Adjusting to the Impact of Tariffs: Why Zero-Based Budgeting is More Critical Than Ever

In the wake of global tariff shifts and trade policy upheavals, organizations are rethinking how they allocate resources and manage costs. If tariffs have forced you to revisit your sourcing and operations, now’s the perfect time to rethink your budgeting process too.

Zero-based budgeting (ZBB) has seen a resurgence as companies look for smarter, more strategic ways to align expenses with organizational goals as they scenario plan the impact of tariffs. So, what’s driving this renewed focus—and why are finance leaders increasingly embracing ZBB?

Zero-Based Budgeting Amid Tariffs: A Reset for Capital Planning

Zero-based budgeting is a financial planning approach that requires building a budget from scratch each fiscal year. Instead of rolling forward last year’s numbers which may now be distorted by tariffs, ZBB requires every expense to be justified anew, ensuring a clear line of sight between spending and strategy. This method helps minimize waste, support agility, and cultivate a culture of continuous improvement.

Zero-based budgeting is a financial planning approach that requires building a budget from scratch each fiscal year. Instead of rolling forward last year’s numbers which may now be distorted by tariffs, ZBB requires every expense to be justified anew, ensuring a clear line of sight between spending and strategy. This method helps minimize waste, support agility, and cultivate a culture of continuous improvement.

The volatility caused by shifting tariffs has exposed the risks of rigid, legacy-based budgeting processes. In response, many organizations are adopting more dynamic, responsive financial practices—and are now leaning into ZBB to stay resilient even if tariff pressures evolve.

As Boston Consulting Group notes, “Although ZBB is not new, introducing a ZBB program could not be more timely. Tariffs and related trade disruptions have created a new reality, challenging old assumptions and opening the door for smarter, more disciplined financial management.”

To be certain, ZBB is more than a cost-cutting tactic — it’s a mindset shift that embeds cost-consciousness into every part of the organization, improving both efficiency and flexibility.

Capital planners, in particular, understand the importance of allocating resources to projects with the highest risk-adjusted ROI. ZBB applies that disciplined evaluation across the entire enterprise, ensuring every dollar directly supports strategic objectives.

Thriving in a Post-Tariffs Environment

Tariffs have the potential to reshape global supply chains, procurement strategies, and market dynamics. As Accenture points out, “organizations are increasingly working from a clean slate because historical budgets no longer reflect the realities of a tariff-impacted economy.” In this landscape, zero-based budgeting stands out for several reasons:

Flexibility and Agility

The ever-changing tariff environment demands an adaptable budgeting process. ZBB allows companies to pivot quickly by linking spending directly to strategic priorities. Hewlett Packard, for instance, adopted ZBB and achieved notable margin improvements in 2022, illustrating how nimble budgeting supports profitability even amid external pressures.

Better Decision-Making

Tariff changes have revealed just how dangerous it can be to assume past spending patterns are future-proof. ZBB forces a critical “bottom up” reassessment of all expenses, leading to better-informed resource allocations. General Motors, for example, implemented ZBB in response to economic volatility, boosting efficiency and cost control across business units.

Stronger Accountability and Ownership

Starting budgets from zero fosters greater ownership and accountability among department leaders. In a world where tariff changes can quickly impact input costs and margins, strong financial stewardship at every level is critical to maintaining a competitive edge.

Navigating the Challenges of Zero-Based Budgeting

Zero-based budgeting offers compelling benefits, but implementation can be demanding. Building a budget from scratch requires detailed justifications for every cost category, which can initially strain internal resources.

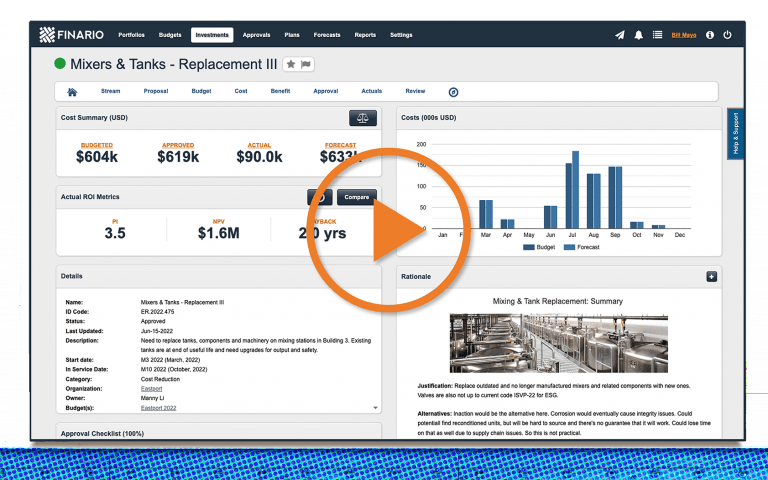

Fortunately, modern cloud-based tools such as Finario are helping finance teams manage this complexity. New platforms make it easier and faster to adopt ZBB without overhauling the entire budgeting system at once. In fact, many organizations are beginning by applying ZBB to select cost areas such as capital project portfolios or high-impact business units and scaling from there.

Ultimately, businesses have learned that the financial discipline instilled by ZBB—first adopted as a reaction to tariffs—is valuable far beyond times of crisis. Intelligent tools like Finario make it simpler than ever to maintain a tariff-resilient, strategic approach to budgeting that drives success in any economic environment.

For more information on how to implement ZBB, click here.

Watch our product

overview video