FOR CAPITAL INVESTMENT STAKEHOLDERS

Large-scale investments in production lines, specialized machinery, automation, and infrastructure are paramount, effectively managing capital expenditures (Capex) – all of which have a bearing on market leadership … or stagnation., Because navigating these complex investments presents myriad challenges for financial executives and operations teams, staying abreast of best practices and new automation tools for effective capital allocation is paramount.

Several key trends and factors are poised to influence Capex planning within this dynamic industry, some of which are relatively predictable, such as the continuous need for technological upgrades and regulatory compliance, while others, like global economic shifts, geopolitical instability, and supply chain vulnerabilities, introduce significant uncertainty.

1. The Imperative of Advanced Manufacturing Technologies

The demand for substantial investments in advanced technologies often fuels a debate that centers on defining acceptable ROI benchmarks for these critical upgrades.

Whether it’s for sophisticated robotics and advanced analytics to artificial intelligence (AI), the Industrial Internet of Things (IIoT), and cloud-based platforms, the considerable costs of these newer technologies, and when to time the related expense(s), can fuel considerable debate. Moreover, scaling innovations like these across the entire value chain, from design and production to logistics and maintenance, is also challenging once a proof of concept is in hand. What’s less debatable is the potential for impact. Recent research by McKinsey reveals that, “in five years, the manufacturing function of the average CPG business is likely to see higher degrees of automation (around 40 percent) compared with other functions” (McKinsey, 2025). This automation potential varies significantly across functions, with manufacturing uniquely positioned for higher degrees of automation due to its manual, repetitive processes and centralized operations.

The acceleration of AI adoption is particularly noteworthy. McKinsey’s research shows that “CPG companies, comparatively, have more concentrated labor pools at their manufacturing plants and warehouses, allowing tech-enabled process improvements to have more of an impact” (McKinsey, 2025). This concentration effect makes manufacturing investments in AI and automation particularly attractive from a capital allocation perspective.

Financial Considerations:

Depreciation and ROI: Finance teams must meticulously evaluate the depreciation schedules, amortization, and return on investment (ROI) potential for each technology adoption as they are key to allocating the cost of new production technologies and sustainable manufacturing processes over their useful lives.

Funding Mechanisms: Companies should explore their funding options, including traditional debt financing, equity, or specialized venture capital for tech investments taking into account capital availability, interest rates, and the projected financial impact of the technology. Given the substantial upfront costs, McKinsey’s research indicates that “the first few years of automation implementation are likely to be cash-flow negative” (McKinsey, 2025), requiring careful cash flow management and strategic capital reallocation.

The current manufacturing investment landscape presents unique financing challenges and opportunities. According to Suite by Monitor, “The necessity for Capex investment amidst budget constraints may prompt manufacturers to explore operating leasing and structured finance solutions” (Suite by Monitor, 2024). This shift reflects broader changes in how manufacturers approach capital allocation in an environment of elevated interest rates and economic uncertainty.

Government incentives are also driving significant investment activity. As Suite by Monitor observes, “Manufacturers are compelled to invest in property, plant and equipment (PP&E) to support ongoing expansions and capitalize on recent decisions to re-shore or take advantage of government incentives” (Suite by Monitor, 2024). These policy-driven investments require careful coordination between financial planning and operational execution.

Operational Impact:

Integration Challenges: Integrating new technologies into existing manufacturing workflows can be complex, potentially leading to temporary disruptions. The complexity is heightened by the need to redesign workflows entirely, as McKinsey research shows that successful transformation means “not only learning new tools and skills but also redesigning work altogether” (McKinsey, 2025).

