INSIDER PERSPECTIVES

FOR CAPITAL INVESTMENT STAKEHOLDERS

In an industry where large-scale investments in plant equipment, raw materials, technology, and infrastructure are crucial, mastering capital expenditures (Capex) can be the key to solid growth or decline. But doing so isn’t easy: Financial executives and operations teams are often confronted with a range of challenges as they navigate how to allocate capital best.

Looking forward, several key trends and factors are set to shape Capex planning in this sector. Some of these are more predictable – such as technology costs and the need to meet regulatory requirements; others are not – such as the geopolitical landscape, macroeconomics, and other “wild cards.”

1. The High Cost of Equipment and Technology Upgrades

Most people in the building materials sector would agree that staying competitive requires substantial investments in new equipment and cutting-edge technologies. Where the debate rages is in what ROI benchmarks should be considered “acceptable.”

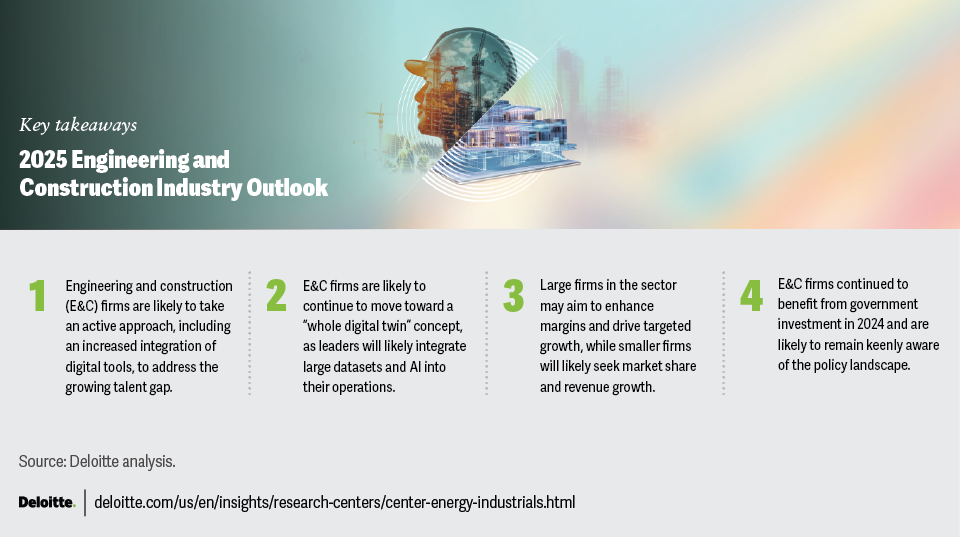

Whether it’s state-of-the-art machinery, artificial intelligence (AI), the Internet of Things (IoT), or cloud computing, these technological upgrades come with significant costs. As highlighted by Deloitte’s 2025 Engineering and Construction Outlook, many industry leaders are already adopting these advanced technologies to streamline their operations – and now focusing on scaling them across functions, from back-office to project delivery, with an emphasis on connected construction, digital twins, and enhanced building information modeling systems. Their aim is to boost their capacity and capabilities, addressing labor shortages by optimizing work hours through automation and improved efficiency.

Financial Considerations:

- Depreciation and ROI: Finance teams must carefully assess the depreciation schedules and return on investment (ROI) for each piece of equipment. Large Capex investments should align with the company’s long-term strategic goals and yield measurable benefits.

- Leasing vs. Purchasing: Companies should weigh the pros and cons of leasing versus purchasing equipment. Leasing offers flexibility, but purchasing provides long-term ownership, which may be more cost-effective in the long run. Consideration can be given to capital availability, tax implications, and liquidity needs.

Operational Impact:

- Integration with Existing Systems: New technologies must be effectively integrated into existing production workflows – which can be a complex process leading to temporary disruptions.

- Maintenance and Downtime: High-tech equipment often requires specialized maintenance. Operations teams must plan for potential downtime, ensuring that production continues smoothly without costly delays.

