Webinar/Demo Series Roundup

Five Industries Reshaping Capital Strategy in 2026

Capital inefficiency. Outdated “static” approaches to budgeting and allocation. Processes that choke efficient decision-making and inhibit agility. These are some of the headwinds in today’s Capex landscape.

Companies that do capital planning and management well have a significant competitive advantage. So, over a two-week period, we explored how five essential industries are navigating this transformative capital landscape.

Here’s a roundup of key takeaways from those sessions:

Industrial Revelations: Chemicals

Capex stakeholders in the chemicals industry are facing a perfect storm of cost inflation, carbon regulation, and demand uncertainty. Couple that with shifting supply chain dynamics and tightening regional policies, and it’s easy to see how the era of static capital plans is over. Every capital dollar needs to prove its worth, and companies are being judged not just on growth but on how resilient and transparent their investments are.

Our webinar/demo for chemicals revealed how leading producers are re-prioritizing investments in digital transparency, decarbonization, and collaboration across finance, engineering, and operations. Moreover, we examined how modern Capex governance platforms, modular project delivery, and data-driven decisioning are helping companies turn uncertainty into competitive advantage and redefine what “capital excellence” really means in an unprecedented world.

Industrial Revelations: Building Materials

The building materials sector needs a new growth playbook as focus shifts from “how big can we grow?” to “How smart can we execute?” Along with flat construction demand, rising energy costs, and carbon regulations, these factors are forcing cement, glass, and aggregate producers to rethink their capital deployment strategies from the ground up. Shifting the focus from scale to sustainability … and from expansion to execution.

Our webinar/demo for building materials highlighted the new blueprint for capital success: ESG-linked project portfolios, energy-efficient retrofits, and digital Capex governance that unites finance and engineering in real time. This forward-looking analysis shows how the sector’s leaders are building smarter, faster, and leaner, transforming compliance into ROI and decarbonization into a durable competitive advantage.

Industrial Revelations: Food & Beverage

Tight margins. New regulations. Consumers who want sustainability and innovation yesterday. Sound familiar? For food and beverage manufacturers, 2026 is the year of disciplined capital: shorter paybacks, smarter automation, and sustainability projects that deliver measurable ROI. The winners will be those who treat capital planning as a strategic advantage, not just paperwork.

Our webinar/demo for food & beverage breaks down the key drivers shaping the industry’s next investment cycle from ESG compliance and packaging reform to AI-driven forecasting, modular automation, and cross-functional capital governance. It’s a roadmap for finance, operations, and IT leaders who need agility, accountability, and growth in a low-margin environment.

Industrial Revelations: Paper & Packaging

After years of post-pandemic demand swings, the global packaging industry faces a reset: slower growth, tighter regulation, and relentless pressure to decarbonize. For boardrooms and plant operators alike, capital allocation now hinges on sustainability, cost control, and the digital modernization of legacy assets. The race is on to turn compliance into competitiveness.

Our webinar/demo for paper & packaging examined how leading companies are transforming their Capex portfolios, funding recycled fiber systems, electrifying mills, and adopting digital Capex platforms that make ROI and ESG performance visible across the enterprise. Discover how this transformation isn’t just about reducing footprint, it’s about redefining capital productivity for the circular economy era.

Industrial Revelations: Metals & Mining

The metals and mining sector is facing one of its biggest moments ever. The demand for copper, lithium, and other critical minerals is accelerating thanks to the energy transition demand, but permitting delays, geopolitical tensions, and carbon regulations are completely reshaping where and how capital gets invested. With cost inflation and execution risks thrown into the mix, one thing is clear: success isn’t about spending more, it’s about investing smarter.

Our webinar/demo for metals & mining unpacked the trends redefining the industry’s capital agenda from mine electrification and AI-driven project controls to ESG-linked compliance and tailings governance. Whether you’re a CFO seeking capital agility or an operations leader focused on delivery discipline, this session gives you a data-driven look at how tomorrow’s leaders will fund, govern, and execute their growth plans.

A Common Thread: Capital Excellence as Competitive Advantage

Across all five industries, companies that master capital portfolio management outperform their peers. Whether navigating volatility, compliance mandates, or margin pressure, leaders share common practices:

- Enterprise-wide capital discipline

- Scenario planning

- Meaningful ESG integration

- A single source of truth for all capital expenditure data

Don’t miss any insights from this series. Access all five Industrial Revelations webinar/demo replays and see how leading companies are transforming capital planning and management into a competitive advantage

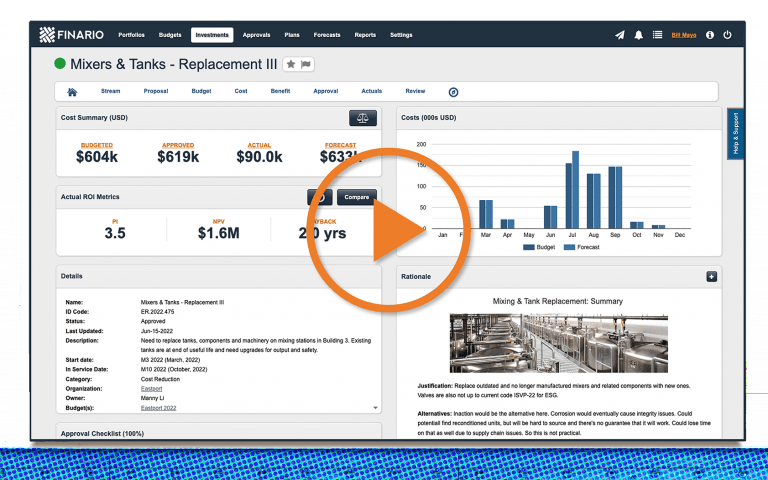

Watch our product

overview video