Deep Dive: A Capital Planning Executive's Perspectives on Trends in the Food and Beverage Industry

Capex spending among food and beverage (F&B) companies rose sharply in the first half of 2023, and industry insiders expect the trend to continue for the remainder of the year. According to Food Processing, 33 of the largest publicly-traded F&B companies plan to increase Capex 21.4% versus 2022, which is the highest one-year increase since 2006.

In this deep dive, we’ll explore where capital planners are investing in response to shifting economic factors and consumer trends.

A burst of Capex to start 2023

2022 was characterized by severe labor shortages and continued supply-chain snags, and companies responded by investing in automation and robotics that allowed them to maintain production with fewer workers. Hormel Foods told investors that the company has “always included automation in our annual capital planning process,” but would be “ramping up our investments in automation” in response to a tight labor market. Tyson Foods followed suit in 2022, rolling out a $1.3 billion automation investment program.

But this year, the theme is different—with the global supply chain crisis “in the rear-view mirror” for most companies, they’re looking to deploy capital into expanding capacity and meeting new consumer demands.

Familiar players in the United States (U.S.) have unveiled several large projects this year. For example, Coca-Cola announced it would build a $650 million production facility for its Fairlife milk brand in response to skyrocketing demand, and US Foods is planning to build a $100 million processing facility in Illinois. Lesser-known brands are also making a splash with big capital commitments, including Clark Beverage Group’s new $100M distribution center and Karis Cold’s massive new cold storage facility in Charlotte.

But this Capex surge isn’t limited to the U.S. In Mexico, Grupo Bimbo expects to more than double last year’s Capex budget, spending up to $2 billion on increasing “production capacity related to top-line growth around the world.” Italian pasta maker Barilla also plans to invest over $1 billion in the next five years “in areas including production capacity, upgrading IT and introducing Industry 4.0 technology.”

As producers forge ahead with these projects, they’re keeping an eye on a number of potential challenges. Input costs have eased up since their highs in mid-2022, but companies are well-aware of how inflation is eating into household budgets. Premium producers are being hurt the most as consumers increasingly opt for private-label brands over premium offerings; sales of the former grew 11.3% in 2022.

With more interest rate hikes on the horizon, the economy is in a delicate state. Striking the right balance between capitalizing on new opportunities while not getting overextended is the focus for most capital planners in the F&B industry today.

Demand for healthy, locally-sourced products intensifies

The consumer trend towards healthier products isn’t new, but it’s picked up steam in recent years. Consumers no longer want to be told how great a product is—they want to learn about where it’s from and whether the workers, animals, and local environment are treated well.

The preference for organic and locally-sourced products, which tend to be easier on the environment and support surrounding communities, are forcing F&B producers to rethink their supply chains. A study from Nielsen showed that nearly half of Americans prioritize buying local, and 70% are willing to pay a premium for locally-sourced products. Globally, the organic food and beverage market is expected to grow by over $300 billion by 2027.

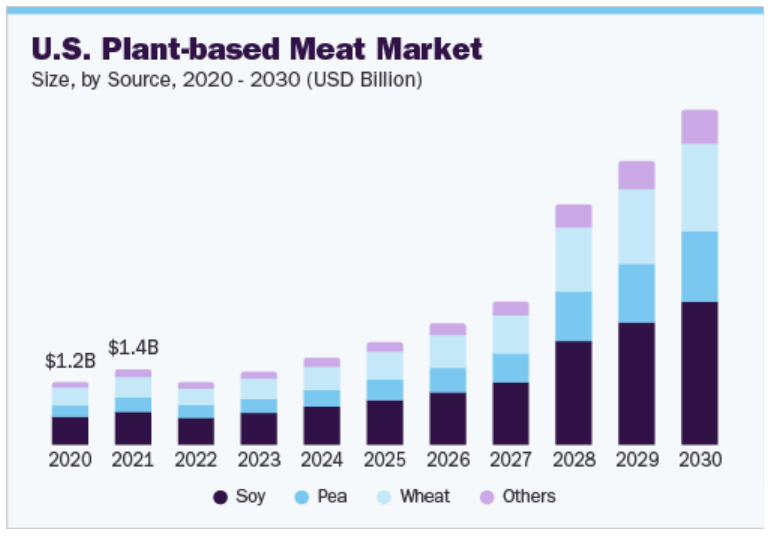

While many meat-buyers are looking for more responsibly-sourced offerings, others are looking to ditch animal products altogether. Plant-based meat is a $5 billion global industry, and leading companies such as Impossible Foods and Beyond Meat say their products are the future. But after several years of strong growth, demand started to plateau in 2022.

Despite this dip, the global plant-based meat market is still “expected to reach $12.32 billion by 2027, rising at a market growth of 18.3% CAGR.” Nearly 40% of consumers are trying to eat more plant-based foods, and replacing traditional meat with plant-based versions is easier than completely overhauling their diet.

British consumer goods giant Unilever has seen the writing on the wall, and expects plant-based products to make up a much greater portion of sales by 2025. It recently built a $100 million plant-based innovation center in the Netherlands, and plans to continue investing in improving the taste and texture of those products.

Industry leaders will be watching closely in the next few years to see if plant-based meats can reach a wider audience.

New Capex projects focus on sustainability

Treating all stakeholders responsibly is important, but it’s only a part of the sustainability equation. Consumers also want to know that the companies they’re supporting are doing their part to stave off climate change. The industry is responding by making big investments in clean energy to fuel their production and logistics efforts.

For instance, Anheuser-Busch (AB) Inbev, the world’s largest brewer, made a bold commitment to “source all of its purchased electricity from renewable sources” by 2025, and achieve net zero by 2040. Dutch brewer Heineken set the same goal for 2030, and achieved 58% renewable electricity use in 2022.

In order to reach these lofty goals, AB Inbev and other agrifood companies will need to focus on the environmental impacts of their inputs. Embracing regenerative agriculture, which “is a collection of agricultural concepts and practices that emphasize soil properties while taking into consideration conservation efforts, the use of fertilizers, and other factors,” is one impactful way to do so. The net result is a significantly reduced environmental footprint from the agricultural processes that these companies rely on for their products.

PepsiCo, for instance, is investing $216 million over the next ten years into adopting and promoting regenerative agriculture. The project will influence roughly 7 million acres of land, which represents nearly all the farmland in PepsiCo’s North American footprint. French food products company Danone is taking similar steps, investing $2.18 billion in a “climate acceleration plan over the next three years” that includes regenerative agriculture as “a key part of the plan.”

But it’s not just production that’s being transformed in the pursuit of sustainability. Logistics, an often overlooked aspect of the food and beverage industry, is also undergoing a green revolution. Tesla’s Semi, an all-electric truck, has been attracting attention from several companies in the sector—PepsiCo placed an order for 100 trucks as part of its commitment to achieve net-zero emissions by 2040.

Sustainable packaging is another area where companies are stepping up their efforts. New “flow wrap” meat packaging from Tyson Foods “uses about 50% less plastic and 50% less energy in the manufacturing process versus traditional expanded polystyrene product packaging.” Grocers are increasingly adopting this new packaging both for its environmental benefits and reduced leakage. In addition, Nestlé has promised that all of its packaging will be recyclable or reusable by 2025, and is spending $2 billion to transition away from virgin plastic.

From renewable energy, to regenerative agriculture, to better packaging, consumer demand for greater sustainability is having a profound effect on the food and beverage industry’s Capex strategies.