Reducing Cost Overruns

It’s hard to act upon something you can’t see.

SEE HOW FINARIO CAN HELP YOU REDUCE CAPEX COST OVERRUNS (OR PREVENT THEM IN THE FIRST PLACE)

“As many as 90% of major capital projects suffer from an average of 28% budget overrun. This in turn extends the rate of return of capital invested to achieve organisational growth, and significantly erodes the intended benefit of the delivered asset.”

— Deloitte

Plan Better

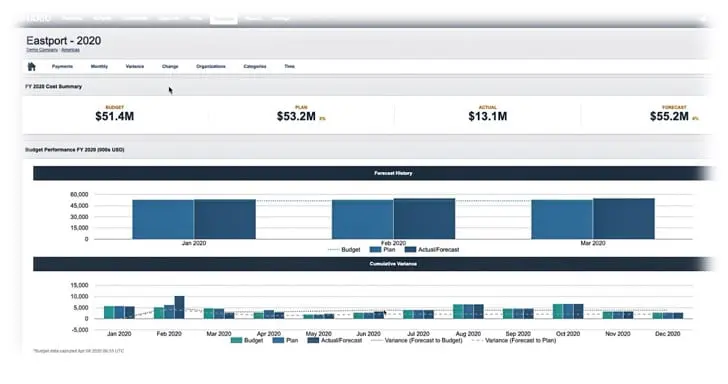

Reducing Capex cost overruns starts with a simple concept: discipline. That’s because most cost overruns are – as the chart below illustrates – a result of poor or inadequate planning. Adding forecasting rigor and consistent risk/ROI assessments can help mitigate “the planning fallacy” (a bias for optimistic outcomes), ensure proper due diligence, and provide transparency and an audit history.

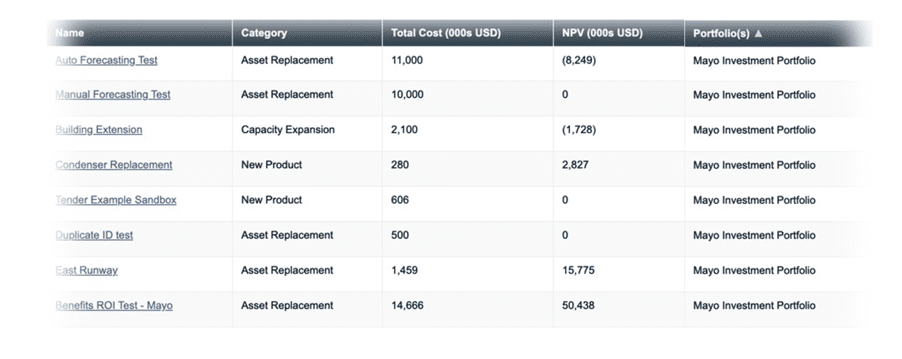

Having a holistic and dynamic view of all projects in the portfolio, as well as the ability to stack rank them, can be essential in providing the insights and perspective that are critical to effective capital allocation.

Finario makes it possible to have instill that discipline and essential capabilities throughout the enterprise, quickly and easily.

Execute Better

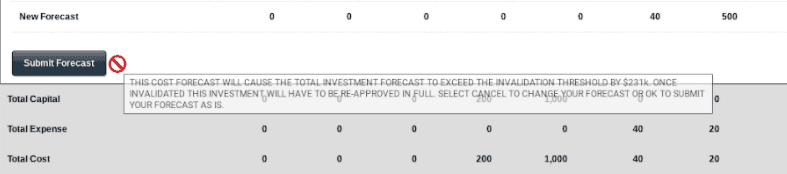

The ability to “intervene” at critical times in a project life cycle can be the difference between runaway costs and making the right decisions at the right time to stay on track. Two obvious examples: when requests are made to increase an approved budget, or the forecast time horizon to completion gets stretched. That’s when you need red-flag alerts to investigate and determine how to best address the situation.

