A Guide to Choosing the

Best Capex Software

Solution

You’ve done an initial round of due diligence. You’ve narrowed your choices for a Capex / capital planning solution. Now it’s time to separate the wheat from the chaff … the claims from the real differences … the solutions that will truly perform vs. those that will come up short. When evaluating the best Capex software, here are some of the most important things to look for in making your decision:

Purpose-Built Capex Software

Some purported “Capex solutions” are nothing more than form builders with workflow and rudimentary reporting. They are “form-centric” rather than “project-centric” and can’t provide a single source of truth across the capital investment lifecycle or the range of functionality required for effective Capex decision making. So you should ask: Does the provider specialize in workflow or in capital planning? Because let’s face it: managing Capex well takes a lot more than workflow. Capital investment is too important to your organization’s performance to place it on an inadequate foundation.

Finario is the first and only purpose-built, enterprise capital planning software solution. Capex is all we do, and helping you invest better is our only mission.

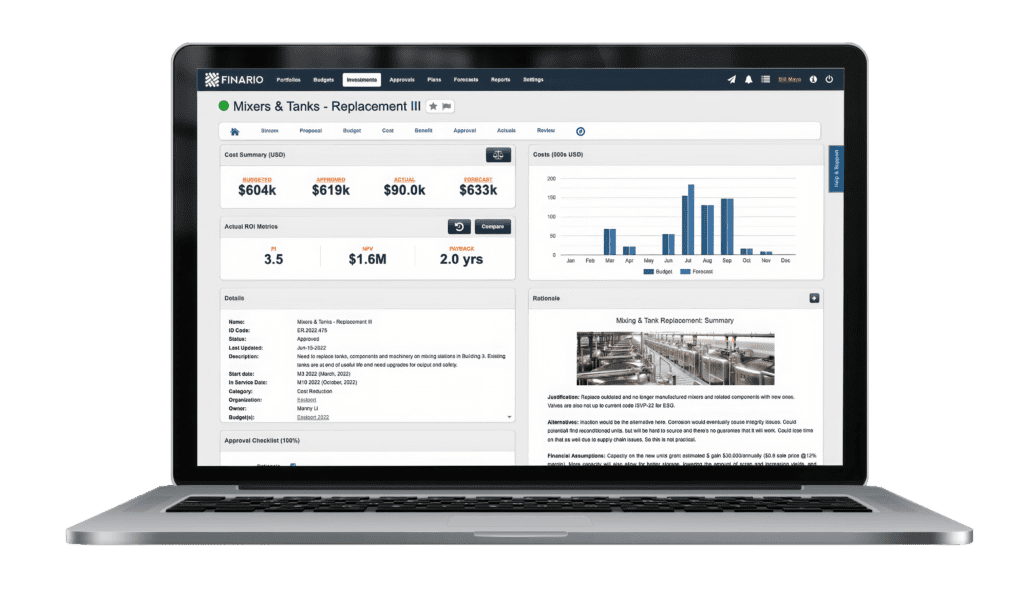

Dynamic Project Environment

If the solution’s architecture is project-centric, the next question is whether it is capable of capturing as much detail as necessary. Does it make it easy to enter a very small expenditure but also seamlessly accommodate the considerable amount of information required for your largest, most strategic capital project? If not, how can you expect to approve, manage, and report meaningful data? To truly understand material projects you need to be able to break the project down into its constituent parts, however you want to define them. This is critical for two reasons:

1) It enables you to see what costs have and have not come through (for management review and analysis); and, 2) it greatly simplifies the transition of assets from Construction in Progress (CIP) to Fixed Assets and depreciation expense since all relevant detail has been captured (for accounting and reporting).

Finario has been built from the ground-up to support every phase of the capital investment process for every project – from the most simple to the most complex.

Financial Intelligence

A true financial application rolls through plan and quarterly forecasts from quarter to quarter and year to year. Its not a static “dumb” form, and data isn’t constrained to a single fiscal year. This is critical if you want to compare projects or portfolios over multiple years, perform reference class forecasting, and many more essential tasks. The technology behind a financial reporting system is very different from the technology driving an approval process and workflow. To manage the financial impact of Capex spend you need an application built from the ground up for finance. You need an application designed around the planning and forecasting financial cycle. A system that understands both fiscal years and project years, can cross multiple years and knows the difference between a new project and carryover spend. You need real financial intelligence.

Finario’s portfolio planning, capital budgeting and project forecasting application includes 50+ “standard” reports from the get go, and the ability for business users to create an unlimited number of ad-hoc custom reports – without IT support.

Investing Mindset

Another thing to look for: Some applications are focused solely on cost control. Yes, capturing costs is important, but it’s only a small part of what a Capex system should do. Capital expenditures are an investment and should be treated as such. Your application should include a robust and flexible ROI modeling capability that allows standardized and financial correct estimation of ROI for all material projects. Consistently applied, the ROI metrics enable you to compare one project against another on level ground without the risk of error inherent to spreadsheets. It’s all about getting the most from your finite investment of funds. “ROI” can’t just be a box you check on a form or a rough number generated from a simplistic, static ROI calculation.

ROI is woven into the fabric of Finario, from budgeting through approval and post-completion review. Our robust ROI modeling and reporting capabilities give leaders in financial planning and analysis what they require to take a more strategic role in their organizations.