2. Rising Raw Material Costs, Tariff Concerns, and Supply Chain Constraints

Fluctuations in raw material prices — such as cement, steel, and timber — pose a significant challenge for capital planners. Case in point: Construction Dive reported that “New or increased tariffs have the potential to raise prices for a wide range of construction inputs, including items produced domestically that compete with imports.”

Additionally, while inflation has been moderated from its highs, concerns remain over the prospect of higher rates if it doesn’t reach the targets set by central banks, or stagflation. And geopolitical concerns remain which could disrupt supply chains.

Financial Considerations:

- Cost Volatility: Materials like steel and timber often experience significant price volatility, which puts the onus on finance teams to prepare for price hikes by having contingency plans and the data to pivot quickly and modify budgets and forecasts.

- Inventory Management: Efficient inventory management becomes critical. Companies must balance maintaining sufficient raw materials with avoiding excess inventory that ties up capital.

Operational Impact:

- Supply Chain Disruptions: Operations teams are diversifying supplier relationships, onshoring, and ensuring backup plans are in place to manage risks related to unforeseen disruptions.

- Waste Management: Rising material costs create an incentive to reduce waste during production, which not only cuts costs but also helps the company meet sustainability goals.

3. Sustainability and Regulatory Compliance

Environmental regulations and consumer demand for sustainable building materials are pushing companies to adopt greener practices. Meeting these demands can require significant Capex investments, but the long-term benefits — both financial and environmental — are often substantial.

Financial Considerations:

- Green Capital Investments: Investing in energy-efficient machinery, eco-friendly materials, and waste reduction systems often requires significant capital. This means that budgeting decisions, including approval workflows, should factor in the benefits, risks, and strategic alignment of those investments at every stage of the capital planning process.

- Government Incentives and Grants: Many governments offer financial incentives for sustainable investments. These can help offset some of the initial Capex outlays, improving ROI.

Operational Impact:

- Transitioning to Sustainable Practices: Shifting toward sustainable manufacturing processes may create short-term inefficiencies, but the long-term payoff is often worth the effort.

- Waste and Recycling Programs: Integrating recycling processes can impact production capacity in the short term but also help reduce raw material costs and improve environmental sustainability.

4. Managing Risk and Uncertainty in Capex Planning

The building materials industry is inherently volatile, with fluctuations in global demand, regulatory changes, and geopolitical tensions. This unpredictability makes risk management essential in Capex planning.

Financial Considerations:

- Risk Mitigation: Finance teams should implement risk-mitigation strategies such as diversification, insurance, and scenario planning to protect capital investments.

- Capital Allocation: An “activist” approach to resource allocation ensures that investments are directed, and re-directed, toward projects with the highest long-term potential, especially in uncertain environments on an ongoing basis.

Operational Impact:

- Flexibility in Operations: Operations teams have a difficult task in deciding which capital projects to pursue and which to put on hold when faced with labor shortages, challenges in getting required machinery or parts within a predictable timeframe, “competition” for budgets from emerging technologies with high infrastructure requirements (such as AI) and the like. It’s a topic we covered at length in a recent article, “Prioritizing Capex projects is more challenging than ever before. Here’s why.” in our Capex Resource Center.

- Contingency Planning: Having contingency plans in place ensures that projects can continue without significant delays, even in the face of unexpected challenges.

5. Economic Sensitivity and Volatility: A Persistent Challenge for Capex Planning

Financial Considerations:

