Creating a Single Source of Truth

Unifying the how, what, when, where and why of successful Capex management.

Have trust in your data. Then unleash its power across your organization. With Capex management software from Finario.

It’s hard to fully trust the data that you collect, analyze and report on when it has come from multiple, fragmented sources, and has had manual interventions. Moving to a single source of truth with Finario Capex management software changes all that. Report with confidence and decide with clarity.

SEE HOW FINARIO CAPEX MANAGEMENT SOFTWARE CAN CREATE A SINGLE SOURCE OF TRUTH

— CFO Magazine, Numbers Don’t Lie, Until They Do, 2019

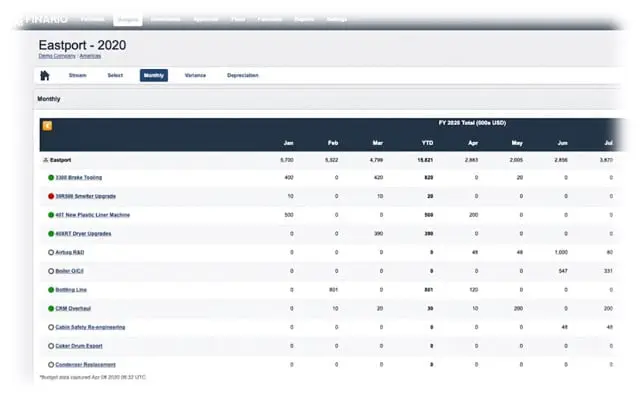

Looking Back: Gain greater clarity into

investment performance.

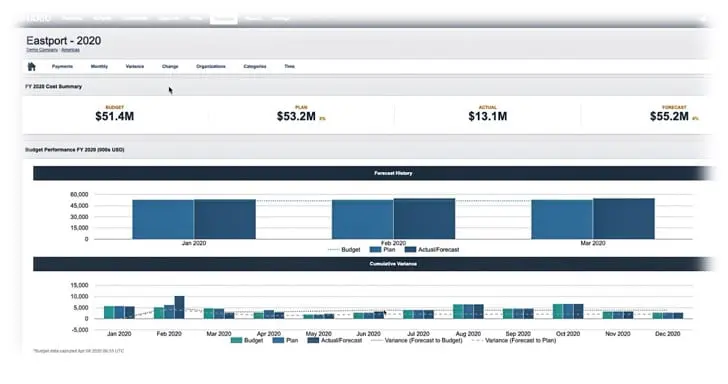

Finario Capex management software is project-centric, which means it provides infinitely more detail that enables you to answer the question, “Why are we doing that?”

Drill-down into individual projects and sub-projects for essential details that are up-to-date

Assess project status in real-time with dynamically updated forecasts

Know quickly what projects are on the horizon and how much capital you have

Evaluate key performance indicators with a single source of context: what’s happened and what’s coming, over time

Correlate project outcomes to future initiatives with all project documentation stored digitally

Looking Forward: Better visibility into possibilities.

Finario Capex management software provides a more effective way to manage your capital investment program:

Optimize project selection across all potential investments from all organizations or create a series of focused portfolios based on investment category, strategic alignment or any combination of dimensions

Compare two portfolios along multiple dimensions such as total cost, timing of cash flows or composition of spend

Create new portfolios every year or manage a series of overlapping multi-year portfolios or programs

Budget your final optimal portfolio plan with a single click

Use waterfall view to reconcile plan to budget and forecast numbers, providing further insight into how the authorized spend for your organization is compiled

A DEEPER DIVE INTO FINARIO CAPEX MANAGEMENT SOFTWARE

With Finario, “executive leadership has all the information it needs for higher value investments right at their fingertips.”

— Operations Controller, Hoffmaster Consumer Products

FAQs

Do we have to go 'all in' on a single source of truth to implement it correctly?

No. While there are obvious benefits to fully implementing all aspects of your capital investment life cycle into the system at once, many organizations choose to take a phased approach based on prevailing priorities, their digital transformation road map, technology considerations, etc.

What exactly is a 'single source of truth' anyway?

Annotated from Forbes:

When [multiple tools are] spitting out different numbers it can be hard to know which numbers to rely on. Often differences can come down to when, where and how the data is collected. The terms “single version of truth” and “single source of truth” are often used interchangeably in analytics and business intelligence conversations.

Single source of truth: A data storage principle to always source a particular piece of information from one place, to enable a single version of truth where there is one view of data that everyone in a company agrees is the real, trusted number.

Capex Management Resources for Finance Professionals

From Finario Executive Briefings

Essential Components of a Unified Capital Planning Framework