You’ve identified a problem that needs to be solved. You’ve explored solutions to resolve that problem, identified what’s required, and have a supplier in mind that you believe is a great fit.

Now comes the hardest part for many: getting everyone who has a say in approving a final decision on board.

This is where the art of gaining consensus becomes essential – particularly at a time when business conditions can be so uncertain.

Research by the Corporate Executive Board (CEB) suggests that, on average, 6.8 “stakeholders” must sign off on a B2B solution such as a SaaS software investment for it to be approved. Complicating matters: they can come from a variety of roles, functions and geographies, bringing with them differing needs and opinions.

Do you know who these folks are? Do you have open lines of communication with them? Have you made an effort to understand the perspectives/biases that each bring to the table? It’s not unusual for a company to go from needs definition, requirements and vendor selection in a silo … and then come to a grinding halt when the buying group converges to make a decision. Whether or not that’s the case in your situation, there are important steps you can take to make the process smoother, and the outcome as desired.

Shared Understanding

Most “experts” agree that consensus-building actually begins with framing the costs or missed opportunities inherent in the status quo. The more data and strategic rationale you have to create this shared understanding, and communicate it, the better. Two simple succinct documents – a “situational assessment” and “Descartes Square” model – can be invaluable.

In your situation assessment for an enterprise capital planning solution, succinctly outline known factors such as:

Average weeks/months it takes to properly route a project proposal for approval

- Notable missed investment opportunities attributable to flawed internal processes

- Documented history of project cost overruns

- Recent funding of projects that later were regretted or which missed ROI targets

- Organization’s performance experience in pivoting/agile decision making in times of adverse business conditions

- Quantifiable implications of absence of insightful reporting

- Documented forecasting/reporting errors and their implications

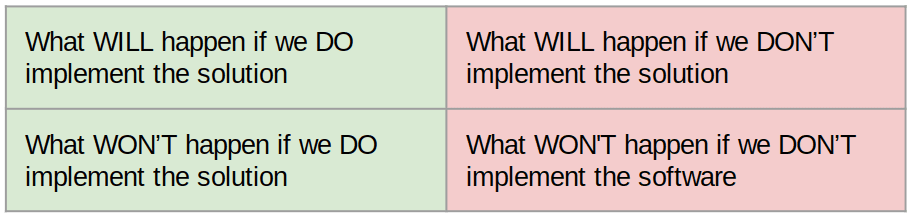

Additionally, the “Descartes Square” model is a simple, but effective way to frame action vs. inaction.

Now, let’s say that, in doing this exercise, it’s revealed that 40% of capital projects exceed their initial forecast by 15% or more, with a bottom-line implication of ~$70 million annually. If you’re on the engineering team, you might cast blame on the approval and sourcing processes. If you’re on the FP&A team, you might call out bias in the initial plan/forecast. If you represent IT you could point a figure at being denied the funds to make necessary changes.

Don’t go there. Playing the “blame game” just ratchets up indecision and resentment.

Creating common ground is critical. Focus on solutions and empowerment. Emphasize how the product that’s being proposed will enable key stakeholders to be successful at performing their jobs … and the material implications of doing so.

Empowering your “mobilizer.”

Studies conducted by Harvard Business Review indicate the importance of empowering “mobilizers” – those who are “motivated to improve their organization; are passionate about sharing their insights with colleagues; ask smart, probing questions; and have the organizational clout and connections to bring decision makers together.”¹

Whether that person is you or someone else, being a mobilizer doesn’t make you a salesperson. Which means, it’s reasonable to want help articulating and communicating the proposed solution and its value proposition that’s being advocated.

A good strategy, therefore, might be to ask your vendor of choice for help in this regard – whether it be in providing ROI estimates, sample reports, a customized demo for a particular person/role in your organization, articulation of competitive differences, benefits summary doc, or all of the above.

In short, giving your mobilizer the confidence to become a champion for your much-needed enterprise capital planning solution will go a long way in achieving consensus for sign-off. To be most effective, you want your mobilizer to be less concerned about the risk being tagged as the champion of something that doesn’t work out – for whatever reason – and more excited about the possibility of being lauded for creating consensus around something that positively impacts the business, and the way folks are able to perform their jobs.

Conflicting views on the need for change.

Last but not least, any discussion on consensus is incomplete without talking about conflict resolution. For example, what do you do if you have five teammates who are proponents of an enterprise capital planning solution buying decision, but one who is an opponent – and holding back the entire group? Or, how about a situation where, for example, the finance team is solidly behind it, but IT is pushing back? Or where the C Suite (CFO and/or CEO) says he/she sees the rationale, but not the urgency, of approving the expense?

Each situation is unique, of course, but some well-established rules apply:

- Acknowledge mutual respect for differing points of view

- Stick to the facts; make an argument that is strategic and grounded in metrics

- Speak to the problems you’re looking to solve in terms that are most meaningful to the person/people you’re looking to persuade

- Listen to arguments being made counter to your POV without knee-jerk reactions

- Have a willingness to compromise

- Articulate the win/win

At the end of the day, “getting over the finish line” on an important decision such as optimizing your enterprise capital planning amounts to rallying your team around a common goal, with a clear and desirable outcome. Getting there is rarely a linear process, or necessarily fast. But, when successful, worth the effort.

1. Making the Consensus Sale, Harvard Business Review, March 2015