2025 Was Challenging. Next Year May Be More So.

Be Prepared for Anything with a Capex Council.

Let’s be honest: 2025 tested your capital allocation strategy in ways you probably couldn’t anticipate. And as you look ahead to 2026, many of the same variables persist: tariff uncertainty, technology disruption, supply chain headaches, and persistent inflation.

And one thing you can be sure of is that something new will emerge that will also test your company’s ability to make sound decisions more quickly than ever before.

During those times, will you be scrambling to figure out if you should be delaying or scrapping projects, reallocating capital to more promising investments, or doubling down on a project that’s in progress?

The answer to that question is dependent on many factors, of course, but perhaps none are as crucial as having a collaborative structure in place, and the right data at hand to empower smart choices. We’ve found that that starts with having a Capex Council.

What an Effective Capex Council Looks Like in 2026

So what is a Capex Council?

In a prior blog, we outlined exactly what a Capex Council is. We even created Capex Conversation Starter Cards to help facilitate conversations around it. To summarize: It’s a cross-functional team, typically comprising leaders from finance, operations, IT, and procurement, with one overarching mandate: to align capital allocation decisions with high-level strategic objectives.

Its responsibilities include:

- Reviewing proposed and ongoing projects to ensure they’re still viable and on track.

- Reallocating resources when new opportunities arise or priorities shift.

- Championing transformative initiatives and ensuring they secure the attention they deserve at senior levels.

Some important things to consider:

Clear Governance and Authority

Define the council’s decision-making authority. What threshold requires council approval? Who has the final say when the council is split? How do urgent requests get handled? Clear governance prevents the council from becoming a bottleneck.

Data-Driven Decision Making

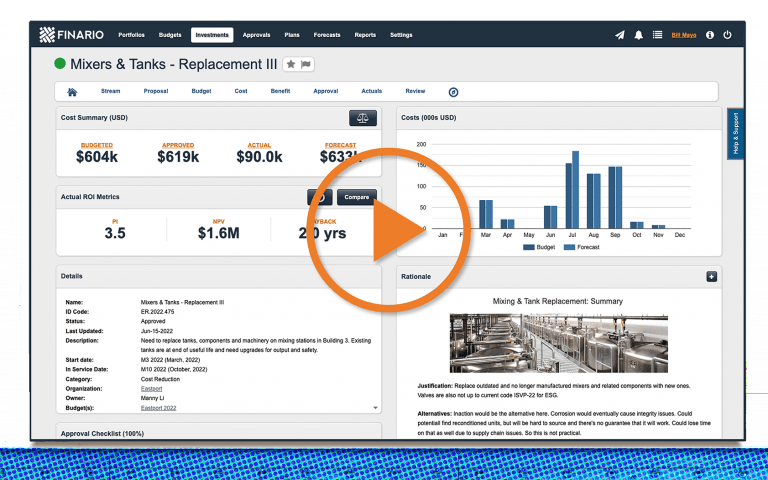

Gut feelings and compelling presentations won’t be enough in 2026. Councils need access to real-time data on project performance, portfolio health, and financial metrics. An enterprise-grade like Finario provides the visibility and analytics to enable councils to drill into project details during meetings, compare scenarios, and make decisions based on facts rather than assumptions.

Regular Cadence with Flexibility

Establish a consistent meeting schedule, whether that’s bi-weekly, monthly, or quarterly, depending on your organization’s capital intensity, but build in flexibility for urgent sessions when market conditions demand immediate action.

Focus on Outcomes, Not Just Approvals

The most mature councils track not just what gets funded, but how funded projects perform. They establish clear success metrics, monitor progress, and learn from both successes and failures to continuously improve capital allocation effectiveness.

Why A Capex Council Will Be a Competitive Advantage in 2026

Agility When Priorities Shift

If we’ve learned anything since the onset of the pandemic, it’s that the five-year capital plan can become obsolete in five months. A Capex council doesn’t just approve projects at the start of the year and walk away. It provides ongoing governance that allows organizations to reallocate resources when market conditions change, when strategic opportunities emerge, or when projects aren’t delivering as expected.

Companies with mature Capex councils aren’t locked into outdated plans. They have the structure and discipline to pivot quickly, funding break-in projects that address urgent needs while pausing or scaling back initiatives that no longer make strategic sense.

