By Charlie Rhomberg

In the current environment of changing business models, monetary policy uncertainty, and an upside-down supply chain, making assumptions about the future can be futile.

Yet, despite the clouded outlook, or perhaps because of it, prudent capital planning remains essential to success.

To be in control amid these changing dynamics, companies need capital planning software that provides insights, financial intelligence, and ensures the accuracy of their forecasts for sound deployment of capital resources.

For that, spreadsheets and siloed legacy solutions no longer make the cut.

Enter Finario.

By creating a single source of truth for Capex along with best-in-class decision support capabilities, Finario is an all-in-one program for the modern enterprise. Gone are the days of tying data from different systems, manually sharing forecasts with project managers, and Excel-based project modeling. It gives your business a state-of-the-art capital planning capability commensurate to the size and importance of your capital budget.

Viewing capital planning through different lenses

As a former FP&A analyst, I worked on various aspects of the capital plan, using multiple systems for different needs.

If I had to approve a Capex project proposal, I went to Coupa, which doesn’t include project-level detail.

If I was modeling the NPV of a proposed investment, I was in Excel.

If I was looking up details on a current project for reporting purposes, I went to JD Edwards.

Using all these systems made it difficult to get a complete picture of the capital plan. In FP&A, the focus should be on ensuring that capital is going to the portfolio of projects that will generate the highest return on the company’s capital.

