At a high level, the differences between Opex and Capex are very clear:

Opex (operating expenses) covers an organization’s day-to-day expenses that keep the lights on, including payroll, rent, and inventory costs. Capex (capital expenses) covers major purchases that are meant to improve efficiency or capacity of current operations and/or generate value over the long run. These include plants, buildings, technology, machinery and other equipment.

While both types of spending command a large share of an enterprise budget, and ultimately impact profit or loss, Opex has been the preferred target for digital transformation initiatives in the form of enterprise performance management (EPM) solutions. This is because Capex dollars on the balance sheet are often overshadowed by the day-to-day focus on the P&L. In the past, these investments could be revisited a few times per quarter; today’s pace of change in the business environment, however, demands more frequent reviews, and more detailed metrics.

Moreover, in many companies, the ritual of the monthly actuals review focuses mainly on Opex variances. Comparisons against the annual plan and the latest forecast dominate the discussion, with Capex often an afterthought, reviewed once a quarter or so.

This, frankly, defies logic. Here’s why.

The “Capex gap” and the business case for integration

Within most EPMs, Capex is represented as a single line item per business unit or per project that reports what has been budgeted and spent, with little project-level detail. Insights into the rationale or projected financial return on the projects, actual dollars spent at any given point in time, and other key information and metrics are rarely available.

In an era of constant change and disruption, and where Capex budgets are substantial, this simply will not do.

Coming out of COVID, and with the specter of supply chain challenges and other economic forces looming, it’s clearer than ever that assumptions are always in flux, meaning that companies today need systems that can keep up.

In short, without a purpose-built solution for Capex, you’re operating at extreme disadvantage.

Is it efficient to continuously chase down data sitting in a spreadsheet on an engineer’s computer? To require five to ten days to produce an essential report, when it could be available in minutes? To make critical investment decisions without knowing what has been actually spent on projects already in progress.

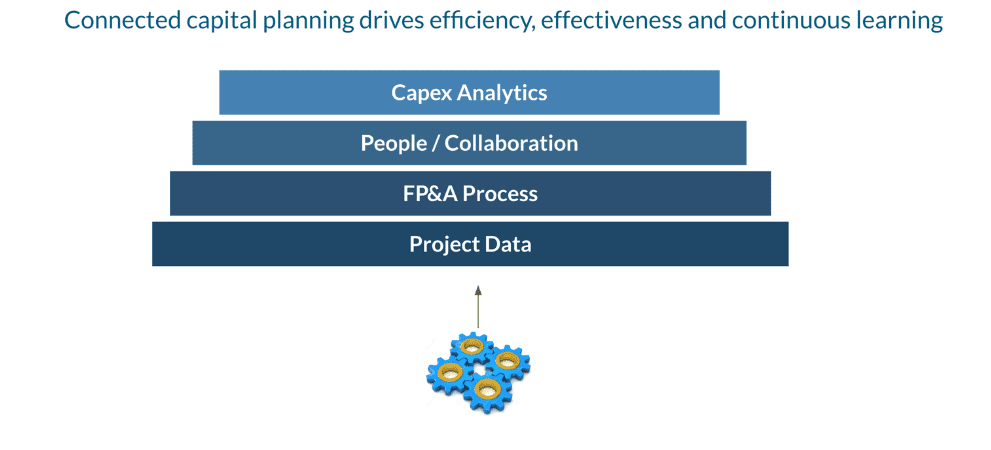

Of course not. The case for connected capital planning is stronger than ever.

Creating a “Capex hub”

Instead of thinking of “Opex vs. Capex,” the more strategic view is “Opex and Capex.” Which means adding cloud-based capital planning software to your stack/ecosystem.

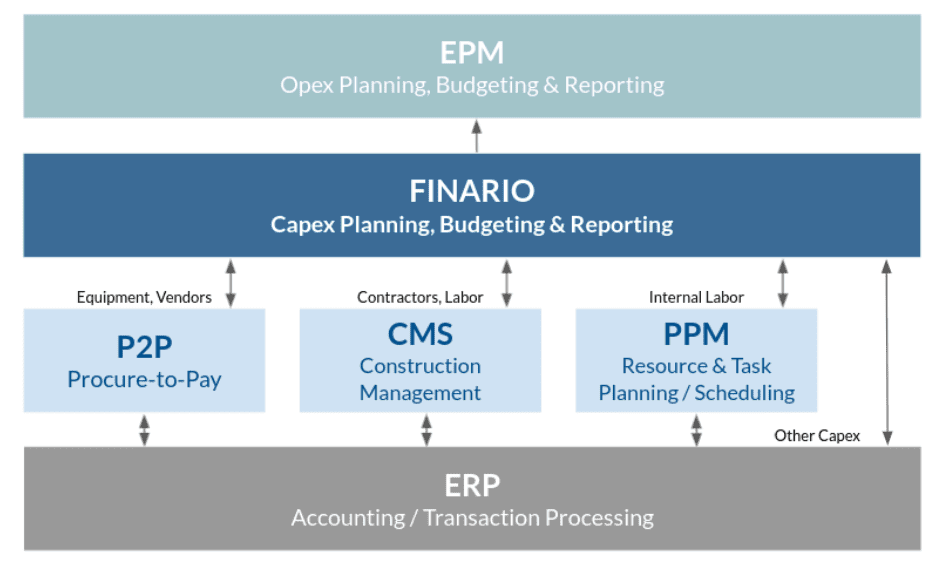

As you can see, the ability to pass data between your ERP, EPM, and other solutions such as procure-to-pay and construction management, creates the single source of truth that can be so critical to accuracy and insights.

This starts with integrated actuals from your ERP automatically matching to the correct project, eliminating a common headache for finance teams. Analysts that spend time painstakingly updating projects with actuals through manual coding processes will be freed up for more value-added tasks.

Having that real-time view of approved spend versus pending requests and what has actually been spent can be invaluable. For example, suppose your company had a large capital outlay in place for new office space which–coming out of Covid—was just scratched due to the rise of remote work. With real-time insights into the capital portfolio and the tools to rank and prioritize projects, finance leaders can redeploy those dollars quickly to other priority initiatives that will produce a better return on investment.

Perhaps most importantly, taking an integrated view of Opex and Capex in particular, and the entire “finance stack” in general, drives collaboration between corporate functions and the people who are engaged in them. As has been well documented, silos between departments and data throw sand in the gears of your company. Approval periods take longer than they should, teams don’t communicate well with one another, and priorities become misaligned across the organization. Breaking down the silos which inhibit information sharing can have a game-changing impact on efficiency and effectiveness.

So, yes, while the “Opex vs. Capex” narrative is popular in finance circles, the real question that should be asked is “what’s the best way to manage Opex and Capex?” Because, while they’re different, they are both critical components of strategic growth and profitability.