Zero-Based Budgeting

Zero-Based Budgeting for Capex:

How to ensure that projects with the most merit get funded.

SEE HOW FINARIO CAN HELP IMPLEMENT YOUR ZERO-BASED BUDGETING STRATEGY

“While cost-cutting has a role to play, ZBB’s real aim is to make thoughtful spending decisions—reframing choices as cost management. The small changes that result have the cumulative effect of creating investment opportunities to drive growth.”

– Forbes, April 2019

Video courtesy of McKinsey & Company

A DEEPER DIVE INTO FINARIO: ZERO-BASED BUDGETING

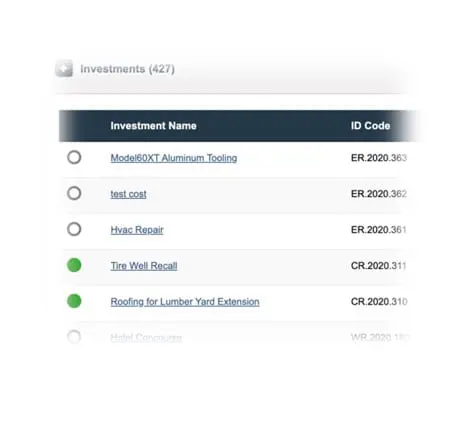

INITIATE

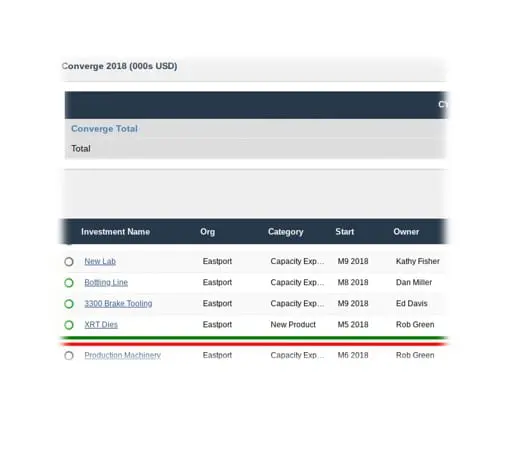

As project owners build their proposals directly in the system a pipeline gets established – giving senior decision makers a more comprehensive view to aid in budgeting those projects with the most merit.

EVALUATE

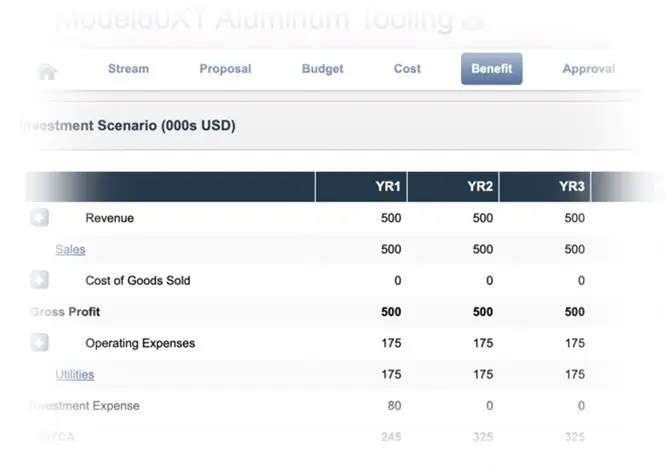

To be considered for approval, candidate projects can be required to apply consistent ROI metrics – so that they can be ranked appropriate on an apples-to-apples basis.

IMPLEMENT

Because it’s cloud-based, Finario makes implementation easier and helps to enforce compliance. This can be critical for enabling ZBB not just across a single location, but across a distributed enterprise and entire portfolio of projects.– AFP Guide to Zero-Based Budgeting 2.0: A New Take on an Old Method, Association for Financial Professionals, 2016

FAQs

Opex vs. Capex

An operating expense (OPEX) is an expense required for the day-to-day functioning of a business. In contrast, a capital expense (CAPEX) is an expense a business incurs to create a benefit in the future. Operating expenses and capital expenses are treated quite differently for accounting and tax purposes. Examples of Capex include plant and equipment, building expansion and improvements, hardware purchases such as computers, and vehicles to transport goods.

Capital expenditures are recorded as assets on the balance sheet under the property, plant and equipment (PP&E) section. It’s also recorded on the cash flow statement under investing activities because it’s a cash outlay for that accounting period.

(Source: Investopedia)

How do companies manage rolling forecasts?

“With rolling forecasts, businesses establish a set of periods after which to update the forecast. For example, if the company sets the period to a month, the budget is automatically updated one month after every month is complete. This allows businesses to be more efficiently responsive by regularly adapting their budgets to reflect recent trends and changes in the marketplace.”

Source: Corporate Finance Institute