Skill Gaps and Training: High-tech manufacturing equipment requires specialized skills for operation and maintenance. Addressing potential skill gaps through comprehensive training programs is crucial to maximizing the efficiency of new investments and minimizing downtime. This challenge is particularly acute given that “there might be a shortage of talent in critical new roles, such as product flow engineers, integrative-marketing strategists, and consumer experience designers” (McKinsey, 2025). The labor shortage is driving automation investments as much as technological advancement. Suite by Monitor notes that “Investment in automation technologies is becoming imperative in an environment where labor scarcity is prevalent” (Suite by Monitor, 2024). This creates a dual challenge: manufacturers must invest in both technology and human capital development to successfully implement automated systems.

2. Navigating Raw Material Volatility and Supply Chain Resilience

Fluctuations in raw material prices and ongoing supply chain challenges continue to pose significant hurdles for capital planners in manufacturing. The impact of tariffs, trade policies, and global demand shifts can dramatically affect input costs.

Despite some moderation in inflation, concerns persist regarding potential rate hikes or stagflation, further complicating cost forecasting. Geopolitical tensions also remain a constant threat, capable of disrupting global supply chains and impacting the availability of essential materials.

Financial Considerations:

Cost Management and Hedging: Manufacturers must develop robust strategies to manage cost volatility, including forward contracts or hedging instruments to mitigate price hikes. Finance teams need real-time data to quickly adjust budgets and forecasts in response to market changes.

Working Capital Optimization: Efficient inventory management is critical to balance the need for sufficient raw materials with the imperative to avoid excess inventory that ties up significant capital.

Operational Impact:

Diversification of Suppliers: Operations teams are actively diversifying their supplier base, exploring regional sourcing, and implementing robust backup plans to mitigate risks associated with supply chain disruptions.

Lean Manufacturing and Waste Reduction: Rising material costs intensify the focus on lean manufacturing principles and waste reduction initiatives. This not only cuts costs but also contributes to sustainability goals and improves overall resource efficiency.

3. Strategic Risk Management in a Volatile Landscape

The manufacturing industry is inherently susceptible to global economic fluctuations, technological obsolescence, and geopolitical events. This unpredictability makes robust risk management an indispensable component of Capex planning.

Financial Considerations:

Scenario Planning and Stress Testing: Finance teams should implement advanced scenario planning and stress testing for Capex projects to assess their resilience under various market conditions. This includes evaluating impacts from interest rate changes, demand shifts, or supply chain disruptions.

Dynamic Capital Allocation: An agile approach to capital allocation ensures that investments are continually re-evaluated and directed towards projects with the highest strategic value and long-term potential, especially in uncertain environments. This is particularly important given the significant upfront investments required, as consumer companies should task a cross-functional group of leaders from the HR, technology, and finance functions (at the very least) to transform functions and the organization’s operating model (McKinsey, 2025).

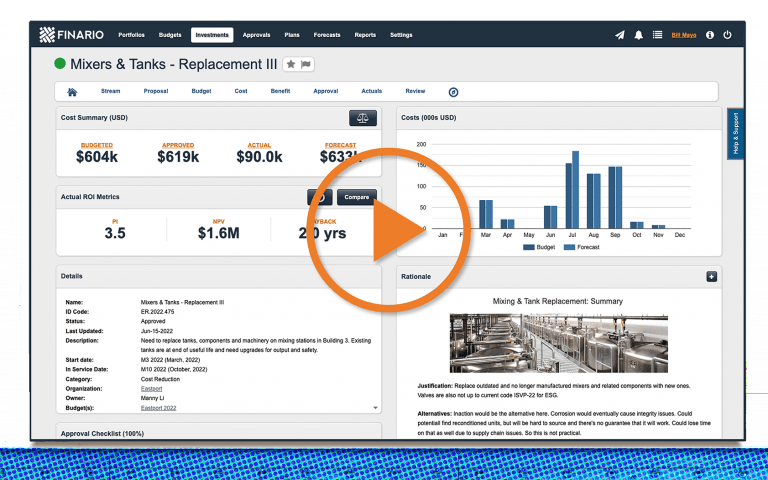

To implement this approach effectively, many leading consumer companies are establishing Capex Councils, cross-functional forums that bring together key stakeholders to evaluate trade-offs and prioritize projects with precision. With the support of tools like Finario, these Councils gain real-time visibility into project data, enabling confident, insight-driven decisions that align capital spend with long-term strategic goals.

