Prioritizing Capex projects is

more challenging than ever

before. Here’s why.

You’ve got multiple projects competing for finite funds … and your approval.

Some align particularly well with your organization’s ESG strategy. Others have outsized ROI potential … but could take several years to materialize. And there are those favored by a team whose product line has been a cash cow in the past, but can’t be milked much further.

Which do you choose? It’s the type of conundrum that’s common to hear from finance, operations and engineering teams across myriad industries.

In short, choosing capital projects can be more challenging than ever before. You know the drill: do you prioritize “keeping the lights on,” driving long-term growth or satisfying Wall Street’s insatiable appetite for short-term success? Moreover, the larger your capital portfolio, the more scenarios like these you have to contend with.

Modern project prioritization requires a nuanced, dynamic approach that considers strategic alignment, interdependencies, disruption, macroeconomic risks, and more. Here are but a few of the factors Capex stakeholders are considering, and how you can cut through the noise to make prioritization a little easier, and the desired outcomes more predictable.

1. Economic headwinds

Inflation and higher interest rates

The rate of inflation may have slowed considerably since its peak in mid-2022, but materials costs have not exactly come back down to Earth, and higher interest rates continue to put pressure on every project to deliver.

When evaluating the merits of larger projects, the stakes are even higher – particularly when requiring CEO or board-level approval. That’s because these decision makers aren’t just asking if a project is worth pursuing — they want to know why now and whether it will deliver a return justifying potentially higher financing costs. To get the green light, you need an airtight case, demonstrating both a compelling ROI and how the project fits into the bigger strategic picture.

Impact of tariffs

With shifting trade policies and the potential for higher costs on imported materials, reassessing investment priorities becomes paramount — particularly for companies reliant on global supply chains. Delaying or scaling back major capital projects to avoid the risk of unexpected cost escalations can be prudent. For some companies, that may mean reallocating capital budgets toward supply chain diversification and domestic production capabilities to mitigate tariff-related risks.

For some companies, that may mean prioritizing in projects that invest in automation, local sourcing and infrastructure that offers resilience against trade disruptions. Others might prioritize flexible, incremental investments over large, longer-term commitments to retain financial agility.

Compounding the challenge is the uncertainty regarding where, when, to what degree these tariffs will be in effect. All of which underscores the importance of having the data, insights and reporting to make decisions quickly. Which means having a real-time view of your entire Capex portfolio, integrated actuals for accurate cash flow forecasting, and the tools required to apply what if analyses as you prepare for any and all possible scenarios.

Short-term return pressure

If you’re a public company, missing your quarterly targets isn’t an option. Stakeholders — from Wall Street analysts to private equity backers — are increasingly vocal about their expectations for meeting and exceeding targets. And while dividends and stock buybacks are easy to rationalize to shareholders, capital projects with long payback periods are less so.

That can put you in a tough spot. You feel the heat to prioritize quick wins, but leaning too heavily into short-term gains means sacrificing initiatives with lasting, transformative potential. Balancing these conflicting priorities is no small feat.

Compounding the challenge can be the intensifying scrutiny for Capex funding. With the rise of bottom-up budgeting, rolling forecasts, and cost-focused approaches, every project — especially those with higher investment thresholds — can become a candidate for reevaluation, even mid-cycle.

Moreover, as you and your team pour over layers of data and assumptions to validate each project’s value, it’s easy for “analysis paralysis” to set in.

2. Fast-moving technology cycles

The pacing problem

Why do regulations appear to be changing so much faster than they used to? Much of it stems from an attempt to keep up with accelerating technology innovation cycles, a phenomenon known as the “pacing problem.” It’s never been easy to forecast the impact of new technologies, but in prior decades, leaders had some breathing room to adjust. Today, the window is shrinking. If your organization isn’t adapting just as quickly, you risk falling behind.

Of course, innovation doesn’t come cheap — or easy. Cutting-edge projects with transformative potential tend to come with steep upfront costs and implementation challenges. As an engineering leader, you might know the strategic value of a new technology inside and out, but convincing others — especially when budgets are tight— can be an entirely different challenge.