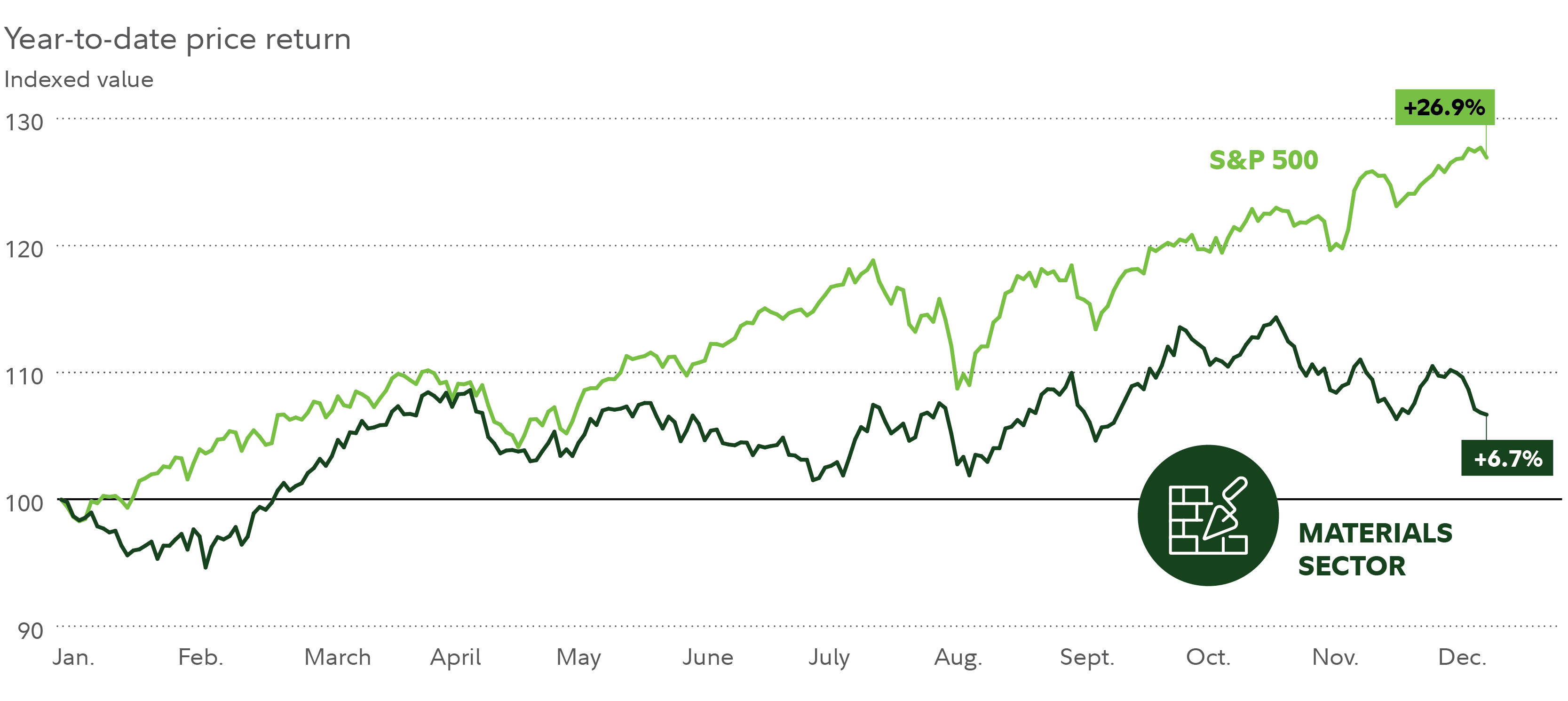

- Interest Rate Sensitivity: Rising interest rates can increase the cost of capital for Capex projects. As seen in Fidelity’s 2024 outlook, materials performance has been relatively sluggish in 2024, largely due to ongoing worries about the U.S. economy, a slowdown in China, and relatively high global interest rates. The materials sector gained 6.7% as of December 9, 2024, significantly underperforming the broader market, which rose by 26.9%. These economic factors have created challenges for companies planning capital expenditures.

- Risk Mitigation: Given the industry’s sensitivity to economic cycles, finance teams must prepare for downturns by enabling real-time reporting of where every capital project in their portfolio stands in regard to whether it’s been started, what has been spent, and how much capital has been allocated to each. This provides the ability to make critical decisions without the delay inherent in manual and generic systems which can make a substantial difference in performance outcomes.

Operational Impact:

- Demand Shifts: Demand fluctuations due to economic cycles significantly impact operations in the building materials sector. To counter this, companies need flexible production schedules to adjust quickly to changes in demand—ramping up during booms and slowing down during downturns. Accurate forecasting, powered by analytics, is key in anticipating these shifts and adjusting accordingly. Strong supplier relationships and long-term contracts can help mitigate risks during volatile periods, while underutilized machinery can be repurposed to maintain efficiency. Cost control measures, like lean manufacturing and just-in-time inventory systems, can also help to maintain profitability when demand is unpredictable.

