INSIDER PERSPECTIVES

FOR CAPITAL INVESTMENT STAKEHOLDERS

Capex Confidential: Pharma & Biotech

Regulatory pressures and technological disruption are the norm in pharma and biotech. But a new wave of challenges and opportunities — from market saturation to AI-powered drug discovery — is forcing a rewrite of the capital allocation playbook.

In this installment of “Capex Confidential,” we’ll delve into the critical choices facing pharma and biotech leaders in 2024 and beyond.

Opportunities

Less Crowded Markets

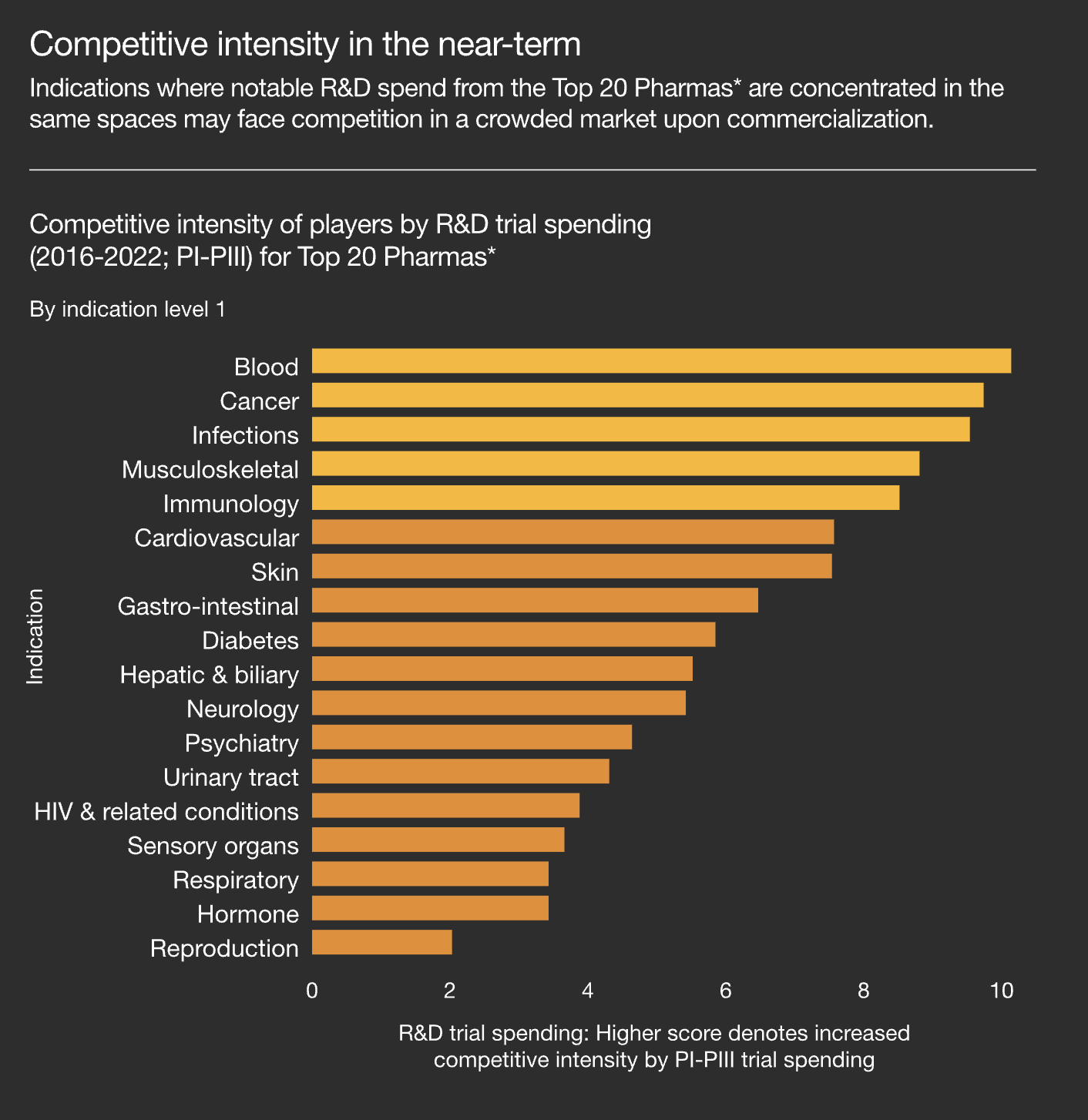

The last several decades have seen pharma players focusing on a smaller subset of patient populations. PwC highlights how this crowding effect is “resulting in more expensive investments in sales and marketing efforts, higher acquisition costs per patient, potentially lower peak sales and lower margins.”

It’s not hard to see why companies are increasingly going after established, low-risk markets. But, as competition erodes the returns of these already well-served populations, there’s a greater opportunity to deploy R&D into “white space” investments. It’s a classic risk/reward scenario — there’s no guarantee that therapies for new patient populations will pan out, but if they do, it could unlock higher returns for decades.

