What do Capex stakeholders need to know about the One Big Beautiful Bill Act?

CAPITAL PLANNING | CAPEX BUDGETING | OBBBA

The One Big Beautiful Bill Act (OBBBA), signed July 4, 2025, isn’t just another tax tweak; it’s the biggest shift in capital planning rules since 2017. For Capex stakeholders, this is a critical time to reconsider your capital investment strategies and priorities.

Why? OBBBA permanently restores 100% bonus depreciation for qualified property placed in service after January 19, 2025 (RSM, 2025). No more phase-outs. No more gradual deductions. Just immediate write-offs that can supercharge cash flow and free up capital for your next big move.

And it dosen’t stop here:

Section 179 Expensing

Increases to a $2.5M cap with a $4M phase-out – a major win for small and mid-sized portfolios (Anders, 2025).

Qualified Production Property (QPP)

Is eligible for a 100% expensing election for U.S.-based manufacturing, refining, and production facilities, provided the property is placed in service by December 31, 2028, and completed by December 31, 2030 (JD Supra, 2025). Miss those dates? You miss the windfall.

What the Bill Doesn’t Cover

While general equipment and production property investments qualify for full expensing, significant green energy tax provisions have been explicitly removed or accelerated toward expiration.

Moreover, the law doesn’t change the rules around how the IRS distinguishes between capital and maintenance expenditures. Routine maintenance, de minimis expenses, and minor repairs remain subject to existing guidance and safe harbor thresholds. For example, the routine maintenance safe harbor does not extend to higher expensing limits under OBBBA.

Thriving in a Post-Tariffs Environment

Capex investment is already surging with +16.6% increase in the first half of 2025, and equipment production is up 23% in Q1 (MSN, 2025). CFOs who don’t front-load eligible assets could be leaving capital and competitive advantage on the table.

Finario’s Three Moves Every CFO Should Consider This Quarter

- Swift Capital Acceleration

Identify and fast-track projects that qualify under QPP. Finario’s Converge platform surfaces eligible assets immediately, letting you front-load capital where it counts. Because there’s a 10‑year recapture window, don’t let hesitation cost you ROI.

- Reforecast with Agility

Use Finario’s scenario planning workflows to overlay OBBBA impacts on your 3–5 year plan:

– Push depreciation into year one.

– Simulate cash‑flow and tax outcomes across “what‑if” scenarios.

– Reallocate capital dynamically to high‑return projects.

- Secure Compliance & Audit Readiness

With Finario, you can document contract dates, supplier origins, and placement milestones in a single source of truth. Automated audit trails and standardized workflows mean you’re IRS‑ready before the audit knocks.

The Bottom Line for CFOs:

OBBBA is more than tax policy; it’s a once-in-a-decade inflection point. Organizations that align Capex cash flow and tax strategy, procurement timing, and operational execution now will gain an agility advantage and improved returns. Those who delay may risk missing peak benefits and give up the advantage to faster, more prepared competitors.

If you want to move at the speed of OBBBA, frameworks like Finario’s Capex SwiftShift™ can help your team:

– Rapidly reallocate budgets to fast-track eligible investments

– Model tax outcomes with real-time visibility into write-off scenarios

– Align procurement timelines with placement-in-service milestones

– Ensure documentation integrity across contract dates, elections, and usage audits

The clock’s ticking. Every quarter you wait is another quarter you’re leaving money on the table.

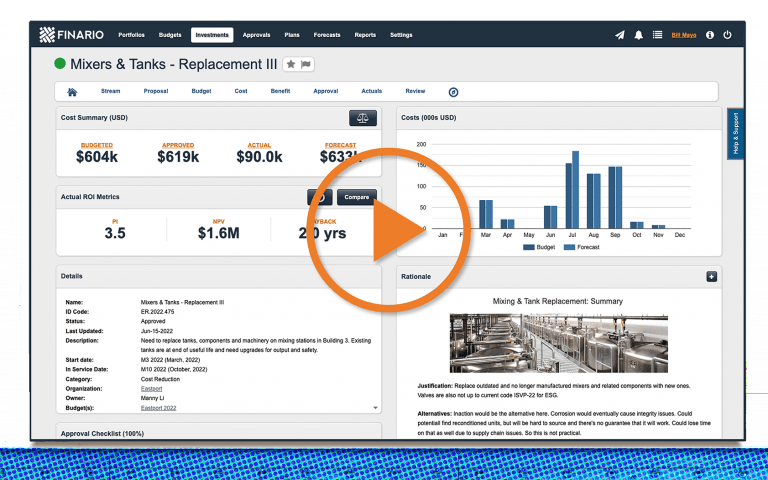

Watch our product

overview video