3. A thicket of regulatory requirements

To say that the regulatory landscape is a moving target is a gross understatement! Data protection rules, environmental standards, financial transparency laws…it’s a lot to juggle. And few people know this better than those in operations and engineering.

ESG considerations

The on-again/off-again push for environmental, social, and governance (ESG) accountability adds a new layer to project evaluation. For leaders in your position, it might no longer be just a checkbox for compliance — it can be a mandate from shareholders and leadership alike. As a result, sustainability metrics need to be part of your Capex planning from the start.

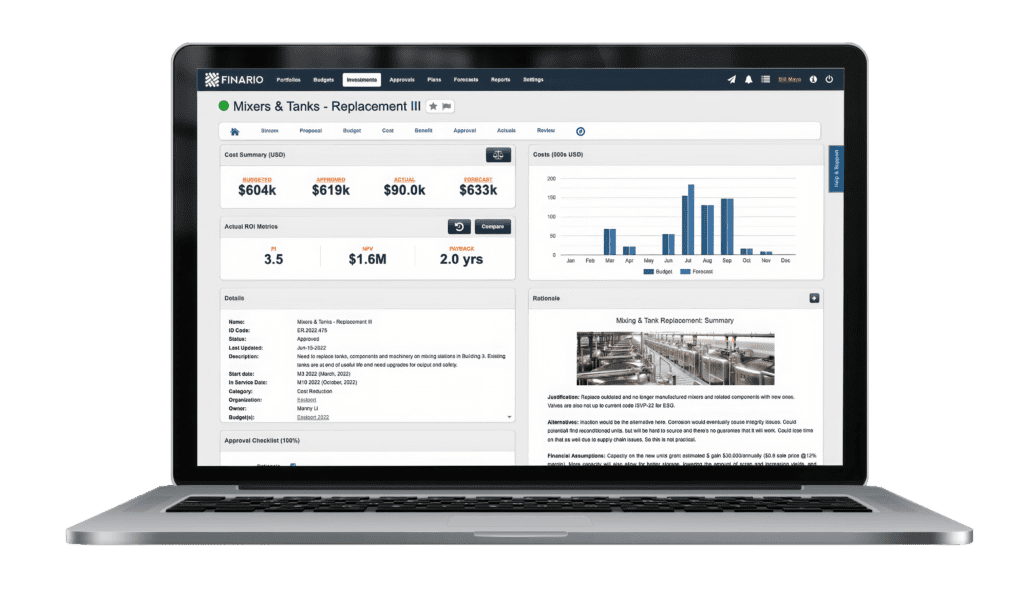

This is why so many Capex stakeholders we talk to tell us the same thing: when two projects have a similar risk/return profile, the one with a stronger ESG “credentials” usually gets the nod. For this reason, many companies are including essential metrics (carbon emissions, for example) and strategic criteria in their approval workflows using a system like Finario.

4. Shifts in government spending priorities

In the whirlwind of shifting geopolitics, elections, macroeconomics and more, governments shift priorities — from infrastructure investment and industrial policy to regulatory changes and fiscal incentives—significantly influencing how and where capital is allocated. These policy decisions can dramatically alter market dynamics, disrupt supply chains, and shift the cost-benefit analysis of major capital expenditures. As governments redirect spending toward sectors such as energy production, advanced manufacturing, and critical infrastructure, businesses are forced to rethink their investment strategies to align with emerging opportunities while mitigating potential risks.

For example, changes in corporate tax rates, subsidies, and trade policies can alter the financial viability of large-scale projects. Government-led initiatives in semiconductor manufacturing, for example, have driven companies to invest in that sector, while industries facing tighter regulations or reduced federal funding may see diminished investment. Moreover, unexpected shifts in government spending —whether due to political cycles, economic downturns, or geopolitical tensions—create an unpredictable investment climate. In response, many enterprises are adopting more flexible Capex strategies, emphasizing modular investments and scalable projects that can be adjusted as policies evolve.

