ENTERPRISE CAPEX SOFTWARE

Make Every

Capital Project Count

Connect your people, projects and systems for an accurate view of all capital project activity and options

Top performing companies globally count on Finario's enterprise Capex software

Get a Customer's Perspective ...

Better decisions. Faster growth. Increased profits.

Aim Higher

Connect Your People

When operations, finance, procurement and IT are on the same page, great things happen.

Call it the power of transparency and collaboration: Inefficiencies are eliminated, forecast accuracy is enhanced, and decision-making accelerated.

Finario puts deep project-level data and broad project portfolio synchronization at the ready for all Capex stakeholders.

Learn more by clicking on your role below.

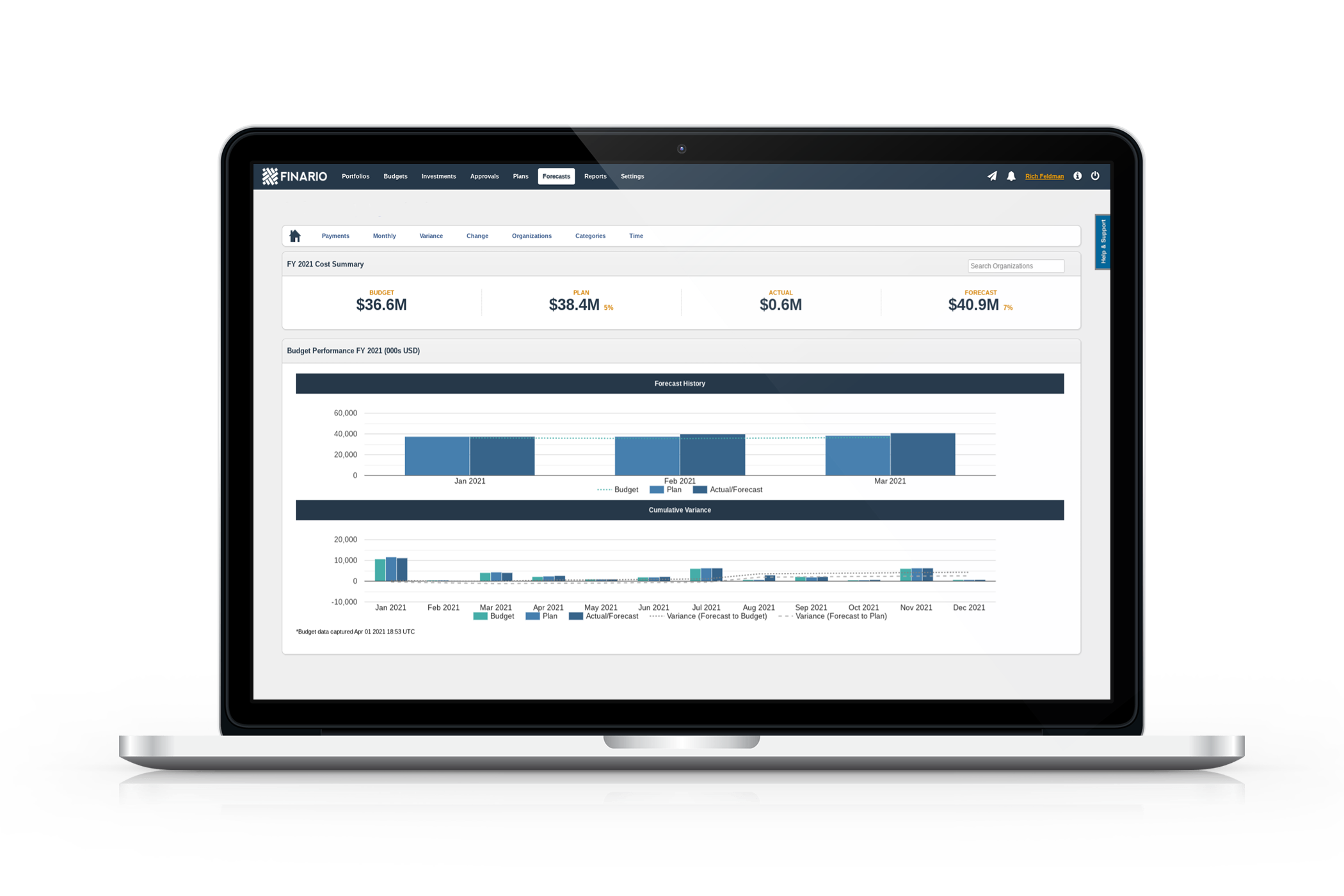

Connect Your Projects

Prioritizing projects across a large portfolio has always been challenging. Rapidly shifting global markets and public policies aren't making it any easier.

To win the battle, efficiently standardize and centralize your data, including deep project detail with costs, benefits, risk & return. Then, mindful of enterprise budgeting, forecast variances and evolving strategic objectives, leverage that data into valuable insights.

