Strategic investments: the cornerstone

of how leaders bring their vision to life

“Capital Allocation Is The Most Important Responsibility

of the Chief Executive Officer”

– Morgan Stanley

“Unless your company’s return on capital exceeds its cost of capital, no amount of revenue growth can create value,” wrote the Harvard Business Review.

It’s why the job of capital allocation is so important, and why the responsibility for that starts with the CEO. Yet, that same HBR article’s headline was telling: “CEO’s Don’t Care Enough About Capital Allocation.”

It was a provocation, of course. But it does hit a nerve: it’s been documented that those CEOs who do capital allocation well have longer tenures, produce better results and help their organizations navigate macroeconomic turbulence in superior fashion.

"Doing it well" requires that companies become "capital activists" according to Gartner, which they define as "exerting influence on how investments are evaluated to ensure that enterprise-wide value creation is put first, rather than short-term or siloed objectives."

Strategic capital allocation is a balancing act.

Driving long-term value starts with Capex investments.

What makes capital allocation strategic

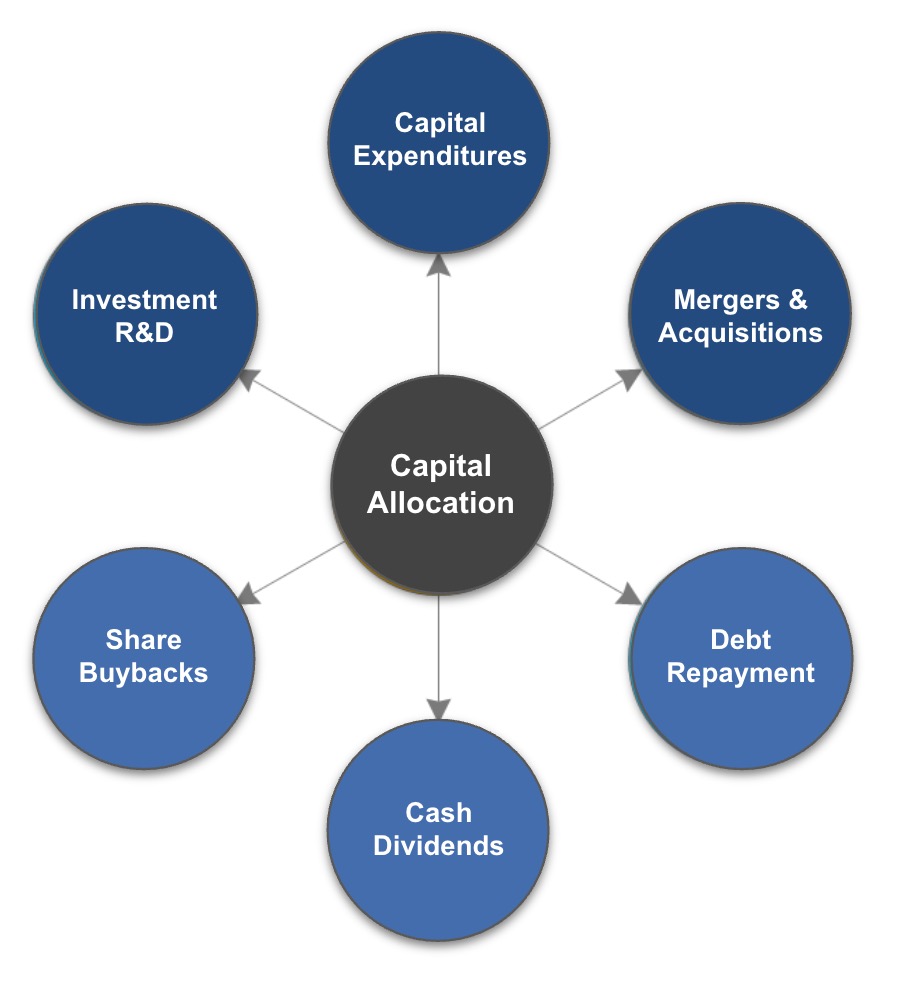

It starts with the consideration of how allocated capital fits in a portfolio of capital investment opportunities and which have the best prospect for increasing long-run corporate growth and profitability.

Moreover, it requires truly proactive management of the capital investment pipeline, as opposed to reactive capital expenditure control.

The importance of strategic capital allocation

Long-term corporate success (or decline) is highly correlated with sustained capital allocation effectiveness.

This perhaps explains why a leading reason that companies fail to achieve their stated strategic objectives is their inability to allocate capital strategically.

The timeliness of strategic capital allocation

Today’s business environment demands a strategic approach to capital allocation.

With rising interest rates, capital has gotten more expensive and harder to access as corporate lending and debt markets pull back; with an increasingly global marketplace, competition is fiercer than ever; and, with a 24/7 news cycle and easy access to data, the cost of a misstep is rising. Every Capex forecast surprise is an invitation to be “punished” by Wall Street.

How to implement a strategic approach

As with most things, it starts with senior leadership providing clarity and focus on the importance of strategic capital allocation … and the risks/rewards of doing it well.

Key to success is that it can’t happen once a year or even periodically; it needs to be a continuous effort — from the germination of potential investment opportunities and establishment of long-term strategies and plans, through annual budgeting and each individual Capex approval decision and forecast revision.

Also critical: a single-source of truth for capital investment data to support sound decision making from opportunity ideation through post-project performance reviews.