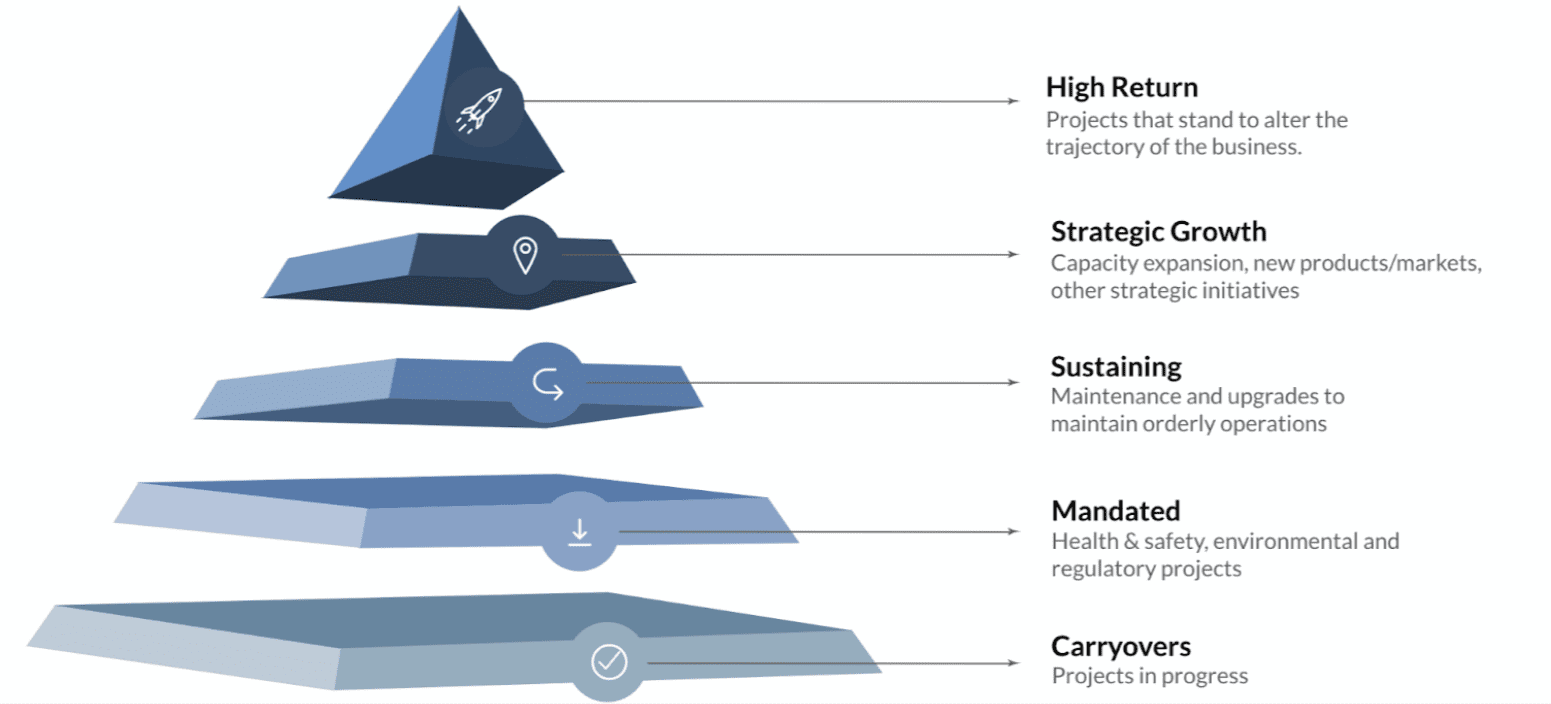

For engineers, the definition is a bit different. The Capex approval process is how their projects are added to the queue, and their incentives can differ from the broader goals of the organization. This can mean that impactful projects may be trimmed to fit the “mandated” or “sustaining” labels in order to increase chances of approval, as “growth” projects are likely to receive more scrutiny. In fact, a recent report in HBR wrote, “Senior managers end up rubber-stamping the small proposals that often makeup 80% of the capital budget.”

Dynamic approval workflows offered by Finario GO streamline the process, and ensure that the right people are in the approval flow, at the right time, with the essential data they need to make an informed decision. Additionally, the reference class forecasting feature compares new requests to similar ones that have already occurred, giving approvers unbiased, historical data from which to assess the new project.

For accountants, capital planning looks different still. Ensuring the company has the bandwidth to finance a project along with other commitments is of the utmost importance to them. If promising projects are held up due to long budgetary processes, the company could miss out on valuable investment opportunities that could enhance their long-term strategy.

Real-time insight into committed (and spent) cash across the portfolio gives all senior stakeholders the ability to have a real-time view into where things stand should unforeseen decisions need to be made. And Finario’s Converge feature allows you to compare various projects in the queue, and see how approving one or another will impact your budget. This type of insight is crucial in today’s fast-paced business environment.

Capital planning is core to corporate growth strategy

Getting FP&A and corporate strategy teams aligned on capital planning reduces the chances that a 5-year plan turns into merely a toothless corporate vision statement.

In developing mid-to long-term plans, corporate strategy typically sets the vision first. After some period of market research, they’ll usually recommend new markets for the company to enter, as well as paths to increased share in currently-served markets. Depending on the length of the plan, they may also include high-level associated revenue projections.

Once this plan is developed, FP&A is tasked with modeling various scenarios for funding that growth, while continuing to sustain existing operations. Aligning on assumptions with strategy teams is imperative at this stage. If the company doesn’t have the capital resources to execute on the goals corporate strategy has set, the plan is doomed to fail.

Moreover, initial alignment isn’t enough. I’ve seen how quickly assumptions can change, so strategy and FP&A need to be tied at the hip to course-correct as necessary.

The bottom line is, a capital plan should serve a company’s corporate strategy—not vice versa. Modern companies need real-time visibility into their plan to ensure its continued service to strategic goals.

Is a new CFO coming in? She likely wants to review details on previously-approved projects.

Did input costs unexpectedly increase, pushing the updated project estimate over budget?

Does one long-time engineer tend to underestimate costs associated with his project proposals, frustrating FP&A on the back end?

Insights into questions like these are difficult and time-consuming with generic workflow solutions like Sharepoint or spreadsheets. Finario gives you full visibility into your capital planning, past and present.

From the analyst’s desk to the C-Suite, Finario increases productivity across the board

The dream of every CFO is to have engaged, productive finance teams. Legacy systems make that engagement significantly harder to attain. Instead of focusing on value-adding analysis, teams spend their time reconciling data across systems and chasing down necessary approvals. In my experience, this leads to apathy around the entire capital planning process.

With a capital planning solution such as Finario, it’s not just finance that will see their productivity increase. IT will no longer have to deal with the inherent headaches of manual workarounds. Risk management will have a real-time picture of risk across the portfolio. Accounting can see project budgets by fiscal periods automatically.

So that should answer the question, “what is capital planning.” Which then leads to the next one: does your organization have the tools it needs to do it as well as it should?