Let’s get right to the point: you wouldn’t want to go into a battle blindfolded … and if making better capital allocation decisions is a priority at your company, you can’t count on an Enterprise Performance Management (EPM) system to enable you to do so.

That’s not to say that EPM software doesn’t have a place in your “finance stack” — of course it does … for operational budgeting and reporting.

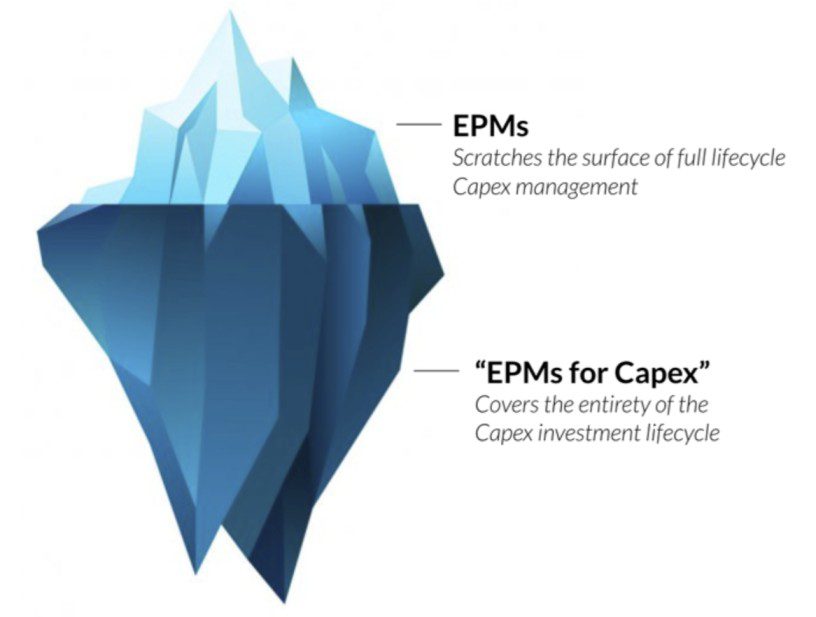

But to optimize your capital investment … to make better, growth-driving decisions, you need to have on-demand access to the data that matters, rigor and flexibility in your approval processes, the analytical tools specific to capital allocation, and a holistic, portfolio view. It requires a “bottoms-up,” project-focused approach that a solution such as Finario provides … a solution that you can think of as an “EPM specifically for Capex.”

Getting down to specifics, an EPM, with its focus on departmental budgeting, treats capital projects as merely a line item. Total project cost, or total cost by month and associated depreciation. That’s it. Very “two-dimensional.” And while, yes, there is some simple workflow, it’s rarely enough for the typical complexity of a Capex approval process in a large enterprise.

Finario, on the other hand, is built around projects (called “investments” within the application to reflect a proper mindset for capital allocation). A large investment can contain dozens of costs, each with their own month-by-month cash flow projections along with a written rationale, ROI model, file storage and other capabilities enabling analysis and management of the project from idea inception, through budgeting, approval, forecasting and post-completion review. Risk models are built in, and users are able to visually rank projects based on their merits and immediately see the impact of those decisions on the budget. The template is flexible to allow as much information as necessary on large or strategic investments, or the bare minimum for small routine expenditures. And each investment’s cost detail is automatically consolidated into a multitude of budgeting and forecasting reports by entity and fiscal year – giving FP&A professionals exactly the information they need.

Finario also tracks each investment’s progress as a project against its budgeted and approved project goals, which may span multiple fiscal periods. This data is automatically rolled up into a bevy of reports and tools that give operations and procurement executives the information they need to manage projects intelligently, get an early warning of pending cost overruns, and optimize the overall project portfolio.

So, as you can see, while an EPM and Finario both offer budgeting and forecasting functionality, the focus and depth of information is very different. Which is why any business with meaningful Capex will need an “EPM for Capex” in addition to a traditional EPM. Fortunately, this will not add “yet another piece” of software to a stack, as it can replace both your homegrown Capex approval system as well as scores of spreadsheets, thus streamlining your overall IT infrastructure.

Most importantly, having all critical financial information related to every project in one system along with the workflow to approve expenditures and adjust budgets makes it much easier to make sound decisions in a timely way, with full confidence in the integrity of your data. More so, every approval decision that is made automatically updates your plan and forecast for the fiscal year. So if a project starts to go over budget, designated stakeholders can be automatically alerted so that they can make critical decisions, such as approval for additional spend or changes to the timetable. This is infinitely more efficient than gathering required data scattered across spreadsheets and other systems for each and every such change.

Another key difference is that the moment a capital budget is complete, a traditional EPM ceases to be of much use for Capex, while Finario has only begun to deliver value. It can help develop a cycle of continuous improvement where one year’s results flow seamlessly into the creation of the following year’s plan and decisions can be made quickly every month and every day in between.

Furthermore, when it comes to implementation, an EPM is a toolbox by design. It requires extensive and expensive customization for every customer. Finario, on the other hand, is already optimized for Capex. The configuration process is thus much faster and less risky.

All told, the benefits of having a clear-eyed, well-informed perch atop all capital allocation decisions are many. But the most important one, is perhaps this: having Finario at the center of your Capex management empowers you to go from an annual battle over a share of budget, to one of making solid arguments for individual projects based on their merits. The result: Misallocations avoided. Shareholder value optimized.