The metals and mining industry is at a pivotal moment. Long known for navigating complex regulatory environments and technological disruptions, the sector now faces an unprecedented convergence of challenges and opportunities. From geopolitical shifts and ESG pressures to rapid advancements in automation and digital transformation, metals and mining companies must rethink how they allocate capital.

In this edition of Capex Confidential, we explore the evolving capital expenditure (Capex) landscape shaping the future of the industry in 2025 and beyond.

Escalating Costs and Delays: The Megaproject Challenge

Mining megaprojects are notorious for overshooting both budgets and timelines. According to McKinsey, 83% of major mining projects exceed initial Capex by over 40%, while schedule delays often range from 20% to 30% (McKinsey). These overruns are primarily due to outdated planning frameworks, insufficient risk management, and resource bottlenecks.

The fix? Enhanced project management, early-stage risk assessments, and agile planning methodologies are now imperative. That’s where Finario comes in. As an end-to-end Capex management solution, Finario provides the visibility, control, and agility mining companies need to plan and execute large-scale investments more effectively. By enabling real-time forecasting, scenario planning, and standardized approvals, Finario helps mining organizations reduce costly delays and budget overrunsunlocking more value from every capital project. Investing upfront in better planning can save millions in delayed production and missed opportunities.

Resource Nationalism and Regulatory Hurdles

Governments around the world are asserting greater control over natural resources, reshaping the global mining landscape. In 2025, a “wave of resource nationalism” is taking hold, with countries like Indonesia proposing export restrictions on critical minerals such as nickel to strengthen domestic value chains (Control Risks, 2025). Similar measuresranging from royalty hikes to retroactive taxesare being explored in the DRC (cobalt, copper), Latin America (lithium, copper), and other resource-rich regions.

At the same time, environmental regulations are tightening. Stricter ESG mandates – particularly in the eurozone – now demand enhanced transparency, sustainability, and community engagement. This dual pressure from both geopolitical and regulatory fronts is driving mining companies to increase capital allocation toward legal compliance and sustainability initiatives.

The implications are profound: miners must now rethink their global strategies. Diversifying across regions and commodities has become essential to mitigate risk. Regulatory approval for cross-border deals, especially those involving strategic minerals, is also becoming more difficult. Nationalist sentiment and geopolitical tensions (particularly involving China) are prompting review boards in the EU and US to scrutinize or block large mergers in sectors like copper and lithium (Control Risks, 2025).

To adapt, mining companies are increasingly pursuing joint ventures and strategic partnerships. These structures help navigate foreign ownership restrictions, share investment risk, and maintain operational continuity in a volatile regulatory environment (EY, 2025).