For example, in Finario, you can set variance tolerances at the project-level. If costs increase more than what is allowed, the project is routed for re-approval.

In considering the status of a flagged project, the ability to compare actual line-item costs to budgeted amounts is invaluable. As is having the entire project history, business case, and performance-to-date at your fingertips.

Stage Better

Widely used, particularly among enterprises with large and complex capital projects, a stage-gate process helps to ensure oversight and mitigate risk by creating checkpoints (or “gates”) where ongoing funding is contingent on satisfying established requirements or the resolution of issues raised by senior management.

While the design of a SGP, such as that illustrated below, varies from company to company there are some universal truths:

• Having your entire Capex portfolio managed with a single system providing a single source of truth makes every stage infinitely more efficient and productive

• Because each stage requires an approval workflow, the process itself can create the very delays it’s trying to avoid; with an automated system like Finario that is not an issue

• Quality reporting is essential to making informed decisions – particularly at the later stages; manual processes and systems like Lotus Notes or Sharepoint simply make it difficult, if not impossible, to create those reports

“As many as 90% of major capital projects suffer from an average of 28% budget overrun. This in turn extends the rate of return of capital invested to achieve organisational growth, and significantly erodes the intended benefit of the delivered asset.”

— Deloitte

A DEEPER DIVE INTO FINARIO: REDUCING CAPEX COST OVERRUNS

GAIN A PORTFOLIO PERSPECTIVE

Review all the projects in consideration within a portfolio and across portfolios. See how they compare by your organization’s chosen ROI metrics and other criteria you set.

CHOOSE SMART

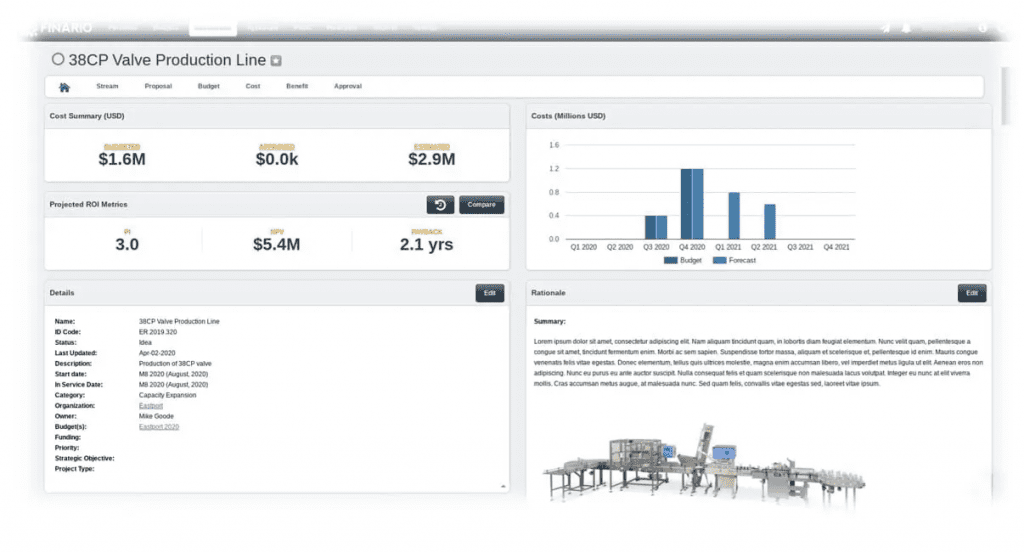

Every project includes the details, rationale, ROI metrics and forecasts needed to make better decisions, with apples-to-apples comparisons. Stack rank projects based on their merits and implications on your budget and plan.

ACT IN REAL TIME

With the reporting you need, on demand and accessible in an instant, you can intervene at critical points of the project life cycle when contingencies, unanticipated costs, or other factors point to potential overruns.

Additional Resources You May Be Interested In

From Finario Executive Briefings

Why Making the Most of Your Capex Budget Should be a Priority