Finario is purpose-built to provide a unified view of your project data from investment inception through completion.

Discover the Finario product best suited to your organization’s needs

Connect Your Systems

What is your system of record for Capex?

Most organizations struggle to establish a single view of this critical enterprise imperative.

Capital budgeting, project approvals and forecast changes are ultimately all part of the same capital allocation decision. Finario’s capital and portfolio planning application integrates seamlessly with your ERP and other transaction systems to finally establish a single source of truth for Capex.

Better for business users. Easier for IT. More secure for all.

Watch our product

overview video

Reliable. Secure. Easy to use.

CLOUD TECHNOLOGY

Optimum operational performance

for ensured availability.

SOC-2 CERTIFIED

The highest level of security to protect the interests of your organization.

OPEN INTEGRATION

Seamlessly integrate with J.D. Edwards, SAP, Oracle and other enterprise systems.

Getting Started with Finario Enterprise Capex Software

We get to know your process

Join a demo tailored to your business

Collaborate with IT to ensure success

Implement in as little as two weeks

Get guidance for a full fiscal year

Run our ROI calculator to get a sense of the potential financial impact of a Finario implementation

Every growth-minded organization is certain to benefit from Finario's best-in-class enterprise Capex software. Here's why.

Simply put: there’s a lot of money on the line – funds that are critical to maintaining your uninterrupted operation and ability to meet demand … to satisfying regulatory requirements strategically … and for investing in growth.

Competing and performing at a high level requires a solution that’s up to the task … that’s ready for anything … that’s trusted and proven. That’s Finario.

Explore what's new in the Capex Resource Center

FAQs

What is enterprise Capex software?

Whether you consider 50 capital projects a year, 500 or 5,000, there are myriad factors to evaluate in determining which deserve to be budgeted, and why. You want to consider projects individually and holistically to ensure the right balance of sustaining operations while best positioning the company for growth. And looking ahead, you want to ensure that essential data for every project “travels” with it through the budgeting, approval, forecasting and reporting cycles.

Purpose-built enterprise Capex software automates and streamlines critical Capex processes, and enables finance and operations leaders to assess and consistently compare each material project’s strategic value, ROI and other investment criteria to make the most informed decisions.

Key benefits include:

– A more efficient capital budgeting process and annual plan for Capex investments

– ROI metrics calculated correctly and consistently on all material projects

– Capex request approval process moves smoothly without manual intervention or workarounds

– Actuals fed automatically from your ERP(s) into a single system of record for capital forecasting and variance analysis

– Makes it easy for HQ at all times to know exactly where each business unit and all of its projects stand in relation to budget and proposed completion dates

– Post-completion reviews can be easily performed on time and that intelligence leveraged by others on their projects

What is capital planning software?

Capital planning software automates and streamlines critical Capex processes, and enables finance leaders to assess and consistently compare each material project’s strategic value, ROI and other investment criteria to make the most informed decisions. It’s why an enterprise capital planning solution like Finario is such an important component of the modern finance tech stack.

How does Finario compare to worflow solutions built on a form-builder platform?

Vendors of generic workflow tools tout the “flexibility” and “customization” that their systems provide as the answer to a multitude of problems. But for a process that is inherently financial such as Capex, these attributes are a mirage, describing nothing more than the ability to label and move fields around on a page form. The fields themselves are inherently dumb with no understanding of fiscal years or how all the complex data associated with capital planning inter-relates. No matter how much time, effort or cost one might put into customizing such a system, the end result will inevitably be a pale imitation of a true financial planning system purpose built for the job. You wouldn’t consider for even a moment trying to custom build an ERP or CPM/EPM solution on such a tool, and trying to create a capital planning on such a narrow foundation would be an equally risky and costly mistake.

How does Finario compare to a SharePoint solution?

Historically, many organizations have customized generic workflow applications such as Lotus Notes or Microsoft SharePoint to manage Capex approvals. While seemingly a sound choice since they are often already in use for many other internal processes, it’s typically “tough road to hoe” given the complexity of Capex and most deployment “conclude” well short of the original aims, leaving business users frustrated and IT stuck with repeated requests to engineer manual workarounds.

Moreover, as approval is just one small step in the much larger capital planning and management process, these organization continue to rely on spreadsheets for capital budgeting, forecasting and reporting. This not only wastes time and leaves them exposed to errors and security risks, but short changes decision makers tasked with employing the enterprises capital wisely.

Finario, in contrast, was purpose-built for full life-cycle capital and portfolio management, combining a robust project analysis foundation with sophisticated financial intelligence to provide world leading performance for companies that care about Capex. As a cloud-native solution, deployment is rapid and risk-free.

How does Finario compare to an EPM solution?

