INSIDER PERSPECTIVES

FOR CAPITAL INVESTMENT STAKEHOLDERS

As an asset-heavy sector with long investment horizons, the chemicals industry is one where prudent capital allocation has an outsized impact. Making the right choices, however, has become more challenging; old rules no longer apply. The energy transition, AI, and a shifting competitive landscape are upending traditional strategies.

In this edition of “Capex Confidential,” we’ll give you an inside look into the challenges and opportunities that will define the chemical industry in 2025 and beyond.

Capex opportunities in the chemicals industry

The energy transition

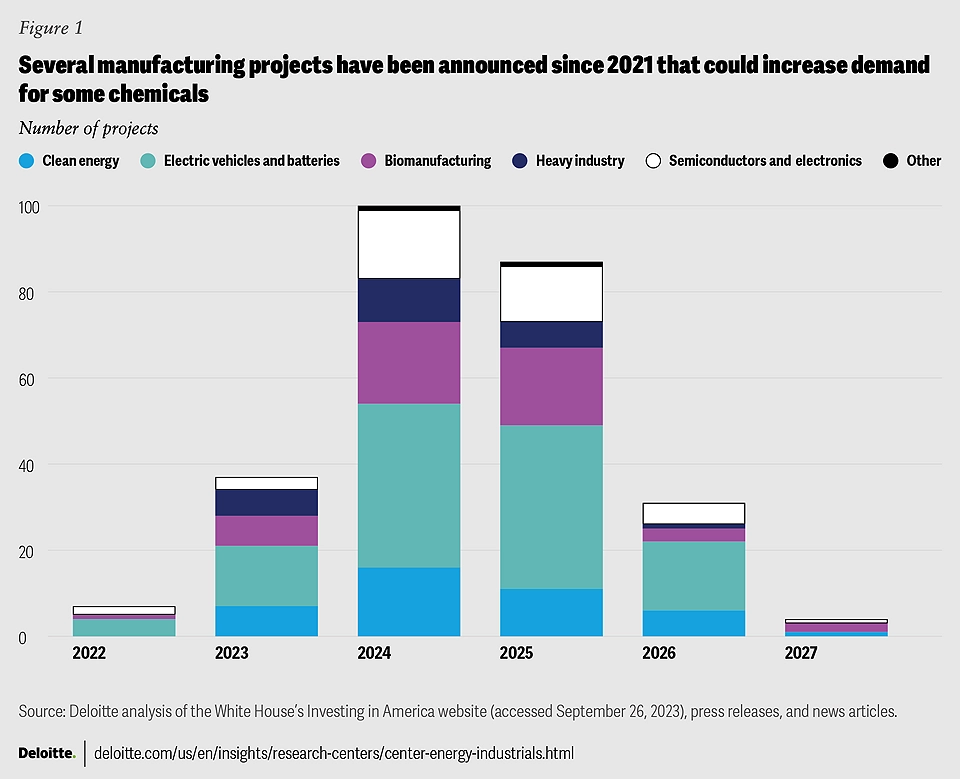

As the race to decarbonize shifts into high gear, demand for specialized chemicals related to green energy — the building blocks for batteries, heat pumps, and wind turbines — is exploding. With over 100 energy transition projects slated to go live in the next two years, leaders are eager to capitalize on this surging demand.

Lithium is a prime example. This key ingredient in electric vehicle batteries is seeing demand take off alongside EV production. By 2025, the global economy will need 1.4 million metric tons of lithium, more than double what was needed just two years ago. And with government incentives within the U.S. Inflation Reduction Act and Europe’s Green Deal adding fuel to the fire, that demand is only going to accelerate.

The opportunity for chemical companies lies in investing in infrastructure that can produce and deliver the necessary materials to support these projects at scale. Facilities capable of churning out advanced composites for wind turbines and high-performance chemicals for battery storage are set to generate enormous value in the coming years.

Dow’s investment in a new U.S. Gulf Coast facility to produce carbonate solvents, a crucial component in lithium-ion batteries, exemplifies this shift. Along with supporting the rapidly-growing EV market, this facility will capture “more than 90% of the carbon dioxide from the ethylene oxide manufacturing process.”

The potential rewards of the energy transition are significant, but capital planners also need to keep its risks top of mind. These kinds of investments should only be greenlit if they promise a compelling risk-adjusted ROI and align with your organization’s specific long-term objectives.

AI-powered process optimization

Efficiency-driving applications are the most immediate and accessible opportunity for AI in the chemicals industry. These mostly come in the form of algorithms that slash waste by optimizing everything from batch processes to R&D. The opportunity is significant — according to the American Chemistry Council, predictive maintenance can reduce the $20 billion the industry spends annually on maintenance by up to 30%.

But while efficiency improvements are meaningful, the real-game changer is AI-assisted chemical discovery. The industry is desperate for new formulations: as McKinsey points out, “all of the top-ten chemical products were developed over 50 years ago.” Their survey found that, along with chemical process innovation, AI-assisted chemical discovery holds “the most potential for near-term growth.”