Portfolio Scenario Planning

One of the great benefits of a robust Capex system is the ability to create a portfolio of projects to understand the “what if” implications of adding or removing specific projects to your plant. The portfolio building process should be as simple as picking a financial metric, a threshold, and applying it to your list of proposed projects. You should then be able to stack rank projects and add or remove individual projects as needed based on established priorities and immediately see the implications of such. Ask whether you can create unlimited portfolio scenarios and whether the same project can be included in multiple scenarios. Are the scenarios solely cost based, or can they reflect ROI metrics and risk scoring. Are you able to compare portfolios themselves on the basis of ROI. Do the scenario capabilities extend beyond the planning period, that is can they be used to complement the approval and quarterly re-forecasting processes?

Finario provides the ability to evaluate present and construct future portfolios with ease. Effortlessly see how specific approval decisions impact your plan and cash flow forecast.

Bottom-Up Budgeting

Ideally, budgeting should be performed with project-level detail, not just top down. Why? Because you can’t determine meaningful variances to a budget without granular project-level details. Does the application house all budgeting activity or does the vendor suggest using offline tools like Excel to capture details? Besides defeating the purpose of moving to a digital platform in the first place, it’s critical to have all data in one location and viewable by leadership at any given time. If you can’t drill into your budget to see the detail that makes it up, you simply cannot perform variance analysis when comparing to actuals.

Finario provides the flexibility you need, and is ideal for bottom-up budgeting and zero-based budgeting. All investment selection and budgeting can be done within the application.

Approval Rules Engine

Most generic workflow systems focus on routing forms with fancy drag-and-drop workflow builders. While this works well for simple business processes like time off requests, it creates two serious problems for Capex. First, the criteria are too varied to be able to map them effectively graphically, turning those slick builders into spaghetti. A rules builder is much more efficient and easy to manage. Twenty simple rules, for example, can create and easily manage hundreds of different paths to accommodate all the different types of projects and needs across your capital portfolio. Second, form-based systems are inflexible. Once the form has begun routing, any changes to personnel or policies will require manual intervention and workarounds – defeating the purpose of the workflow automation in the first place.

Finario’s approval workflow is rules-based, dynamically updated for all changes to the project, policies or personnel – never requiring manual intervention to set it right.

Enterprise Scalability & Control

Obviously, it’s important that the application you choose is able to handle the volume of users and projects that you have today. But, how about five years from now? You want a solution that can grow with you. Another question to ask: Are any of the Global 2000 using the candidate provider’s application? Will the provider give you references to speak with about their use of the application? Real-world experience lends credibility to the provider’s claims, and confidence to your decision.

Finario is enterprise-ready at every level and used by some of the most respected companies in the world across dozens of different industries.

TCO to Value

It’s easy to be lured in by a low license or subscription fee. The old adage applies: you get what you pay for. Deconstruct the total cost of ownership (“TCO”): Is the set up and implementation fee a fixed bid or for time and materials? This can be a major variable if the “base” capabilities you get require customization. How about user support costs? Don’t assume unlimited support is included in the annual fee. Also ask if continuous feature enhancements are included. Are they automatically pushed to your users in updates (via the cloud)? Or do they incur additional costs. Again, don’t just assume the answer is “yes.” Will there be expensive, “forced” migrations when underlying hardware or software components are no longer supported.

Finario’s solution advisors will help you select an edition that provides the features and functions you need today, while giving you the flexibility to upgrade over time. Everything is included in your annual subscription fees; there are no “gotchas.” Moreover, our cloud application is continuously updated to provide best-in-class performance.

Integration

Capex does not operate in a bubble, or at least it shouldn’t! Want to integrate your Capex system with your ERP (such as SAP, Oracle, or Microsoft) or procurement system (such as Coupa or Ariba) to dynamically update actuals, improve sourcing efficiency, streamline approval processes, etc., immediately or in the future? Ask if they have a well-documented API, or if the interfaces will have to be built from scratch. If the latter, you are looking at a longer install, increased complexity, and higher costs.

Finario has been integrated to all the leading ERP and procurement systems via its API.

Localization

Do you do business in more than one country? Make sure your vendor supports all the languages you need and has the ability to operate in multiple currencies. It’s not just about being easier; when users operate in their local currency they are likely to be more effective in extracting reporting insights and applying them. Make sure the application you choose can handle the conversions correctly and enable reporting from all the necessary perspectives.Also, how easy is it to deliver the solution across your global footprint and how will the solution perform. You don’t want your users to be idling, waiting for pages to load.

Finario supports over 100 languages and 80+ currencies, making it easy to track and report on Capex no matter where you are located.

Security

While cloud-based applications (“Software-as-a-Service” or SaaS) have gained wide acceptance in recent years, you should not take it for granted that an acceptable level of security is a given among all SaaS providers. Start by asking if the provider has SOC 2 certification. SOC2 compliance is the gold standard for managing customer data. While compliance isn’t a requirement for SaaS and cloud computing vendors, its role in securing your data cannot be overstated and should be viewed as a requirement for doing business.

Finario is SOC 2 certified, and offers best-in-class security for the ultimate peace of mind.

In Summary

It’s easy to be swayed by an attractive website, a slick sales demo, and compliant sales reps promising that everything can be customized to your requirements. So stay focused on what’s most important and ask the right questions, especially when evaluating the best capex software. We hope this checklist has helped. Making an informed decision will ensure that you have the capabilities, future-proofing, and security your organization requires… at a cost that is fair and produces an outstanding return on investment.

Finario is all about ensuring you receive an outstanding ROI on your capital program, including your investment in us. In fact, the letters ROI are even the last 3 in our name.

See what the world's most trusted Capex software can do for your company

The first step to transforming your Capex planning and management is to get a sense of the possibilities. A short demo will do just that.