The success of GLP-1 agonists like Ozempic exemplifies the outsize returns that can come with addressing unmet needs. While primarily indicated for the treatment of type 2 diabetes, these drugs have also demonstrated significant potential for the underserved obese population. PwC and EY call out Alzheimer’s disease as another promising “white space” ripe for exploration.

For CEOs, CFOs, and all Capex stakeholders, this raises the stakes inherent in the balancing act of extracting the highest value from the lowest possible expenditures, choosing the best possible projects among those being proposed, having a clear-eyed view of what the most critical value-drivers are, and weighing shorter-term risks and rewards with longer-term performance.

AI-powered drug discovery

The journey from drug discovery to commercialization has long been an arduous one. According to BCG, it typically spans 12-15 years and is “estimated to cost approximately $2.5bn…when accounting for the cost of failures. Scientific and technical challenges mean the probability of discovering a new drug and progressing it to clinical trials is in the range of 35%.”

But many pharma leaders think they’ve found a silver bullet in the form of AI. The technology can rapidly analyze vast datasets, identify promising drug candidates, and optimize clinical trial designs, making the entire process orders of magnitude less expensive and more efficient.

Hong Kong-based Insilico Medicine, for example, illustrates the transformative potential of AI in drug discovery. They leveraged generative AI to create a therapy for a rare lung disease called idiopathic pulmonary fibrosis. Instead of the six years and more than $400 million this process would normally have taken, they achieved it in just two and a half years at one-tenth the cost.

There’s also Exscientia, whose Centaur AI platform can “generate highly [optimized] molecules that meet the multiple pharmacology criteria required to enter a compound into a clinical trial…in revolutionary timescales — cutting the industry average timeline from 4.5 years to just 12 to 15 months.”

As with underserved patient populations, a prudent approach to AI investment is a measured one. For all of its promise, AI comes with plenty of baggage — deployments can be expensive and come with complicated regulatory and ethical considerations. While faster drug discovery is enticing, the accelerated timelines can also necessitate a more intense period of capital investment in servers and manufacturing/distribution capacity. This can be a double-edged sword: getting drugs to market faster allows producers to better anticipate manufacturing needs, but it also requires careful planning and significant upfront investment.

Moreover, there is likely to be a long period of time between initial discovery into what the AI models can achieve and confidence in how said models were developed and trained. Lastly, it can’t be ignored that, if indeed, AI can vastly accelerate the discovery of novel drug therapies, then companies investing in the development of said therapies logically need to ask for how long they expect their products to be viable and unique. Indeed, while the “patent cliff” used to be a key consideration, AI can conceivably outpace said patent expiration considerations.

Advanced therapeutics and novel modalities

COVID-19 vaccines served as a global showcase for the transformative power of mRNA technology. But this revolutionary approach to vaccine design is just the tip of the iceberg. Pharma and biotech companies are forging ahead with a range of novel modalities that promise to redefine the treatment landscape.

CRISPR-based gene editing, for instance, is poised to revolutionize genetic medicine. With the recent FDA approval of the first CRISPR-based drug for sickle cell anemia and beta-thalassemia, the once-distant dream of correcting genetic defects and curing previously untreatable diseases is rapidly becoming a reality.

Meanwhile, antibody-drug conjugates (ADCs) are making waves in oncology. By marrying the targeted precision of antibodies with the potent punch of cytotoxic drugs, ADCs offer a more effective and less toxic approach to cancer treatment. Several FDA approvals in recent years highlight their growing significance in the fight against cancer.

Threats

Regulatory uncertainty

Shifting regulations are par for the course in pharma and biotech, and 2024 is no different. PwC explains that, as regulatory bodies become more familiar with AI, they “expect enforcement in the months and years ahead to become more stringent. From increases in audits of transparency programs…to increases in FDA inspections now that the pandemic has passed, regulators are likely to more proactively and effectively enforce current and emerging regulations.”

In the nearer term, capital allocators in the industry will be closely watching the upcoming U.S. presidential election. Potential changes in drug pricing policies are on the table, and price caps and stricter scrutiny could have significant implications on top-line performance. EY also emphasizes the need for biotechs to navigate regulatory shifts like the Inflation Reduction Act, which could significantly impact pricing strategies and, in turn, profit margins.

In Europe, the implementation of new regulations like the European Health Data Space (EHDS), while aimed at improving data sharing, could also introduce stringent compliance requirements that strain resources.

Amid this uncertainty, the case for a more agile approach to financial planning and analysis becomes even more compelling. For while changes in the regulatory landscape can — to a degree — be anticipated, so-called “black swan” events, geopolitical forces, and other unforeseen impacts on demand, supply chain, capital costs etc., cannot be overlooked.

High cost and complexity of advanced therapies

The promise of advanced therapies like CRISPR-based gene editing and mRNA vaccines is undeniable, but they don’t come cheap. These cutting-edge treatments demand specialized facilities and expertise, and construction costs can add up quickly.