6. Global Economic Conditions and Supply-and-Demand Dynamics: Shaping Capex Decisions

The global economy is a significant driver of demand for building materials, and as Fidelity points out, shifts in global economic conditions are poised to influence Capex decisions in the sector in 2025 and beyond. China, as a major consumer of materials like cement, steel, and copper, plays a pivotal role in shaping global supply and demand. Fidelity’s report suggests that, despite short-term economic concerns, the long-term supply-and-demand dynamics in the materials sector remain strong, particularly for materials like copper, which are integral to construction, data centers, electric vehicles, and renewable energy infrastructure. The supply of copper could remain tight due to aging mines and limited new supply, which could drive future price increases and create investment opportunities.

Financial Considerations:

- Strategic Capital Allocation: Finance teams should consider shifting Capex toward sectors that exhibit strong supply-demand fundamentals, such as copper and renewable energy-related materials. This could position companies for long-term growth despite short-term economic fluctuations.

- Supply Chain Resilience: Companies may need to invest in diversifying their supply chains to mitigate the risk of disruptions, especially in markets like China.

Operational Impact:

- Material Shortages: Operational teams need to plan for potential material shortages, ensuring that production schedules and timelines are aligned with available supplies. Strategic sourcing and long-term supplier agreements may be key to securing necessary raw materials at stable prices.

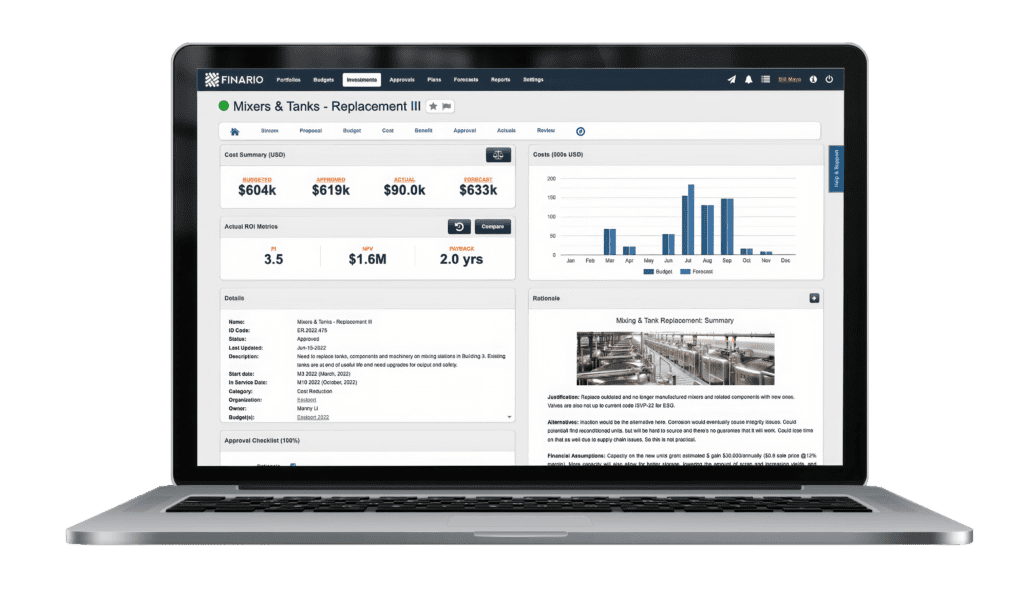

A Dynamic Approach to Capex in Building Materials

In 2025, staying ahead of emissions requirements, market fluctuations, and profit margins will require strategic and efficient Capex management more than ever. Upgrade to the agile, trusted solution designed to meet the unique challenges of the building materials sector with Finario Capex software. Ensure you’re ready to innovate, comply, and grow with confidence.

Ready to discover how Finario can transform your Capex management? To see how it works with your data, check out the Solutions by Industry: Building Materials page now.

See what the world's most trusted Capex software can do for your company

The first step to transforming your Capex planning and management is to get a sense of the possibilities. A short demo will do just that.