Capital Constraints in an Uncertain Economy

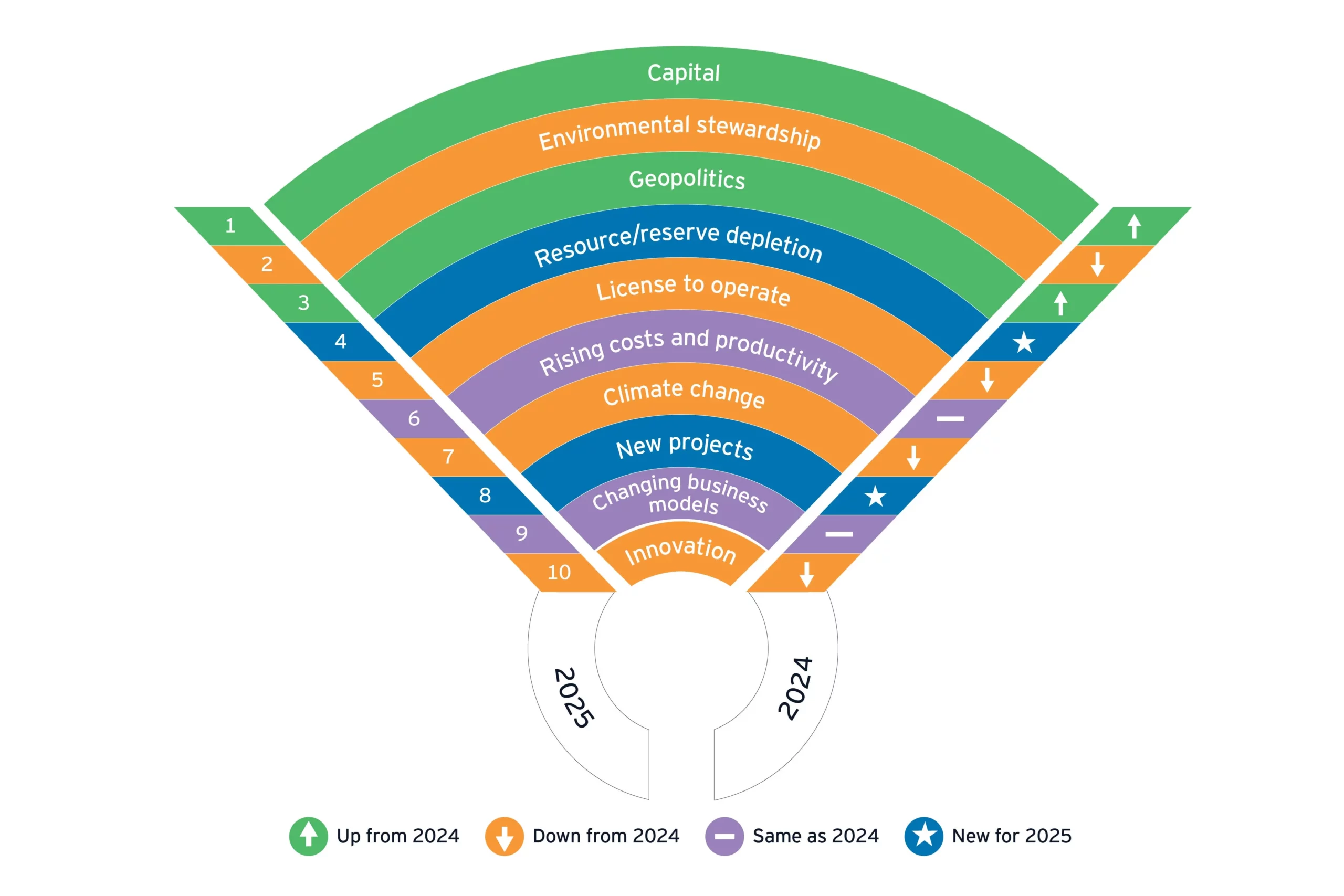

Securing funding in today’s volatile macroeconomic climate is more challenging than ever. According to Ernst & Young (EY), capital management ranks as the top risk facing mining companies in 2025. Inflation, commodity price volatility, and rising investor skepticism are pushing executives to be more selective, disciplined, and strategic in their investment decisions.

Rather than pursuing debt-heavy expansions, many firms are focusing on high-return, strategically aligned projects often financed through joint ventures, mergers, and partnerships. The broader economic outlook is acting as a brake on Capex spending for some, while long-term demand for metals remains strong, higher interest rates, inflation, and uneven global growth are tightening access to capital.

EY’s 2025 survey underscores this reality, identifying a “trifecta” of pressures miners must navigate: capital discipline, sustainable operations, and rising stakeholder expectations. Companies are under increasing pressure to strike a delicate balance between investing for growth and maintaining strict cost controls in a more constrained financial environment.

Recent industry data reflects these headwinds. Global exploration spending dipped approximately 3% in 2023, retreating from 2022’s nine-year high, according to S&P Global. Junior and mid-tier miners were hit hardest, with a 6% year-over-year drop in financings above $2 million and a ~4% overall decline in capital raised. While gold-focused juniors held up better, those targeting copper and zinc struggled to attract funding.

As a result, Capex stakeholders are rethinking capital allocation. As EY’s Lee Downham observes, miners must shift “from focusing solely on short-term returns to prioritizing long-term value creation,” blending capital discipline with strategic growth investments (EY, 2024). Many companies are also using scenario planning (e.g., under different price and policy cases) to stress-test budgets. Watch our recent webinar on the war-gaming approach to scenario planning here, where Kyle Frazer, COO/CFO at Agilion Systems, unpacks proven strategies for coming out on top of recent tariff and inflation headwinds.