How does AI-assisted chemical discovery work? Nexocode explains that, “Using deep learning models, chemical manufacturers can research substances on the molecular level to find the most efficient solutions and improve the existing formulas.” It’s poised to drastically reduce the time and effort necessary to develop new chemical products, which is why 75% of leaders in the industry “are proposing to invest over $100 million in AI-based product development.”

AI can be a game-changer, but modeling potential ROI and its impact on organizational structure and culture are critical to successful implementation and – if you are a public company – managing investor expectations. A component of this calculus is the infrastructure requirements, including data centers and cybersecurity protection.

Circular economy

After decades of hype, the circular economy is finally starting to become a concrete reality. With consumers demanding eco-friendly products and governments cracking down on waste, companies are doubling down on investments in recycling technologies and closed-loop systems.

Plastics recycling, in particular, is red-hot, driven by ambitious corporate sustainability goals and new regulations. With the United Nations aiming to finalize a treaty on plastic pollution by the end of 2024, the pressure to participate is only going to intensify.

However, despite all the talk, only about 9% of plastics actually get recycled. This is where the real opportunity lies. Companies that invest in cutting-edge recycling technologies can dramatically boost recycling rates and slash reliance on virgin materials. For capital planners, this means prioritizing projects that close the loop, minimize waste, and align with the demands of both consumers and regulators.

Threats

Pressure to decarbonize

Decarbonization can’t happen without significant contributions from the chemicals industry. It underpins over 75% of the technologies critical to hitting net-zero emissions by 2050, which is why there’s a burning spotlight on the sector. To meet the Paris Agreement’s 1.5° warming scenario, the industry needs to cut emissions by a whopping 60% by 2030.

Doing so will be a tall order, especially since many chemical processes are huge energy consumers and heavily reliant on fossil fuels. A report from PwC highlights three essential areas for transformation:

- Retrofitting and building new production sites for renewable chemical production

- Integrating renewable energy sources like green hydrogen into high-temperature chemical processes

- Shifting to renewable feedstocks like biomass and synthetic renewable carbon

The capital commitment needed to drive this transformation is massive: between $1.5 trillion and $3.3 trillion by 2050.

Several companies are leading the charge in this effort. DuPont’s proprietary ion exchange resin is enhancing the efficiency and durability of green hydrogen production by optimizing electrolyzer operations. There’s also Chinese energy firm Sinopec, which is currently building a high-capacity green hydrogen facility in Inner Mongolia.

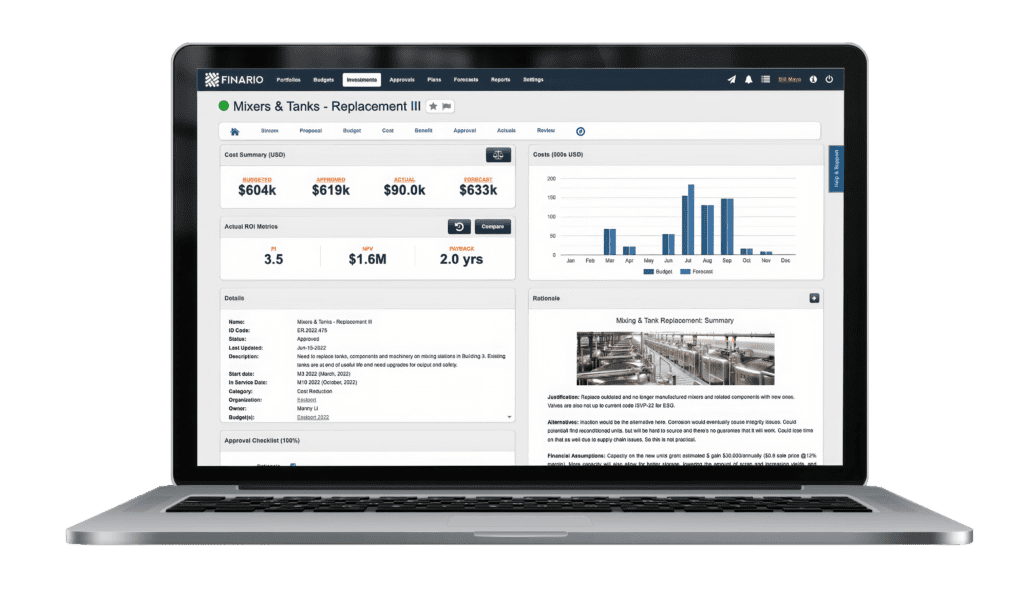

Decarbonizing the chemical industry may be a long game, but that doesn’t mean you can afford to wait. For Capex stakeholders in operations, the task of balancing and prioritizing capital projects to aid in that transition based on projected ROI, risk factors such as obsolescence and governance, and choices related to purchasing vs. leasing essential technologies can be daunting. It’s why a purpose-built capital planning solution that puts all these analyses in one place so that projects can be appropriately ranked, budgeted and managed is so important.

Erosion of existing competitive advantages

For decades, size was everything in the chemicals industry. Large, asset-heavy facilities belonging to the biggest players generated economies of scale and established high barriers to entry.