Learn more about how to structure a Capex Council and embed it into your capital planning process here.

Operational Impact:

Flexibility in Production: Operations teams must build flexibility into production systems to adapt to changing demand or unforeseen challenges. This may involve modular designs, easily reconfigurable production lines, or diversified product offerings.

Contingency Planning: Comprehensive contingency plans for equipment failures, material shortages, or labor disruptions are essential to ensure project continuity and minimize costly delays.

4. Economic Sensitivity and Global Market Dynamics

The manufacturing sector is highly sensitive to economic cycles. Changes in interest rates, economic slowdowns, and shifts in global demand directly influence the viability and timing of capital investments.

Financial Considerations:

Cost of Capital Analysis: Rising interest rates can significantly increase the cost of financing Capex projects. Yet, recent data shows that despite challenging economic conditions, manufacturers continue to invest heavily in capital expenditures. According to Suite by Monitor’s analysis, “2023 posed challenges for U.S. manufacturing. Factors such as higher interest rates and escalating material and labor costs amid a labor shortage, alongside diminishing demand, led to an overall decline in profitability. Despite these obstacles, capital expenditures remained remarkably robust” (Suite by Monitor, 2024).

The shift in financing approaches has become particularly evident. As Suite by Monitor notes, “A significant portion of manufacturers, particularly those with more than $50 million in revenue, have financed Capex using cash or revolving credit in recent years, according to Secured Research. The convergence of new performance pressures, rising interest rates, equipment costs and a slight downturn in financial performance may create an opportune environment for equipment financiers” (Suite by Monitor, 2024).

Tax Policy Implications: Recent tax legislation has significantly impacted capital expenditure decisions. The One Big Beautiful Bill Act has provided manufacturers with enhanced investment incentives. As Manufacturing Dive reports, “The One Big Beautiful Bill Act, signed into law on July 4, preserves the 21% corporate tax rate and creates new expensing opportunities for manufacturers looking to expand” (Manufacturing Dive, 2025). This tax stability provides manufacturers with greater certainty for long-term capital planning and investment decisions.

Real-time Performance Monitoring: To mitigate risks during economic downturns, finance teams require real-time visibility into every capital project’s status, expenditures, and allocated capital. This enables swift, data-driven decisions that can significantly impact financial outcomes.

Operational Impact:

Demand Forecasting and Agile Production: Accurate demand forecasting, powered by advanced analytics, is crucial for adjusting production schedules quickly. Strong supplier relationships and long-term contracts can help buffer against volatility. Implementing lean manufacturing and just-in-time inventory systems can maintain profitability during unpredictable periods.

The Path Forward to Manufacturing Capex

It’s clear that the business environment in general, and the manufacturing sector in particular, is now presented with an even greater challenge around navigating uncertainty and preparedness. In that regard, several themes emerge:

- The need for the enterprise to embrace an “activist allocation” mentality – meaning, to continuously evaluate and re-evaluate their capital investments; pause, cancel, and/or re-allocate money to more worthy projects; and not favor “sacred cows” when more forward-leaning opportunities exist.

- Data insights and agility are paramount to empower this activist mentality. As we are seeing now, companies often don’t have the luxury to wait for the typical, exhaustive analytic and evaluation processes to make critical market moves. These decisions have been fast and well-informed.

- Having a holistic view of all capital projects, both planned and in progress, including their actual spending to date and forecasted spending, will provide the cash flow forecasting capabilities that executive leadership will demand, particularly when difficult decisions need to be made.

All of these modern-day capabilities are empowered by Finario’s purpose-built enterprise Capex software. Which means now is an opportune time to take a deeper dive into its use cases for your organization.

Watch our product

overview video