Tech-Driven Transformation: Efficiency as a Strategy

“The next 10 years will see the continuation of rapid change in the industry…To thrive amid this volatility, companies must rethink the traditional mining model. Change is coming and mining companies must find ways to remain relevant,” Phillip Hopwood, Global Mining & Metals Leader at Deloitte (CAP Logistics, 2025). Modern technologies are no longer optionalthey’re integral to Capex planning. AI, digital twins, IoT, and predictive analytics are transforming mine operations. These tools enable real-time monitoring, predictive maintenance, and improved safety, helping to reduce costs and environmental impact.

Many leading miners are already deploying these innovations on Capex. For example, AI-driven feasibility tools can uncover project cost risks, and cloud platforms enable centralized cost control across multiple sites. Data-driven decision support (integrating geology, engineering and market forecasts) is increasingly used to justify and time spending. These tech levers not only improve efficiency but also support ESG goals (e.g. by enabling more precise water and emissions modeling).

📈 The Finance View: Disciplined Growth and Debt Resilience

Mining CFOs are sharpening their focus on capital efficiency and debt reduction. S&P Global reports that after a period of margin compression, profits have rebounded by 20%, and debt levels are at a decade low (S&P Global).

This healthier financial footing allows for selective Capex deployment, favoring firms that blend M&A strategies with internal innovation. Financial agility is becoming a key competitive advantage.

⚙️ Operational Outlook: Productivity Amid Declining Ore Grades

Ore quality is decreasing globally, driving up extraction costs. To counter this, mining firms are deploying robotic drilling, advanced leaching techniques, and real-time asset management systems. These investments can reduce per-unit costs while meeting ESG targets.

Operational excellence now hinges on technology integration and process optimization, with innovation becoming a differentiator in tight-margin environments.

💻 The IT Outlook: Cybersecurity and Infrastructure Resilience

As mining operations digitize, cybersecurity is a growing Capex priority. With 80% of industrial cyberattacks in 2023 targeting OT systems (Waterfall Security, 2024), mining companies are investing in network segmentation, 24/7 monitoring, and workforce training to protect critical infrastructure.

Opportunity: The Energy Transition and Critical Minerals

In today’s mining landscape, a smart Capex strategy must align growth objectives with ESG priorities and investor expectations. Sustainability is no longer optional; access to capital increasingly depends on credible ESG commitments. As Baker McKenzie notes, miners “must demonstrate a robust commitment to addressing ESG concerns…to access meaningful capital”(Baker Mckenzie, 2023). Studies show that mining firms with higher ESG ratings have delivered substantially better shareholder returns than industry peers. Failure to meet decarbonization and community standards can even prompt divestment: 63% of mining investors say they would withdraw support if companies miss net-zero targets (Baker Mckenzie, 2023).

As a result, capital projects are now vetted for both financial and environmental impact. So, for example, to meet ESG-linked funding requirements, companies are tapping green bonds and sustainability-linked loans, while forming Climate or ESG committees to oversee investments. Finally, Capex planning is becoming more integrated and analytics-driven. Leaders are balancing portfolios to meet both immediate cash flow needs and long-term sustainability goals. Embedding internal carbon pricing or natural capital valuation in project approval streams helps to ensure capital flows to higher-impact, lower-risk initiatives, while building investor confidence.

Conclusion: Building Capex Strategies for a New Era

The mining industry is undergoing a strategic transformation. As companies grapple with cost inflation, rising ESG expectations, and the need for digital resilience, capital discipline is becoming the cornerstone of successful investment.

By embracing technology, strengthening balance sheets, and aligning with the energy transition, mining firms can position themselves for long-term growth. Leaders who understand this new Capex reality will not only thrivethey’ll shape the future of the industry. For example, projected growth in demand for critical energy-transition minerals under IEA scenarios –Lithium, cobalt, and nickel demand – could more than triple by 2040 (IEA, 2025), underscoring the massive Capex needed in new mines and refiners., luctus nec ullamcorper mattis, pulvinar dapibus leo.