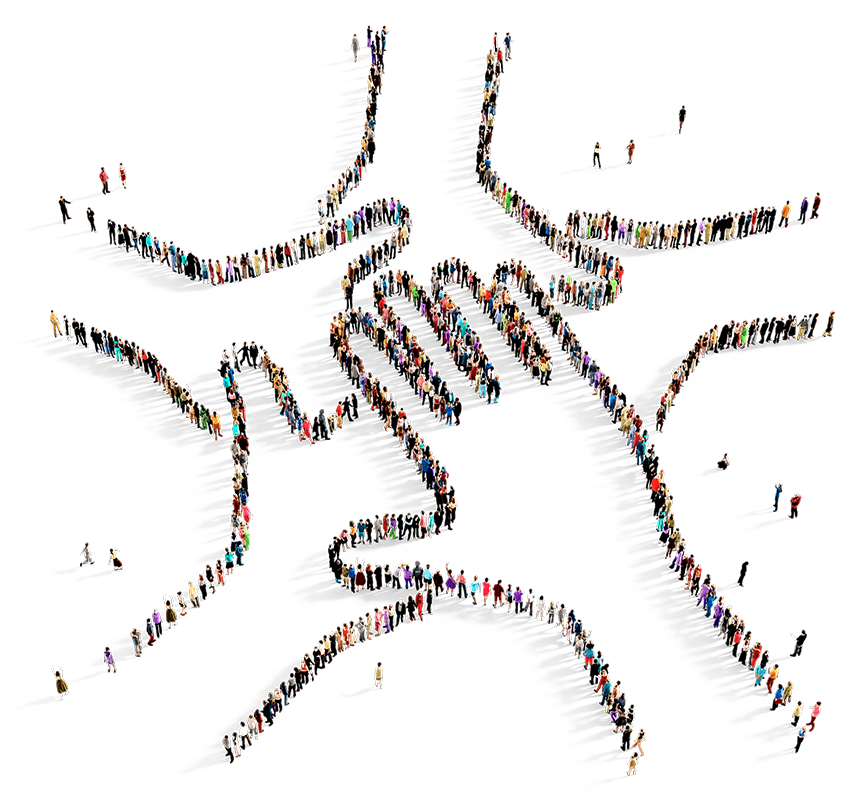

Accepting that the job of strategic capital allocation, like competition in the marketplace itself, is never done; it requires commitment, collaboration and an eye on the prize: creating long-term value

Acknowledging that there are no shortcuts as you aim to rise through the four stages of Capex development: process automation, project insight and financial context; at its "peak" is strategic capital allocation

Leaders today need to master a new skill: capital allocation.

Forbes

Investing

A mindset that every dollar spent is in pursuit of a desirable strategic outcome.

Spending

A mindset that you’ve been allocated money that must be spent for fear of “losing it” next time.

Continuous

Having the resources and discipline to allocate and manage capital based on current conditions, opportunities and real-time data.

Episodic

Allocating and managing based purely on fiscal year budgeting and scheduled/quarterly forecasts and reporting.

Realistic

Budgets, forecasts and ROI models based on unbiased analysis and historical data.

Rose-colored

Budgets, forecasts and ROI models based on assumptions and “gold-plate” optimism.

Targeted

Budgeting and approval of projects that are in support of greater portfolio objectives and strategies.

One-offs

Budgeting and approval of projects that are considered in isolation under the steady stampede of requests and priorities.

Gain new perspective.

Join the conversation.

See what leaders in business consulting, corporate finance, and cloud software have to say about strategic capital allocation and its role in outpacing your peers. Our free eBook is sure to inspire dialogue in your own organization.