But the financial burden doesn’t stop there. Maintaining these complex facilities, coupled with the intricate challenges of scaling up production, requires a continuous stream of capital investment. As interest rates continue to hover above 5%, the cost of capital remains a significant concern, particularly for smaller biotech firms with limited resources. The financial strain can be immense, potentially delaying or even derailing the journey from lab bench to patient bedside.

The Finance Perspective

The financials of pharma and biotech companies are getting squeezed at both ends. Top-line growth, once a reliable engine of expansion, is sputtering due to a confluence of factors. Increased competition from generics and biosimilars, coupled with mounting pressure to lower drug prices, is leading to tepid top-line growth and putting added pressure on companies to merge with, or acquire, other businesses.

EY sums up the outlook: “After a generally tough year for the biotechnology sector, 2023 ended on a positive note amid genuine hope that 2024 may be the beginning of a real recovery…At US$191.9 billion, 2023 revenues for European and US public companies dropped 10.7% from 2022.” Waning vaccine demand in the wake of the pandemic was a main driver of the revenue drop.

The cost side of the equation is equally murky. “Every cost on the P&L is going up due to inflation, interest rates, new tax regimes and an increasing threat environment.”

This situation is forcing finance leaders to make difficult choices and re-evaluate their capital allocation strategies. PwC notes that, “While top-line growth remains essential, cost management is moving up the agenda, and it needs to come with bigger ambitions.”

Finance teams are under increasing pressure to ensure that every dollar spent aligns with value creation. This requires a laser focus on identifying the true drivers of competitive advantage and reallocating resources accordingly. No one is immune — PwC goes on to say that, “Even sophisticated companies that have undergone cost reductions are considering ways to reallocate spending using a stronger value-based approach.”

Pharma and biotech executives recognize the urgency of this challenge. One-third of respondents to a Thermo Fisher Scientific survey cited the “need to maximize asset value and return on investment” as a top five concern.

Embracing capital activism is a great way to cope with these pressures. Deliberately allocating (and reallocating) resources to the most promising growth areas within a pharma company’s portfolio can boost returns on invested capital (ROIC). This approach often involves a shift from traditional annual budgeting to a more dynamic, rolling forecast model that allows for nimble reallocation as opportunities arise. Finario, a purpose-built enterprise platform for capital planning, can be essential in doing just that.

The Operations Perspective

Operations haven’t always been top of mind for pharma and biotech executives. McKinsey notes that, “In the past, many pharmaceutical companies (pharmacos) deprioritized operations strategy in the face of competing business pressures.” But, thanks to the influx of personalized medicine, intricate biologics, and cutting-edge manufacturing techniques, “this is now changing.”

Along with the industry’s evolution, macro trends are also shaking up the operational status quo. Pharmaphorum explains that “many life sciences companies with large, complex, and integrated global supply chains are beginning to consider ‘reshoring’, ‘nearshoring’, or ‘friendshoring’ manufacturing or operation sites within their supply chains…to countries with lower business risk, or less logistical or geopolitical complexity, in order to lessen the risk or lower the impact of disruption.”

While these shifts promise greater control and resilience in the long run, they also come with a hefty price tag and a steep learning curve. Setting up new facilities, training skilled personnel, and ensuring rigorous quality control in unfamiliar territories can be a daunting undertaking. All of which points to even greater collaboration between product development, operations and finance teams within the enterprise.

The IT perspective

As the industry increasingly relies on AI, big data analytics, and a host of other digital tools, the stakes for data security and privacy have never been higher.

Cybersecurity is the front line in this battle. With threats growing more sophisticated and frequent, IT professionals find themselves in a relentless race to stay ahead of increasingly bold cybercriminals. The consequences of a breach are far-reaching, potentially harming patients, tarnishing reputations, and leading to millions in losses—as highlighted by the recent ransomware attack on UnitedHealth that disrupted prescription deliveries for six days.

But the challenges for IT don’t end there. Integrating cutting-edge technologies like AI, machine learning, and digital health tools with existing legacy systems is no easy feat. It’s a complex dance that requires significant resources and expertise to ensure seamless interoperability.

Moreover, as AI-driven drug discovery and development take center stage, the demands on IT infrastructure are skyrocketing. The sheer volume of data involved necessitates scalable solutions capable of handling massive computational workloads. That’s where cloud-based tools come in, offering the scalability, flexibility, and cost-efficiency needed to stay ahead of the curve.

The bottom line is clear: investing in robust cybersecurity, seamless integrations, and scalable infrastructure is imperative in 2024 and beyond.

Pharma and Biotech Are On the Cusp of a New Era

Pharma and biotech are at a crossroads. Several years removed from the pandemic, industry leaders are refocusing on the therapies and technologies that will define the next era of patient care. Companies that embrace change by making strategic Capex investments are the ones that will thrive in this new era.

With regulations and drug development moving faster than ever, pharma and biotech leaders need an agile, evidence-based, and efficient approach to capital allocation. Finario equips you with the tools and insights needed to stay ahead of the curve. Schedule a free demo to see how every phase of the capital allocation process at your company can be made more efficient and effective.