Enterprise Performance Management applications, with their focus on departmental budgeting, treat capital projects as merely a line item. Total project cost, or total cost by month and associated depreciation. While, yes, there is some simple workflow, it’s rarely enough for the typical complexity of a Capex approval process in a large enterprise.

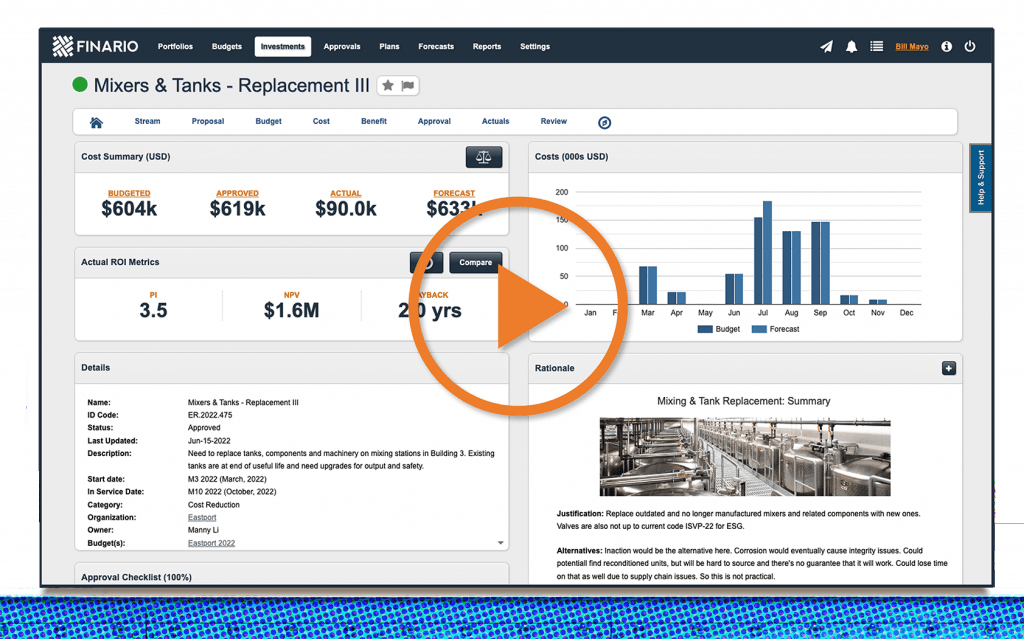

Finario is built around projects (called “investments” within the application). A large investment can contain dozens of costs, each with their own month-by-month cash flow along with a written rationale, ROI model, file storage and other capabilities enabling analysis and management of the project. The template is flexible to allow as much information as necessary on large or strategic investments, or the bare minimum for small routine expenditures. And each investment’s cost detail is automatically consolidated into a multitude of budgeting and forecasting reports by entity and fiscal year – giving FP&A professionals exactly the information they need.

Finario also tracks each investment’s progress as a project against its budgeting and approved project goals, which may span multiple fiscal periods. This data is automatically rolled up into a bevy of reports and tools that give operations and procurement executives the information they need to manage projects intelligently and optimize the overall project portfolio.

So, while an EPM and an “EPM for Capex” such as Finario offer budgeting and forecasting functionality, the focus and depth of information is very different. Which is why any business with meaningful Capex will need a Capex-centric solution in addition to an EPM.

What's the difference between a project budget and capital budget?

A project budget is simply the total funding that has been approved to complete a specific capital project, independent of time frame.

A capital budget is the total funding an organization has set aside in one fiscal year to fund all of the expenses occurring on approved projects during that fiscal year.

As an example, the difference can be seen clearly in a particular expenditure within a project that was expected to occur in October of FY 2021 that is delayed to March of FY 2022. There is no change to the project budget but there is a positive variance for the FY 2021 capital budget as well as the need to allocate funds from the FY 2022 capital budget to complete the project.

So when evaluating applications that purport to support capital budgeting, be sure to validate whether it’s truly capital budgeting and whether, for example, the system can provide historically accurate budget and variance reporting over the years as your organizational structure changes due to growth, M&A and the evolving nature of your business.

What is Return on Invested Capital (ROIC)?

According to many, return on invested capital (ROIC) is the most important metric of financial value creation. In a nutshell, ROIC divides after-tax operating profit by invested capital, and paints a clear picture of how effectively a company is using that capital. Basically, the better return you can produce on your capital, the more investors will pay for your company.

Capex Lightning Rounds - Season Pass Registration Form

Capex Lightning Rounds - Ridding your organization of capital planning "bad habits" Registration Form

Capex Lightning Rounds - Outmaneuvering tariffs and inflation: The new rules of capital allocation Webinar Replay Form

Capex Lightning Rounds - Benchmarking & the metrics that matter most in Capex Webinar Replay

Send me my deck and sign me up for a demo

Let us find the right Finario Product for you!

Book a Demo

Video Tour of Finario

Complete this short form to watch our product overview video.