Holistic Trade-Off Analysis

In 2026, you’ll likely face scenarios where you need to choose between:

- A digital transformation initiative versus traditional equipment upgrades

- Sustainability investments required for compliance versus growth projects

- Defensive spending to maintain competitive parity versus offensive moves to capture market share

Without a Capex council, these decisions can get made in silos or escalate to already-overburdened executives without proper context. With a council, you have a dedicated forum where cross-functional leaders can evaluate trade-offs transparently, using consistent evaluation criteria and shared data.

Companies with mature Capex councils aren’t locked into outdated plans. They have the structure and discipline to pivot quickly, funding break-in projects that address urgent needs while pausing or scaling back initiatives that no longer make strategic sense.

Proactive Portfolio Management

The most effective Capex councils don’t just review new project requests they actively manage the entire capital portfolio. This means:

- Regular check-ins on in-flight projects: Are they on track? Are the original assumptions still valid? Should resources be reallocated?

- Forward-looking capacity planning: What investments will we need in 12, 24, or 36 months? Are we positioning ourselves to act quickly when the time comes?

- Continuous improvement: What lessons are we learning from completed projects? How can we get better at estimating costs, timelines, and returns?

This proactive approach will be essential in 2026 when reactive capital planning could mean missing critical opportunities or doubling down on the wrong investments.

Senior Leadership Alignment

When capital decisions are made departmentally or pushed through without proper vetting, CEOs and boards end up spending valuable time on issues that should have been resolved at lower levels. A Capex council ensures that by the time projects reach executive leadership, they’ve been thoroughly evaluated against strategic priorities, financially modeled, and pressure-tested by cross-functional stakeholders.

This doesn’t slow down decision-making it accelerates it by ensuring executives focus on true strategic choices rather than operational details.

The Cost of Not Having a Capex Council in 2026

Organizations without structured capital governance face predictable challenges that will be magnified in the year ahead:

- Fragmented priorities: Departments compete for capital without a unified strategic framework, leading to suboptimal allocation

- Reactive decision-making: Urgent needs crowd out strategic investments because there’s no mechanism to evaluate trade-offs

- Poor visibility: Leadership lacks real-time insight into portfolio health until problems become crises

- Missed opportunities: Promising initiatives get stuck in bureaucratic limbo while competitors move faster

- Execution gaps: Projects get approved but don’t receive the ongoing oversight needed to ensure they deliver expected returns

In a forgiving economic environment, these inefficiencies might be tolerable. In 2026, they could be fatal to competitive positioning.

Getting Started: It's Not Too Late

If you don’t have a Capex council, the best time to establish one is now. Here’s where to start:

- Build the business case internally: Use the challenges you’ve faced in recent capital planning cycles as evidence for why a structured approach is needed

- Assemble your core team: Identify cross-functional leaders who understand both the strategic importance of capital allocation and the operational realities of project execution

- Define your charter: Establish the council’s mandate, decision-making authority, meeting cadence, and success metrics

- Invest in the right tools: Ensure your council has access to data and analytics that support informed decision-making

- Start small and iterate: You don’t need a perfect process on day one. Launch with a pilot scope and refine based on what you learn

Execution Requires the Right Foundation

2026 will demand more from your capital allocation process than any year in recent memory. Economic uncertainty, technological disruption, regulatory pressure, and competitive dynamics will create a constant stream of difficult decisions about where to deploy your finite capital resources.

But here’s the reality: a Capex council is only as effective as the tools and data it has access to. You can’t make informed trade-offs when project information is scattered across spreadsheets, when forecasts are stale, or when you lack visibility into how the portfolio is actually performing.

This is where Finario makes the difference. Our platform provides real-time visibility and analytics that enable councils to make decisions with precision and confidence. Companies like Schreiber Foods, La-Z-Boy, and Altium Packaging use Finario during council meetings to evaluate projects on the spot, model scenarios, and understand portfolio-level implications of their decisions.

The organizations that thrive in 2026 won’t necessarily be those with the biggest capital budgets. They’ll be the ones with the discipline, structure, and cross-functional collaboration to ensure every dollar deployed advances their strategic objectives and delivers competitive returns.

A well-structured Capex council, supported by the right tools and data, is how you make that happen.

Watch our product

overview video