Underspending Capex: The Pitfalls of Leaving Capital Investment Dollars on the Table

UNDERSPENDING CAPEX | CAPEX BUDGET MANAGEMENT

There’s no shortage of data and anecdotes describing the difficult decisions companies routinely have to make in determining which capital projects they can fund and those they cannot. Or of rampant overspending, which is more norm than the exception.

Less common, however, are incisive examinations of why companies often underspend their capital budgets.

At a time when many large organizations were stuck in neutral for a large portion of the year, awaiting guidance on which way the impact of tariffs and related supply chain issues might go, the topic of underspending may be more relevant than ever.

Some business leaders may be grappling with “use it or lose it” considerations if they follow a “traditional” budgeting cycle. Others may find that they need to play catch-up to meet revised targets.

Whatever the circumstances, leaving budgeted dollars on the table can mean missed opportunities, delayed innovation, and lost competitive ground. So let’s give underspending the attention it deserves.

Why It’s More Common Than You May Think

Data on underspending is relatively sparse. Though there are some hints:

- A survey of Food & Beverage Processors by Food Processing Magazine found that nearly two-thirds of companies they tracked (N=31) underspent their 2023 Capex targets; 25% of which fell short by 20% or more

- A survey of U.S., manufacturing plants by Assembly Magazine found that in 2024, 80% of plants spent at or below 90% of their capital budgets

In our briefing, “Why Your Capital Budget is Probably Being Underspent,” we reviewed why underspending is rarely intentional; rather, it’s often the result of poor visibility into project pipelines, slow approvals, and inconsistent prioritization across business units. “You can either race to spend as much as possible before the end of the fiscal year (and therefore overpay for the assets acquired), or underspend the budget and potentially dampen your company’s future prospects.”

In recent years, underspending is often also a factor of either not being able to identify and hire qualified people fast enough to execute larger projects in the pipeline, or supply chain constraints that limit the availability of desired equipment, machinery, technology, etc.

Lastly, there are those who believe that underspending is a sign of fiscal discipline, when in reality it can signal operational bottlenecks, strategic misalignment, or risk aversion that erodes long‑term value.

Root Causes of Underspending

Fragmented Visibility

Disconnected systems make it hard to see the status of projects across their portfolios in real time, thus have an inability to accurately assess cash flow. Without a unified view, leaders can’t reallocate funds quickly when projects stall.

Over-Cautious Planning

Holding back funds for “potential opportunities” often results in unused budgets when those opportunities never materialize.

Slow Approvals

Manual workflows delay project starts, pushing spend into the next fiscal year. In some enterprises, Capex requests can sit in review queues for 3-6 months, according to published benchmarks.

Execution Complexity

Inflation, supply chain volatility, and regulatory changes slow project delivery, pushing them into subsequent fiscal years.

The Cost of Doing Nothing

Underspending isn’t just a missed opportunity; it’s a strategic liability:

Strategic Initiatives Stall

Growth and efficiency projects can be delayed, sometimes by an entire fiscal cycle.

Market Share Erodes

Competitors who deploy capital faster seize opportunities first, especially in emerging markets or new technology adoption.

Future Budgets Shrink

Finance teams may cut allocations if they see a pattern of underspending, creating a self‑reinforcing cycle of reduced investment capacity.

In industries where speed to market is a differentiator, such as pharmaceuticals, renewable energy, and advanced manufacturing, the cost of underspending can be measured not just in lost revenue but in lost relevance.

Five Ways to Eliminate Underspending in 2025

Though there are often factors out of your control, there are steps that can be taken to optimize your capital budget. These include:

Centralize Capital Planning: Use a single system of record for all projects to enable portfolio‑wide visibility and faster decision‑making.

Implement Real‑Time Tracking: Replace static spreadsheets with live dashboards to spot underspending early and reallocate funds before year‑end.

Standardize Evaluation Criteria: Apply consistent metrics to prioritize projects objectively, ensuring high‑impact initiatives rise to the top.

Align Capex with Strategic Goals: Tie every investment to measurable business outcomes, so leaders can defend and accelerate spending when needed.

Streamline Approvals Automate workflows to reduce bottlenecks and start projects sooner, especially for time‑sensitive initiatives.

The Role of Enterprise Capex Software

Modern Capex management platforms are more than budgeting tools; they’re strategic enablers. They help large enterprises:

Increase Budget Utilization

by ensuring funds are deployed where they’ll have the most impact.

Improve Forecast Accuracy

through historical data and scenario modeling.

Enhance Collaboration

by giving finance, operations, and IT leaders a shared view of priorities and progress.

Enable Agility

by allowing rapid reallocation of funds when market conditions shift.

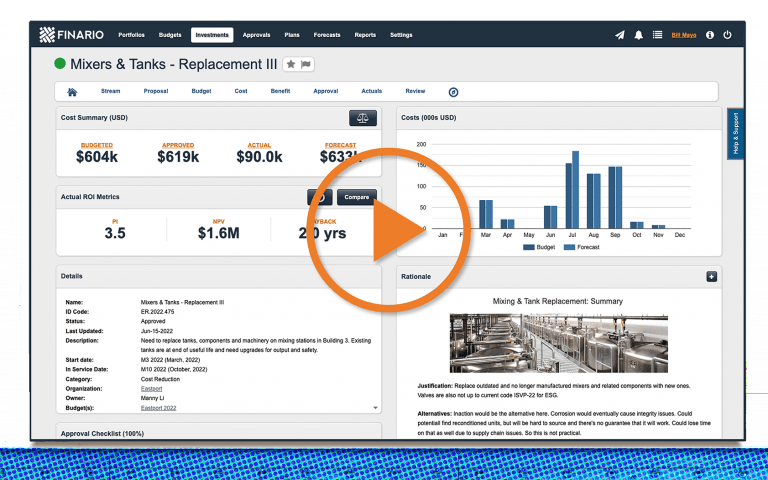

Watch our product

overview video