Remaining competitive requires a more dynamic (or “activist”) approach to capital allocation, incorporating scenario planning and policy risk assessment into the decision-making process. Engaging with policymakers, monitoring legislative developments, and leveraging public-private partnerships are becoming essential strategies for enterprises seeking to optimize their capital portfolios.

Modern solutions to support Capex prioritization

Navigating the competing demands and priorities of a modern-day capital project portfolio, particularly at companies with significant capital budgets, is a challenge for all parties involved – be it finance, operations/engineering, IT, or procurement. Having the right data, collaborative tools, and orchestrating systems is critical. This shouldn’t be left to spreadsheets, generic workflow systems, or “do-everything” service management platforms that can only reflect capital projects at the simplest summary level – which is far less than what is required for intelligent decision-making and portfolio optimization.

It’s why Finario’s cloud-based, purpose-built enterprise Capex software is not a “nice to have,” but rather critical for driving success in today’s complex, rapidly changing business environment.

Eliminating process inefficiency

When finance teams aren’t mired in manual data entry, spreadsheet consolidation, and tracking down project updates, they are freed to more thoroughly evaluate the merits of submitted proposals. Plus, automated financial reporting tools allow finance to quickly surface the insights that matter most to CEOs and CFOs — ROI/ROIC, risk versus return, and strategic impact — without getting bogged down in process minutiae.

Preparing for any outcome

Whether it be something as traumatic as a pandemic or recession, or a cyclical event such as abrupt change in consumer preferences or demand, you need to be able to gauge the status of every project in your portfolio quickly, assess your options and pivot as needed. A project or projects that you may have de-prioritized one day can unexpectedly become much more attractive as market opportunities and competitive threats evolve ever faster.

Having that data at the touch of a button in a crunch is a game-changer. Moreover, even under “normal” conditions, when project timelines shift or delays loom, data-driven insights allow your team to quickly pivot to shovel-ready projects, keeping the momentum strong and budgets fully utilized.

Creating a culture of continuous improvement

Every project offers an opportunity to learn. Robust post-completion reviews let you unpack the outcomes: what worked, what didn’t, and why. You can then use these insights to refine your approach and base future decisions on real-world outcomes rather than assumptions.

As the challenge of prioritizing capital projects only becomes more complex by the day, staying two steps ahead provides a competitive advantage and gives leaders in operations and engineering the confidence they need to defend their choices with vigor.

The power of stack ranking

Whether it’s in comparing projects for budget approval or having to make difficult decisions as circumstances and forecasts change, the ability to immediately see the implications of funding, or not funding, any number of projects — proposed or in progress — is a powerful tool for agile decision making and scenario planning.

Assessing benefits and risks the right way

The clearer the purpose, potential and possible mitigating factors of a proposed project or portfolio, the better the selection process. It’s why standardizing how ROI models are calculated and risk is assessed is such a critical part of Capex strategy and management. Moreover, having consistent metrics is only as good as they are readily available and shared among those who need to approve or evaluate proposals. It’s what a purpose-built system like Finario brings to the table.

Leveraging your ERP to integrate actuals

It’s hard enough to update project forecasts when there are so many responsibilities on your plate. Add the task of tracking down data, synchronizing it across spreadsheets, or having to conjure up assumptions that are speculative v. factual, and you can see why so many organizations struggle with forecast accuracy. Integrating enterprise Capex software with your ERP solves for this – ensuring that projects are always up to date with the latest spend data.

Finario is the platform purpose-built for modern Capex prioritization challenges, combining real-time data integration, standardized ROI modeling and scenario analysis to give your team the insights and agility needed to thrive. Confidently prioritize projects, defend your choices, and adapt as conditions change. Request a free demo today and see it in action with your data.

See what the world's most trusted Capex software can do for your company

The first step to transforming your Capex planning and management is to get a sense of the possibilities. A short demo will do just that.