But this era of dominance is slowly eroding as these well-established competitive advantages lose their punch. Companies are being forced to pivot from relying solely on large-scale production to more collaborative ecosystems that prioritize sustainability and adaptability. EY notes that, in this environment, the role you play in the ecosystem is more important than your size, and the ability to “react and adapt to new market thinking” is invaluable.

Intellectual property (IP) is also becoming less potent. The commoditization of chemical products, driven by the saturation of specialty chemicals and the movement downstream by the oil and gas industry, has intensified competition. As more players enter niche markets once considered high-margin, prices are being driven down, reducing profitability.

Furthermore, feedstock advantages, especially in oil and gas, are being diminished as companies adopt renewable and recycled materials, breaking the industry’s historical reliance on fossil-based inputs.

Amid this competitive transformation, the onus is on chemicals companies to double down their focus on strategic growth investments – which, at times, may mean shifting budgets from business units that have historically been “cash cows” to those that represent the next wave of revenue expansion. Doing so requires leadership backed by data that can support if/then analyses and cash flow projections.

Volatile feedstock prices

Riding the rollercoaster of volatile feedstock prices is nothing new for chemical companies. Oil and gas prices, in particular, have always been a wild card, but 2024 has brought additional complexities. Geopolitical tensions, especially in key oil-producing regions like the Middle East, and supply chain disruptions have added layers of unpredictability. Europe, heavily dependent on natural gas imports, has been particularly impacted.

Feedstock volatility affects not only raw material costs but also impacts the long-term viability of chemical production plants. Many chemical facilities are heavily reliant on fossil-based inputs like natural gas, naphtha, and crude oil derivatives, and rapid price swings can significantly impact profitability.

To mitigate these risks, companies are investing in flexible production systems capable of switching between different feedstock types depending on market conditions. One example is Braskem, a Brazilian petrochemical giant that has been producing “green ethylene” from sugarcane-derived ethanol for over a decade. This bio-based alternative to fossil fuels helps the company manage feedstock volatility while contributing to carbon reduction goals.

Leaders need to consider this volatility when designing new facilities or retrofitting existing ones. Investments in renewable feedstock technologies, like biogenic sources or green molecules, are key to both mitigating volatility and furthering decarbonization goals.

The Finance Perspective

Finance pros in this industry are well-versed in the enormous capital expenditures required to build and maintain infrastructure. Historically, bigger has been better, and larger scale meant larger profits.

While size still matters, the returns from scale are diminishing due to the market’s saturation and changing dynamics. Now, most of the value lies in being able to integrate with broader industrial ecosystems, collaborate with startups and other industries, and maintain flexibility in the face of change.

Finance can take a proactive approach here by embracing capital activism, deliberately and continuously allocating and reallocating resources to the most promising opportunities. The transition to net-zero will require trillions of dollars in investments, and being a capital activist can help your organization make sure that you’re mitigating risk where possible, operating at peak investment efficiency, and seizing growth opportunities.

The Operations Perspective

Chemicals operators have their hands full with significant changes on a number of fronts. Supply chain resilience is a top focus, and many are choosing to bring production closer to home via friendshoring and near-shoring. Doing so can buffer against external shocks while making it easier to achieve sustainability targets, as localized supply chains reduce transportation emissions and allow for better integration of renewable energy sources.

AI-powered automation is also upending the traditional chemical production model. Most of the industry is still in the early innings with AI, but some early adopters are already reaping significant benefits. BASF, for instance, is using machine vision systems to “evaluate product quality in real time, significantly minimizing waste and enhancing yield efficiencies by as much as 20%.”

Operators will need to work hand-in-hand with both finance and IT to make sure these changes can be implemented smoothly without disrupting day-to-day operations.

The IT Perspective

Chemical companies’ IT teams are being stretched thin. The rise of AI means they’re juggling massive amounts of data while also fighting off a growing wave of cyberattacks.

Cyberattacks targeting the chemicals industry have increased in frequency and severity. One of the most concerning trends has been the rise of ransomware and hacktivist attacks that not only disrupt IT systems but also cause physical consequences to Operational Technology (OT) systems. According to a report from Waterfall Security, 80% of these attacks in 2023 targeted OT environments, posing significant risks to production processes and plant safety in chemical facilities. These attacks can lead to shutdowns, equipment failures, and potentially dangerous chemical releases.

As the industry becomes more digital, the threat of cyberattacks is only going to grow. IT teams must simultaneously focus on optimizing infrastructure for AI integration while bolstering cybersecurity measures to protect critical operations from potential attacks.

A new era demands a new approach to capital planning

What’s worked in the past for chemicals companies won’t necessarily work going forward. Business models are changing, and traditional competitive advantages are eroding.

To win in this new world, you need an agile, adaptable, and forward-thinking approach to capital allocation. Finario is the Capex solution built for this moment, dynamic enough to adapt to unforeseen changes and robust enough to manage all your capital project data in one unified platform. Schedule a free demo to see how our platform can support your transition into the new era of chemical production.

See what the world's most trusted Capex software can do for your company

The first step to transforming your Capex planning and management is to get a sense of the possibilities. A short demo will do just that.