Essential Questions Facing Capex Stakeholders as We Approach 2026 … and How to Answer Them

CAPITAL PLANNING | ROI MODELING | DIGITAL TRANSFORMATION

1. What Are Some Key Trends to Look Out for?

Recent industry reports reveal significant shifts across infrastructure and digitalization, directly impacting how Capex is approached in capital-intensive industries:

- Smart Manufacturing & Digital Foundations: According to Deloitte’s 2025 Smart Manufacturing Survey, manufacturers are ramping up investment in foundational technologies, cloud, AI, IIoT, and analytics to unlock ~20% gains in productivity and ~15% in capacity (Deloitte, 2025).

- How will you validate ROI across these foundational technology investments and and ensure real-time performance tracking across digital initiatives?

- Utility & Grid Investments Surging: In 2025 alone, U.S. utilities are expected to invest over $212 billion in grid modernization, decarbonization, and supporting AI-driven energy demands from hyperscale data centers (S&P Global, 2025).

- Even if your company is not in the utilities or energy sectors, how will rising energy costs impact your investment decisions, and what infrastructure decisions are looming for your plants and facilities?

- Explosive Growth in Industry 4.0 Markets: The Industry 4.0 tech market, including robotics, digital twins, and predictive systems, is forecast to grow from $551B in 2024 to $1.6T by 2030, with a CAGR of 19.4% (GlobeNewswire, 2025).

- Are you equipped to effectively justify your spending with standardized business case templates tailored to your organization’s taxonomy, data fields (such as ROI models), and risk-scoring criteria to ensure consistency, accuracy, and strategic alignment across all proposals? Are your approval workflows empowering those with budgeting authority, or obstructing them?

2. How Do Trends Like These Impact Capex Stakeholders?

While finance, operations and IT are focused on their individual metrics and mandates, the need for collaboration has never been more important. For example:

- Finance Leaders

- The cost of capital remains volatile. This mpacts investment priorities and timing, how ROI models are calculated, and the need to factor resilience, and obsolescence risk.

- Can you simulate future scenarios in real-time, assess cash flow, pivot to prioritize/re-prioritize your investments, and quickly reallocate capital to projects that offer better returns and strategic alignment?

- Operations Leaders

- Smart factory investments are now delivering measurable improvements in output and uptime. (Deloitte, 2025).

- Are your Capex strategies prioritizing flexibility with modular plant designs, automation, and predictive maintenance, enabling responsiveness to market shifts?

- IT Leadership

- Cybersecurity and system interoperability are pre-eminent, especially as AI tools become more deeply embedded across enterprise systems. (Data Center Dynamics, 2025).

- Does your organization have a strategy to establish a single source of truth for capital planning and management, so that you can manage your data more proactively and have greater confidence in its insights?

3. What Are Some Top Challenges and Best Practices in Capital Planning Today?

- Common Challenges

- Lack of integration between finance, IT, and operations.

- A Capex Council can be what you need to support cross-functional collaboration between these stakeholders to improve oversight and ensure the best possible projects prioritization and management.

- Technical debt and outdated legacy systems

- Difficulty measuring lifecycle cost, asset performance, and ESG impact

- Uncertain ROI on emerging technologies (e.g., AI, automation, digital twins)

- Lack of integration between finance, IT, and operations.

- Proven Best Practices

- Early cross-functional collaboration in Capex planning

- Scenario-based ROI modeling using digital twins

- Prioritizing scalable, modular designs to reduce errors and downtime

- Continuous benchmarking of Capex execution and asset performance

- Embedding ESG and energy metrics into decision-making frameworks

4. You Have Questions, We Have Answers. Let Us Show You.

The digital transformation of capital planning isn’t a distant future…it’s happening now, and the companies that recognize this are already reshaping their industries. The question is, are you ready for your own industrial revelation?

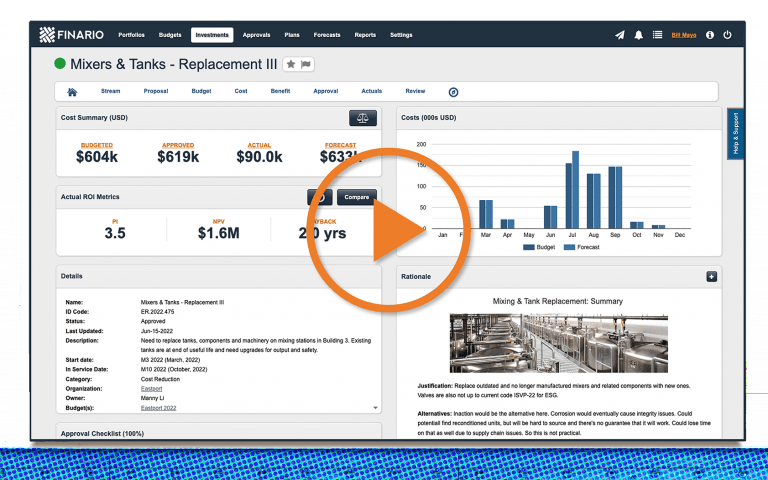

The tools, insights, and strategic framework that will define capital excellence in 2026 and beyond are enterprise-grade, purpose-built, and available today in Finario. Let us show you exactly how industry leaders are making this transformation and how you can lead in your sector.

Join us for our Industrial Webinar + Demo series, catered exclusively for the chemicals, building materials, food & beverage, paper and packaging, and metals & mining industries. Each session will look and industry-specific trends, best practices and how our enterprise Capex software is being deployed by some of the best companies in the world.

Session Dates

Chemicals Industrial Demo

October 14 at 11:00 ET

Building Materials Industrial Demo

October 15 at 11:00 ET

Food & Beverage Industrial Demo

October 16 at 11:00 ET

Paper & Packaging Industrial Demo

October 22 at 11:00 ET

Metals & Mining Industrial Demo

October 23 at 11:00 ET

Watch our product

overview video