ERP, EPM, PPM, BPM, ECP, ECM: When it comes to the software essential to the “digital transformation” of the corporate finance department, discerning between them all can be far from “EZ.”

Aside from sorting through a jumble of Es, Ps, and Ms, there is some overlap and “gray area” in their use cases. This is particularly true with capital planning software — otherwise known as an ECP (enterprise capital planning) solution.

So let’s clear that up for you.

To understand exactly what capital planning software is, how it differs from other solutions, and why you even need it, let’s start with the basics. To start, here’s what it’s not: a tool for managing “capital” in the sense of investments in financial markets.

In our definition, “capital planning” refers to dollars used to build an asset. These capital expenditures — or Capex — are absolutely essential to the stability, competitiveness, and growth potential of a company.

As you plan, budget, and execute on your capital projects, an enterprise capital planning software solution enables you to manage and report on the entire investment lifecycle — from project inception through budgeting and approval workflow … forecasting to post-completion reviews.

At this point, you might be asking: “Why can’t I just use an application we already have to do those things?” Well, truth be told, you can — but in very limited ways.

An ERP (Enterprise Resource Planning) solution, for example, is an essential tool for transaction accounting but as such is organized around charts of accounts, not projects. Moreover, its backward orientation and role as the transaction system or record, and all that being so entails, makes it ill-suited for forward planning, scenario evaluation and dynamic analytics and decision support.

Accordingly, most enterprises deploy an EPM (Enterprise Performance Management) solution to provide this forward looking outlook and help them plan, budget, forecast, and report on business performance as well as consolidate and finalize financial results (“closing the books”). The planning modules in EPMs are organized around annual departmental budgeting templates and thus lack the depth of information necessary for capital planning or the ability to move seamlessly from the project perspective to the fiscal year perspective and back. If all you need is a depreciation calculation, they can suffice, but if your capital spend is material and important to your business, you will need more.

PPM (Project Portfolio Management) solutions are built around projects but, having originated in the world of IT project management, are architected primarily for project execution. Specifically, they excel at task and resource management covering the steps and people needed to complete a project and coordinate scheduling of activity. While some PPMs include rudimentary budgeting and reporting features they are, at their heart, an operations tool and lack the ability to do essential front-end planning, ROI modeling, forecasting and post-completion reviews.

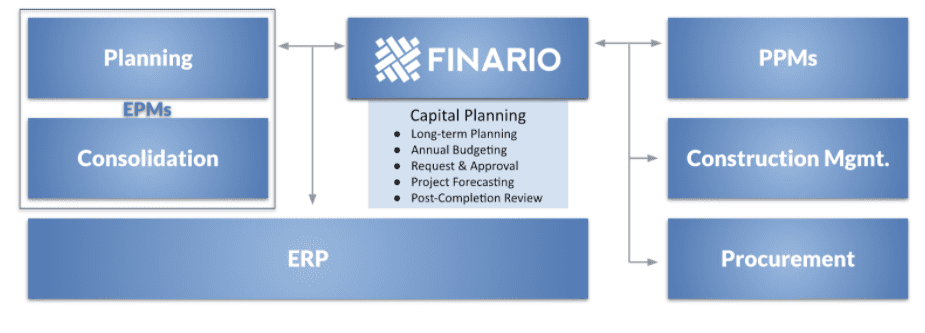

To put it all into perspective, consider this illustration of a modern “finance stack” —

As you can see, an integrated ECP like Finario fills a much-needed gap for capital planning. Notably, it enables:

Budgeting – Collect project ideas, in a central location, in a standard format with business case justification to begin creating an annual budget. Compare and rank ideas using a standard submission template and financial model. Create portfolios of projects to measure financial impacts and create multiple portfolios for “what if” analyses.

Approval Workflow – Once project ideas have been proposed, it’s time to vet those ideas. This means providing required details, calculating ROI based on standardized criteria, getting bids from vendors, and routing for approvals based on established business rules. Lost time and biased forecasts translate to missed opportunities and underinvestment, cost overruns, and frustration in the ranks.

Reporting Actuals and Revising Forecasts – Once all projects have been updated for actuals, project owners should explain any variances and enter forecasts for the remainder of the project. Several levels of operational and financial leadership will want/need to see this information. To this end, capital planning software should bring robust reporting functionality. This includes dashboards for high level review by the C-suite along with more detailed, project level reports that allow plant level leadership to manage activities and remain on budget and on time.

Post Completion Review – Finally, dedicated Capex software should include the ability to capture post completion reviews of projects. These are essential to determine if the assets allocated generated the expected results. While learning what went well on a project is important, discovering what didn’t go well may be even more important. You review employees annually, you review why you lost a significant new contract, you review all M&A activity, you receive feedback from customers …. Why wouldn’t you review how the limited capital you have is performing?

In short, if your company has a significant Capex budget, and even a semblance of complexity to go along with how it’s planned, allocated and managed, you should be implementing capital planning software sooner rather than later.

Hopefully, that helps clear things up.

As a “bonus,” here’s a handy glossary of financial related market definitions terms. There are acronyms for all types of technology. They can focus on either the function or level of data that you are looking to analyze. In the context of Financial Systems here is glossary of terms to help navigate around topics of interest as there are hundreds of acronyms out there to describe software or segments or markets:

BPM Business Process Management

Used to manage various organizational workflows. Examples include: Microsoft Sharepoint and Lotus Notes.

CMS Construction Management Software

ECP Enterprise Capital Planning

EPM Enterprise Performance Management

ERP Enterprise Resource Planning

Do you have any experience where the absence of doing a proper post-completion review was believed to have contributed to a project that was considered a “mistake” or missed opportunity?

An ERP helps automate and manage business processes across finance, manufacturing, retail, supply chain, human resources, and operations. Helping leaders to gain insight, optimize operations, and improve decision-making, ERP systems break down data silos, and foster information sharing between different departments.

Also worth keeping in mind: